Unlock Seamless Growth: Digital Onboarding for High-Assurance Accounts

In today's digital landscape, customers in high-assurance sectors like finance, insurance, and fintech expect swift and seamless onboarding experiences. Traditional, paper-based processes no longer meet these demands, leading to customer frustration and abandonment. A robust digital onboarding strategy is now crucial for attracting and retaining customers, ensuring regulatory compliance, and mitigating fraud.

Digital onboarding offers numerous benefits, including enhanced security through KYC/AML compliance checks and biometric authentication, reduced fraud via digital identity verification and risk signals, and significant cost efficiency by minimizing paperwork and manual processes. Moreover, it delivers a superior customer experience with faster turnaround times and greater convenience, increased efficiency through automation, and the scalability needed to accommodate business growth.

The InstaTouch ID and InstaTouch Pay solutions by Equifax are designed to revolutionize digital onboarding for high-assurance accounts. InstaTouch ID streamlines digital transactions by validating mobile numbers and pre-filling forms, reducing manual data entry and improving user experience. Key features include automated data pre-fill, real-time identity verification, improved identity data insights, and robust fraud mitigation.

Meanwhile, InstaTouch Pay simplifies online payments by retrieving and auto-filling credit card information, offering a one-click payment option that reduces abandonment and minimizes risk. Its benefits include an improved customer payment experience, reduced abandonment rates, limited risk of fraud, real-time credit file access, and PCI compliance.

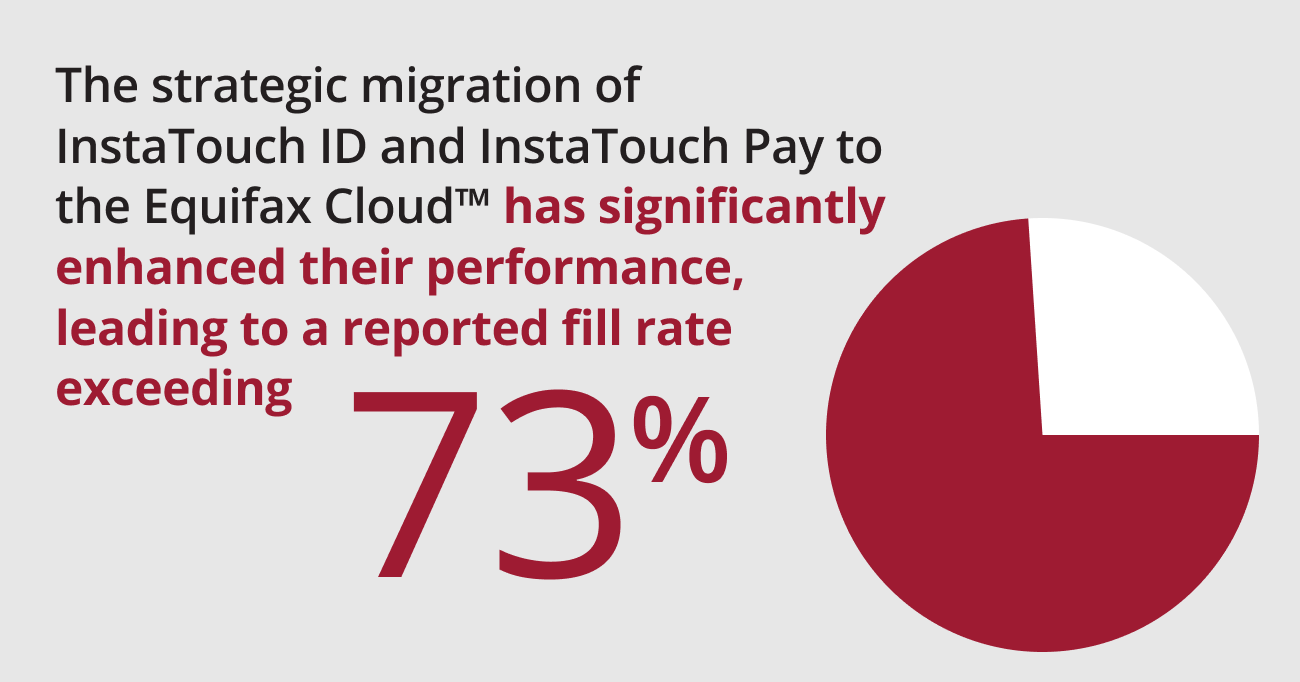

The strategic migration of InstaTouch ID and InstaTouch Pay to the Equifax Cloud™ has significantly enhanced their performance, leading to a reported fill rate exceeding 73%. This cloud infrastructure provides improved speed and performance, enhanced scalability and reliability, access to real-time insights, embedded AI capabilities for better fraud detection, and built-in security. This high fill rate signifies increased customer acquisition, improved operational efficiency, enhanced customer lifetime value, and a stronger competitive advantage.

Equifax prioritizes security and compliance, employing measures like data encryption, multi-level access controls, API security for InstaTouch, and support for regulations like AML and KYC.

In conclusion, digital onboarding is essential for high-assurance industries, offering significant advantages in efficiency, security, and customer experience. The cloud-based InstaTouch ID and InstaTouch Pay solutions by Equifax provide powerful solutions, evidenced by their impressive fill rates, helping businesses unlock seamless growth and deliver exceptional customer experiences in a digital-first world.