Why Your Payment Orchestration Strategy Needs Unified Fraud Protection

Payment orchestration is essential for businesses aiming to streamline transactions across multiple channels and providers. With an effective orchestration strategy, businesses can achieve higher approval rates, reduce costs, and offer a reliable experience that seamlessly adapts to customer expectations.

Yet, orchestration alone is not enough — fraud remains a constant threat. By integrating a single, unified fraud solution within the orchestration hub, businesses gain a powerful defense that secures every transaction without adding operational complexity. This centralized approach to fraud prevention enhances protection, builds customer trust, and ensures a payment experience that’s both efficient and resilient.

A well-designed payment orchestration strategy works with unified fraud protection to strengthen security as well as drive sustainable growth.

UNDERSTANDING PAYMENT ORCHESTRATION

What Is the Payment Orchestration Hub?

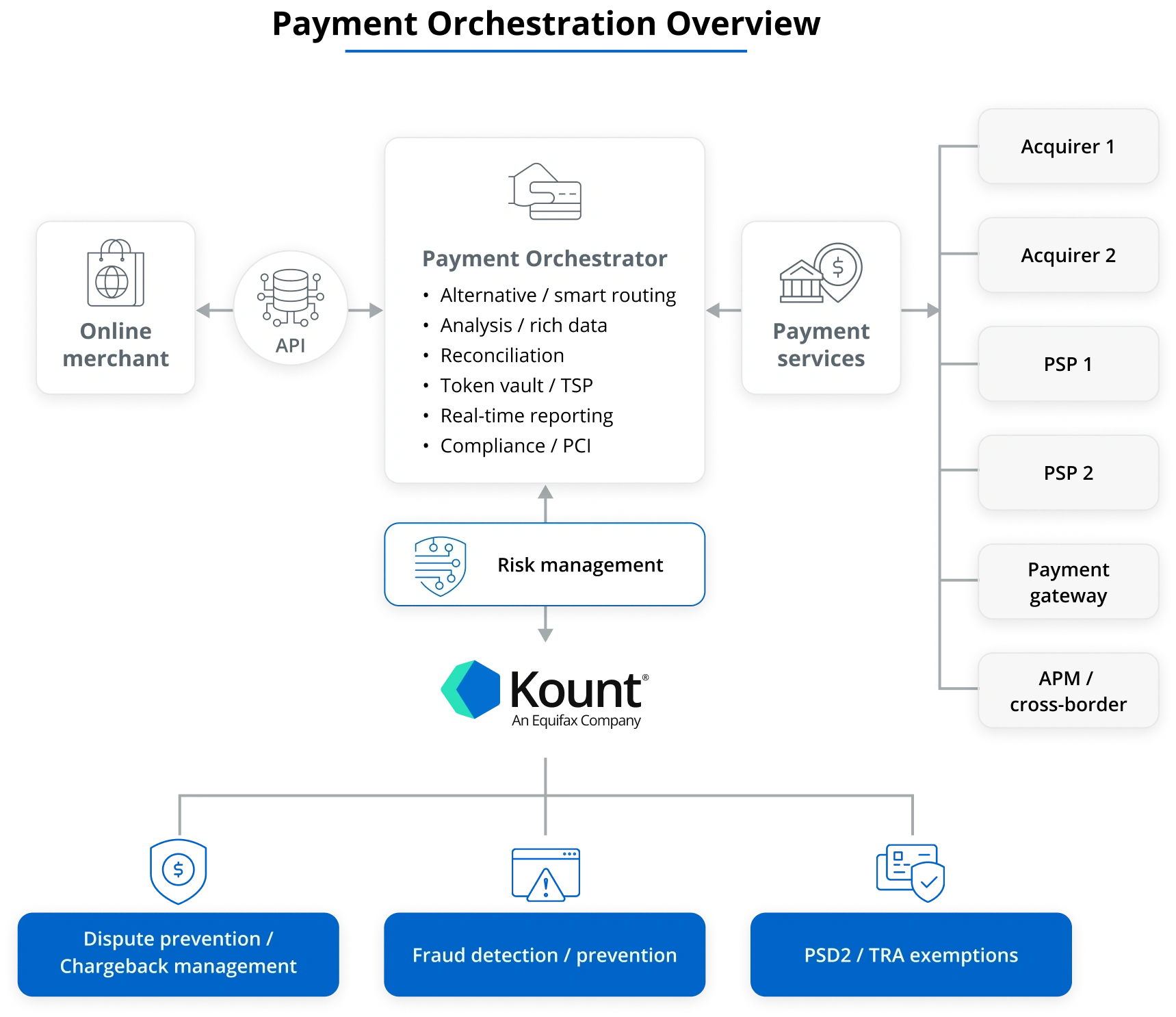

Your payment orchestration hub is a centralized platform that connects your business to multiple payment service providers (PSPs), acquirers, and gateways through a single point. By automatically routing each transaction through the most effective provider, orchestration hubs help reduce costs, ensure fast transaction settlement, and deliver a seamless payment experience across regions and channels.

Orchestration hubs offer the flexibility to integrate multiple solutions, allowing businesses to pick and choose additional support that best fits their needs — such as fraud protection, currency conversion, or loyalty program integration. This modular approach makes it simple to customize the payment stack, supporting specific goals and enhancing the customer experience.

With everything managed under a single hub, businesses gain real-time insights that make it easy to monitor transactions, identify trends, and quickly resolve issues. This setup makes payments more reliable while allowing businesses to add new payment methods and providers as needed, adapting swiftly to customer demands and market changes.

THE REAL BENEFITS OF ORCHESTRATION

Flexibility and Control Across Multiple Acquirers

When you turn to payment orchestration hubs, you get integrated solutions for managing payments with enhanced flexibility and additional support. These solutions simplify the addition or switching of providers as your business grows. Benefits of payment orchestration include:

- Higher Approval Rates: By using smart routing to choose the most efficient acquirer, your business can achieve higher transaction approval rates — ensuring more successful payments.

- Centralized Reporting: Organizations benefit from a single dashboard that monitors transactions, analyzes trends, and reconciles payments — providing clear and actionable insights.

- Enhanced Flexibility: Payment orchestration makes it easy to add or remove payment acquirers, solutions, and global gateways — adapting quickly to shifting markets or customer preferences.

- Cost Efficiency: A multi-acquirer system helps reduce transaction fees by selecting cost-effective payment routes from all available acquirers, essentially making them compete in real-time while lowering your operational costs.

As a result, payment orchestration empowers businesses to manage payments effectively across multiple channels and geographies, delivering smooth, efficient transactions.

DOWNSIDES OF USING MULTIPLE FRAUD PROVIDERS

The Hidden Risks of Fragmented Fraud Solutions

The trade-off for the flexibility of a multi-acquirer or multi-gateway strategy is that it can introduce hidden risks that may compromise security and effectiveness. A piecemeal solution typically involves relying on fraud prevention systems that are not designed specifically to work together. You may turn to one solution for identity verification, another for risk evaluation, and even more for chargeback protection and regulatory compliance. More isn’t always better.

This approach often leads to unnecessary complexity and coverage gaps as well as increased costs and operational inefficiencies. These gaps can weaken overall protection, leaving many transactions — and your business — exposed. Without a centralized fraud strategy, it becomes challenging to monitor activity across all channels and ensure uniform risk detection. Varying levels of service quality and vulnerabilities emerge. Multiple fraud solutions also mean added costs in licensing, training, and system integration, as well as heavier operational burden.

Fragmented fraud prevention setups also tend to deliver more false positives, those unnecessary declines of legitimate transactions that cost both revenue and customer trust. An inconsistent fraud approach often snowballs into these and similar inefficiencies, impacting performance and the overall customer experience. By consolidating fraud protection under a single provider within the orchestration layer, businesses can eliminate many of these challenges and secure a more reliable, effective fraud strategy.

An end-to-end solution remains far preferable to the kind of piecemeal approach that tries to tie together disparate fraud prevention systems for identity, risk, chargebacks, disputes, exemptions, and compliance.

SMART FRAUD PROTECTION ACROSS ALL CHANNELS

The Case for a Single Fraud Provider In Your Orchestration Layer

A unified fraud solution embedded in the orchestration layer can provide comprehensive, end-to-end protection for businesses. These systems help secure a transaction from the initial stage through to completion. They offer:

- Consistent, Unified Protection: With a single embedded fraud provider, businesses can apply consistent rules and standards across all payment channels and acquirers. This reduces the likelihood of fraud slipping through due to misaligned policies. A unified system delivers a seamless fraud prevention experience across the entire payment ecosystem.

- Efficiency and Precision: Centralizing fraud detection provides a clear, comprehensive view of customer transactions, reducing false positives and enhancing accuracy. This setup also allows businesses to minimize friction for legitimate customers, offering a smooth experience that avoids unnecessary security challenges.

- Cost Savings: Consolidating multiple fraud systems under a single provider reduces licensing and operational expenses, driving greater return on investment. By focusing efforts on a single robust system, it is possible to streamline processes.

A centralized fraud solution within the payment orchestration layer provides stronger, more accurate protection, making it the most effective approach for businesses aiming to prevent fraud while improving the customer journey.

Key Benefits of an Integrated Fraud Solution

A Smart, Integrated Fraud Solution for Optimal Protection

In an environment where fraud tactics evolve constantly, businesses need a fraud solution that adapts to new risks and remains flexible. A robust, integrated fraud solution should offer advanced, critical features that deliver maximum benefits.

End-to-End Integration

Embeds directly into your orchestration layer, providing centralized fraud assessments across all acquirers, gateways, and payment channels.

Frictionless Experience

Balances security and user experience by minimizing friction for legitimate customers, allowing for a seamless transaction process.

Comprehensive Data Insights

Accesses data from billions of transactions globally, using powerful insights to improve fraud detection and decision accuracy.

AI and Machine Learning

Continuously learns from patterns to recognize and prevent new types of fraud in real time, protecting against emerging threats.

An integrated fraud solution becomes a versatile tool that defends against sophisticated fraud tactics while supporting secure, smooth transactions for your customers.

STEPS FOR IMPLEMENTING A SINGLE FRAUD PROVIDER

Building a Unified Fraud Defense in Your Orchestration Hub

Enhancing your payment orchestration with a unified fraud solution is often a fairly simple process.

- Assess Existing Systems: Evaluate your current orchestration setup to identify gaps or inconsistencies already in place. Consider evolving trends as well as previous challenges.

- Compare Costs and Efficiencies: Review the expenses and operational impact of multiple fraud providers compared to a single, integrated solution. Look for critical, smart tools and processes.

- Partner for Integration: Collaborate with your orchestration hub to implement a unified fraud solution that protects every payment channel. Hub providers should offer the best available integrated, smart systems.

- Centralize Monitoring: Establish centralized monitoring and reporting to maintain full visibility over transactions, enabling proactive management of fraud risks.

These steps can put you on the path to fortifying your payment orchestration with a robust fraud prevention strategy, providing consistent protection without disrupting operations.

THE FUTURE OF PAYMENT ORCHESTRATION

Optimal Fraud Protection With a Single Provider

When you’re looking to scale in an increasingly digital world, consider a unified fraud solution from a single fraud provider for end-to-end protection that secures and optimizes the transaction process.

Ready to future-proof your payment orchestration?

Connect with us to learn how Kount can safeguard your payment orchestration system and deliver seamless, secure transactions across all channels.

By integrating a comprehensive solution from Kount, businesses and payment hubs can streamline their fraud prevention strategies, gain control over every payment channel, and ensure a safer experience for their customers.

Kount's advanced AI, real-time risk assessments and centralized fraud management offer unparalleled protection across transactions worldwide.

With Kount, you can build a secure system that adapts to your needs and keeps your business ahead of emerging fraud threats.