WHAT’S INCLUDED

A complete strategy for

chargeback management

Kount is capable of solving the problem of chargebacks — the entire problem, not just the most obvious or easiest-to-handle threats.

Our goal is to protect the maximum amount of revenue in the most efficient and accurate way possible.

WHY CHARGEBACK MANAGEMENT MATTERS

The hidden benefits of chargeback management

Why bother with chargeback management? Because it can significantly improve your bottom line in multiple ways.

Benefits of preventing chargebacks

Keep chargeback counts low

Reduce chargeback rates by 60-70%. Keep thresholds low and merchant accounts healthy.

Improve customer experience

Increase customer satisfaction by quickly and proactively resolving complaints.

Take quick action

Identify issues within 24 hours of a dispute rather than waiting for a chargeback 2-5 weeks later.

Save fulfillment costs

Stop the shipment of goods on disputed orders. Retain fulfillment, shipping, and product costs.

Benefits of fighting chargebacks

Recover revenue

If you accept chargebacks as a loss, your hard-earned money is gone forever. But if you fight, you can recover revenue that’s been unfairly sacrificed.

Uncover data

If you ignore your chargebacks, you miss the data they contain. But if you dig in and investigate, you’ll learn why chargebacks happened in the first place.

Avoid penalties

If you don’t respond to certain disputes, you’ll have to pay an expensive fine. But fight back and you can easily avoid those unnecessary penalties.

Prove legitimacy

If you aren’t fighting, the bank is going to wonder why. But fight for money that’s rightfully yours and you’ll help solidify the business’s credibility.

WHAT MAKES KOUNT SPECIAL

Added value achieves better results

Want to manage chargebacks with greater efficiency and better results? Here’s what sets Kount apart from any other strategy.

Impressive return on investment

Other strategies might yield high win rates, but they come with low or negative ROI. At Kount, we understand what really matters — your bottom line. That’s why we strive for both high win rates and significant ROI.

Flexible automation

Not all automation is created equal. You need flexible automation that fits the unique preferences of your business. With options for DIY, fully-managed, and everything in between, Kount can do it all.

Proven expertise

Our chargeback experts have spent decades learning the rules, testing strategies, and building relationships. We know what it takes to succeed. Ongoing insights are funneled into technology that is constantly optimized so results are always improving.

Real-time data

When it comes to managing chargebacks, time is money. You can’t afford to wait days or even hours to know what’s happening. You need data in real time so you can make quick and accurate decisions — and that’s exactly what Kount provides.

WHAT KOUNT OFFERS

Multiple solutions. Complete strategy.

Kount has all the chargeback management tools you need to be successful. Learn more about the individual solutions that go into a complete strategy.

Protection at every stage of the transaction lifestyle

Identity Verification

Transaction Authorization

Dispute Raised

Order Validation

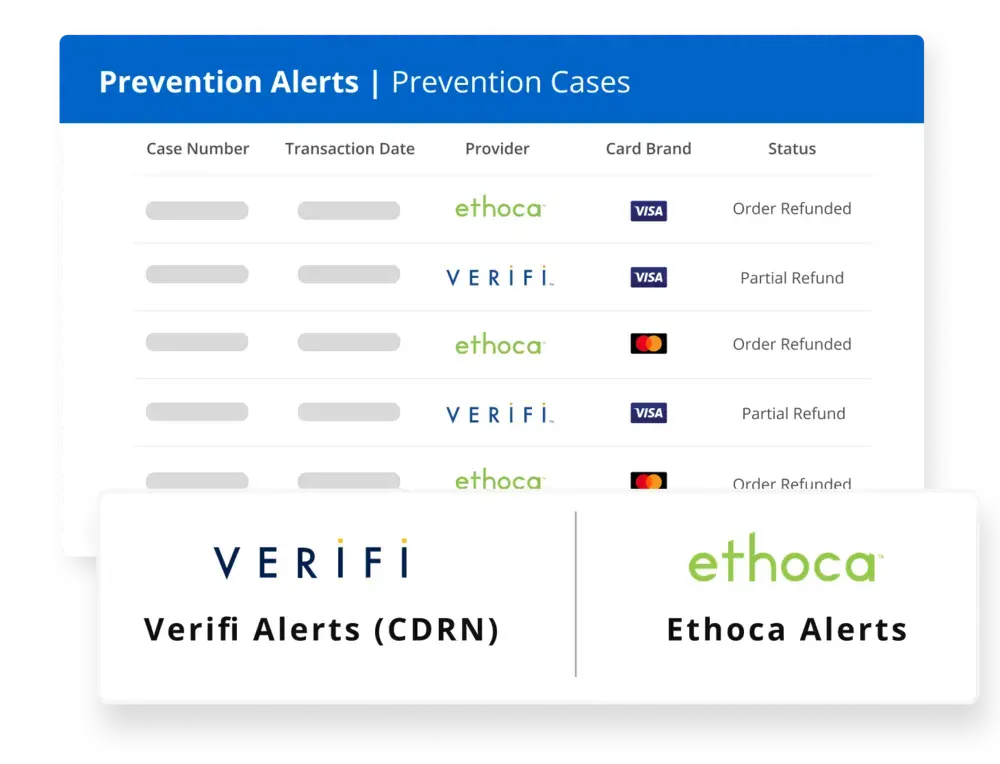

Chargeback Alerts

Rapid Dispute Resolution (RDR)

Chargeback Response

TESTIMONIALS

What our clients are saying

Schedule a demo

GET STARTED TODAY

Solve the problem of chargebacks

Thousands of companies from all over the world use Kount to manage numerous challenges throughout the chargeback process — everything from preventing friendly fraud to recovering revenue. Will you be next? Sign up for a demo today to get started.