Talk to an Expert

Top Holiday Spending Statistics for Ecommerce Businesses

To better gauge customer attitudes and spending this upcoming season, Kount conducted a “Holiday Shopping Trends” survey of 2,000 consumers. In it, consumers reveal when and where they’ll shop, propensity to spend, payment method preferences, top concerns, and best ways to boost their confidence this holiday season.

Amid recession worries, merchants may be preparing for the worst, but Kount’s survey reveals a more optimistic holiday shopper. Inflation-conscious consumers may be more cautious this year, but they’re ready to spend. And they will likely spend even more than last year, offering a lot of earning potential for merchants.

However, the key to winning holiday revenue this year will be to earn customer trust by knowing their pain points and listening to their wants. And these top holiday spending statistics can help.

Consumers are shopping earlier but 65% will still shop later in the season

Consumers are shopping earlier this holiday season. Over 26% of Kount survey respondents say they will start their holiday shopping earlier this year compared to last year. And consumers are showing an increased interest to shop during the months of September and October more than previous years.

Though more consumers are opting to shop earlier than in previous years, 65% of total respondents say they will shop in November and December. That means many customers will still be shopping right up until the holidays this year and merchants have a good opportunity to capture late-season revenue.

When do you plan to do the majority of your shopping for the holiday season?

Merchants should continue with promo codes and ads throughout December and not stop at big shopping days like Black Friday. Businesses should also keep an eye on inventory, particularly popular items, to meet demand for items throughout the end of the season. Preparing for a rush in last-minute shoppers could pay dividends this year.

Consumers will spend more during the holidays this year than last year

Despite concerns around the increased cost of goods, inflation-weary consumers plan to spend more this year. Over 41% of consumers say they plan to spend between slightly and much more money during this holiday season compared to last year’s.

The majority of respondents also say they’ll spend between $501 to $1,000 during the holidays this year. And another almost 25% of consumers say they’ll spend between $1,0001 to $5,000. So even though consumers may be more careful about their spending this year, they are still spending — and a lot more than merchants might expect.

While this is an exciting opportunity for merchants, they should be careful. Increased consumer spending in an economic downtown can mean higher susceptibility to things like friendly fraud. Friendly fraud occurs when customers dispute legitimate purchases with their banks, which often results in chargebacks for merchants.

Every year, friendly fraud is one of the season’s biggest holiday scams. But this year, worries about a potential recession and other increased costs may make shoppers more inclined to have buyer’s remorse. After the holiday joy has worn off, merchants may see an uptick in consumers seeking invalid chargebacks for goods they no longer want.

Inflation, timely deliveries, and shipping concerns can also increase customer confidence

Inflation is on nearly everyone’s mind this year. But it will be especially top of mind for customers this holiday season. Of surveyed consumers, 45% report that their number one concern with holiday shopping this year is “inflation driving up the cost of goods.” And their second biggest concern is “spending too much money.”

Perhaps haunted by the ghosts of supply chain issues past, this season's holiday shoppers are also concerned about on-time deliveries and shipping costs. Consumers say that delayed delivery, expensive shipping, and paying for returns were their other top concerns. In fact, expensive shipping and returns were the two biggest reasons customers would abandon their holiday carts.

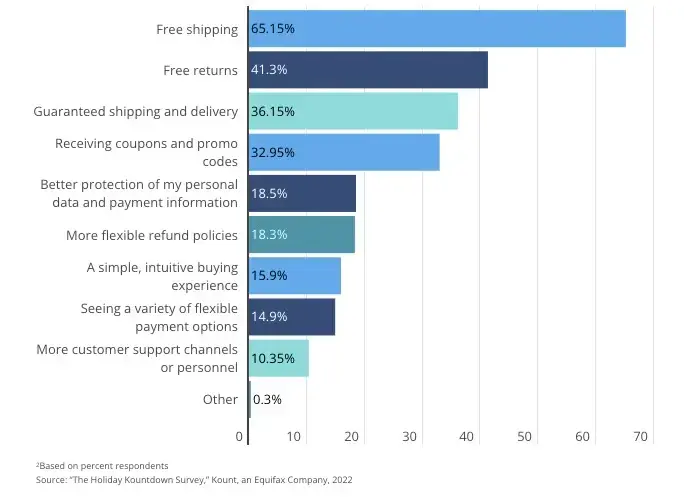

So it’s unsurprising that customers say the top ways merchants can boost their confidence this holiday season is with guaranteed delivery, free shipping and returns, and discount codes. With worries around the cost of goods, the key to capturing holiday revenue this year will be

merchants’ abilities to address customer concerns and build their confidence.

What would increase your confidence in online purchases during the holiday shopping season?

To build customer confidence, merchants can do things like provide visible delivery estimates on their websites to help guide customer’s purchasing decisions. But they should also be realistic about the capabilities of their fulfillment teams and be careful to not over promise on delivery times.

Businesses can also meet customer money-savings wishes by providing discount incentives throughout the holiday season. And since customers prioritize free shipping and returns, not meeting these expectations could drive shoppers to competitors. By tapping into confidence, merchants capture and maximize customer spending this year.

Half of consumers will do their holiday shopping via mobile apps

During the pandemic, businesses saw the value of moving online. For many, it was even a means of survival. As consumers flocked online, businesses followed suit to keep up with demand. But it appears consumers may be shifting their purchasing habits yet again. More than 48% of survey respondents say they will conduct their holiday shopping via mobile apps this year.

Last year, 4% of global holiday sales on a mobile device were made through a social media app. And 10% of mobile traffic originated from consumers browsing through social networks, according to an Ekata report. With over half of consumers shopping through mobile apps this year, retailers can also expect a rise in social media shopping and discovery.

Historically, consumers shopped primarily on desktop computers or laptops. Now, they’re turning towards mobile devices. Retailers can stay ahead of the curve by meeting customers where they are. Offering an omnichannel experience that can adjust to high traffic volumes will be all the more important this holiday season.

More than 80% of consumers will buy a gift card during the holidays

Gift cards tend to be a favorite during the holiday season. The convenience of gift cards, especially e-gift cards, make them easy last-minute purchases during the busiest time of year. But they may be even more popular this season.

Of surveyed respondents, 83% say they will purchase a physical or e-gift card during this holiday shopping season. And over half of respondents say they will spend between $101 to $500 on gift cards.

Gift cards are good for business because consumers typically spend more than a gift card’s balance. They also spread brand awareness, encourage repeat purchases, and increase brand loyalty. However, gift cards are also extremely vulnerable to e-gift card fraud.

Criminals will often use stolen payment information to purchase e-gift cards that can then be used without the risk of detection or resold for a profit. Criminals can also test stolen account information by making small, seemingly low-risk gift card purchases. Due to the limited amount of corresponding data, e-gift card fraud is very easy to commit and difficult to catch.

E-gift card fraud is a favorite of fraudsters, but they especially target gift cards during the holidays, making it one of the biggest holiday scams out there. Fraudsters use the high-volume traffic of the holidays to blend in, making their high-velocity activity appear normal. They also know merchants typically loosen controls around this time to accommodate increased sales.

Merchants would be wise to offer gift cards during the highest gift card purchasing time of year, but they should be extra vigilant in this area. However, too much caution and controls will drive customers away. Knowing the 5 essential e-gift card fraud questions can help merchants balance caution with an effective e-gift card strategy.

Customers will be looking for more flexible payment options at checkout

Buy now, pay later (BNPL) options have grown in popularity over the past couple of years. And it appears that customers will expect these payment methods at checkout during the holidays. Almost 50% of surveyed consumers say they will use buy now, pay later options to purchase goods this upcoming holiday season.

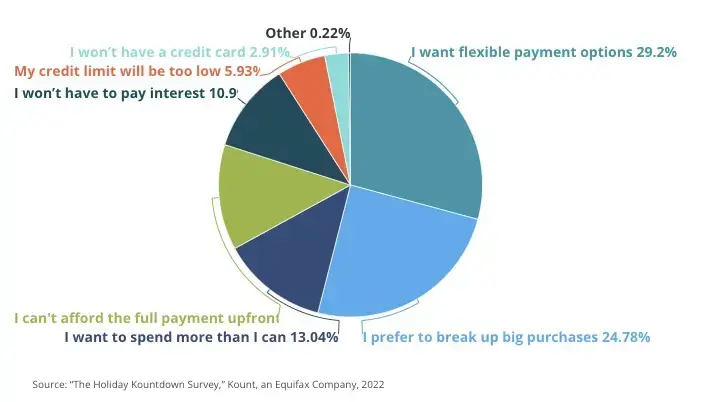

Consumers cite wanting a “more flexible payment option” as the top reason for choosing buy now, pay later services. Other top reasons include wanting to break up big purchases into smaller amounts, spending more than they are able to, and not being able to afford the full amount up front.

Why do you think you'll choose BNPL during the holiday shopping season?

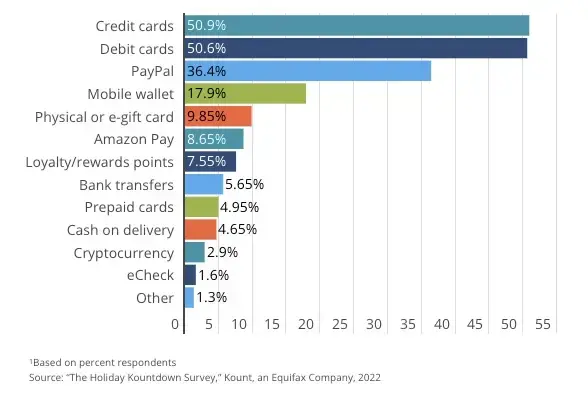

Consumers are also showing interest in other flexible payment options like PayPal and mobile wallets. While debit and credit cards will still be king this holiday season, over a third of consumers say they plan to use PayPal. And they say digital wallets will be their fourth most common payment method used this shopping season.

Which payment methods will you use most often when shopping during the holiday season?

Since customers are likely to abandon their cart if their preferred payment method is not offered, merchants should assess their payment methods to ensure maximum offerings and flexibility. However, new payment methods are magnets for fraud, and merchants should make sure they have the right tools in place before offering them.

Offerings like buy now, pay later are ripe for abuse and could very likely be one of the top holiday scams this year. Its newness and growing popularity paired with the likelihood of customers overextending themselves on BNPL purchases make it a hot target for fraud from bad actors and consumers alike. BNPL risk management will be key to protecting pay later revenue this season.

Amidst recession concerns, consumers are offering merchants a lot of earning potential. But it will be up to merchants to address customer concerns and build their confidence this season by offering flexible payment options, omnichannel experiences, and savings incentives. By doing so, merchants can capture and maximize holiday revenue from this year’s cautious shoppers.

Kount’s solutions protect the entire customer journey year round

Kount’s Identify solutions give you the insights and agility to interact securely with visitors on all digital platforms and enhance the buying experience across every stage of the customer journey.

Using advanced AI and machine learning, Kount’s solutions gather data points from an interaction and compare them to the data in its Identity Trust Global Network™. This analysis determines a potential customer’s level of identity trust or risk. The solutions thwart any high-risk activity while letting good customers seamlessly through.

Identify solutions can assess risk activity across channels. It can verify identities for omnichannel payment options like buy now, pay later options, BOPIS, and more. And it can stop high-velocity activity from things like e-gift card fraud.

By fusing digital and physical identity attributes together, Kount’s solutions also allow businesses to gain a true 360-degree view of their customers. This view reveals things like propensity to spend, purchasing behavior, and demographics. Businesses can use these insights to provide personalized experiences and upsell and cross sell opportunities to good customers.