Automated Chargeback Management: All Your Questions Answered

Kount features automated chargeback management technology. The technology’s creators were former ecommerce merchants who struggled with fighting chargebacks and analyzing data. Manual processes weren’t efficient or effective enough, so they decided to create an entirely new way to manage chargeback processes. The result was Kount’s chargeback technology.

Kount’s team has first-hand experience with both manual and automated chargeback management tools. But, if you haven’t tried technology yet, you likely have some very valid questions about this management style.

Here are some of the most common questions we hear from merchants who are considering a transition to fully managed technology.

Why should I automate?

The reliance on automation in any situation is usually to achieve superior outcomes, ease the burden of completing mundane tasks, or eliminate costly manual labor.

Automated chargeback management can achieve all those goals.

For many merchants, the most compelling reason to automate chargebacks is the cost. Automation costs an average of 45% less than manual, in-house chargeback processes.

The second most common reason businesses turn to technology is that automation can eliminate manual processes. It liberates employees’ valuable time so they can instead focus on growing the business.

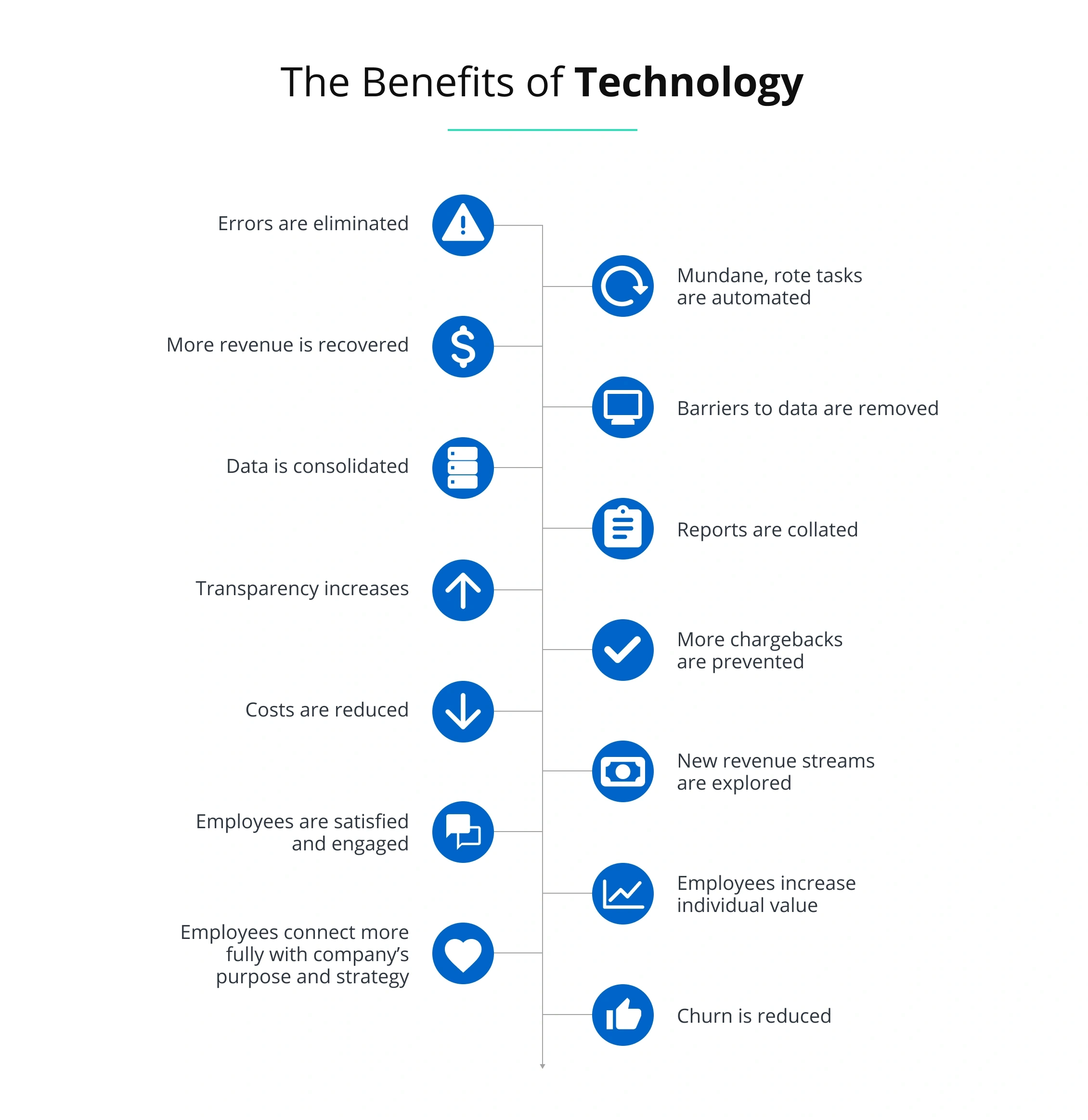

However, the benefits are actually much more comprehensive than just cutting costs and reducing manual labor to save the bottom line. The outcomes are progressive; each new benefit leads to another.

Someday soon, automation might be so influential that it could be a determining factor in whether or not you are able to stay in business.

A 2017 survey anticipates US companies will double the amount of work accomplished through automation in the next three years--you don’t want to be left behind. Because another survey reports 36% of workers fear their employer will fail within five years if the company doesn’t adapt necessary technology. And, 46% of workers believe their company’s competitor already has a technological advantage.

Isn’t automation risky?

You might hear industry members say human involvement is necessary to achieve satisfactory results. After all, humans process chargebacks and payment disputes at the issuing banks, so humans should be involved in the chargeback responses.

Right?

Wrong!

This argument is not only untrue, it can actually do a lot of harm.

The more humans are involved, the higher the likelihood of error. Adaptive, customizable technology is more efficient than humans and is error free.

What errors do manual processes create?

There are numerous errors caused through manual processes that automation can eliminate.

ERRORS WITH ALERTS

- The alert notice isn’t processed in time. It expires and you lose your chance to prevent chargebacks.

- No one notifies the alert vendor of the refund so a chargeback is issued and you pay double.

- Someone accidentally refunds an expired alert that turns into a chargeback, meaning you pay double.

- No one remembers to cancel future billings, so another alert comes through next month.

- No one blacklists the high-risk customer, so the customer makes another purchase and you get another alert.

ERRORS WITH REPORTING

- Because data is manually mined from various locations, you could either get a ton of unnecessary data or not enough of what you need.

- You miss important pieces of data so you don’t have a complete understanding of what’s happening.

- Data isn’t maintained in real time, so small issues become major liabilities before you are even aware of them.

ERRORS WITH DISPUTES

- The chargeback expires before you have the chance to respond.

- An expired chargeback is fought, causing you to devote a lot of valuable resources to a lost cause.

- The wrong compelling evidence is submitted so the dispute won’t win.

- The documents are submitted in the wrong order so the processor won’t even consider it.

- You spend more on the dispute process than you are capable of recovering.

- No one remembers to cancel future billings, so another chargeback comes through next month.

- No one blacklists the customer, so the customer makes another purchase and you get another chargeback.

Will I have to fire my entire fraud management team?

Technology can be used to reduce headcount, but cutting FTEs isn’t a requirement.

Most often, businesses use automated chargeback management software to eliminate repetitive, rote tasks so employees can use their skills for responsibilities with higher returns. In fact, history has shown that automation will often retain more jobs than it destroys.

Once employees have been freed from their paper-pushing responsibilities, they can focus on more high-value activities.

Examples include:

How do I pick the right automated technology?

Unfortunately, not all chargeback management platforms are created equal.

The best technology will include the following features:

- Straightforward, easy-to-understand integration processes

- As much efficient automation as possible

- Opportunities to increase automation with advanced integration options

- Customized chargeback responses to achieve the highest win rates

- Real-time reporting that enables preemptive action

- In-depth analytics that expose the underlying reason for transaction disputes

Ready to Make the Switch?

If you are ready to switch to an automated chargeback management strategy and enjoy all the benefits that technology has to offer, contact Kount today. We’ll show you exactly what you can expect and how the technology can help your business.