What Are Chargebacks & How Do You Manage Them?

A chargeback is a transaction reversal. It reverses the original purchase by withdrawing funds that were deposited into your business’s bank account and returning them to the cardholder.

There are several reasons why a transaction might be reversed. But regardless of the motive, the outcome is the same: chargebacks cause revenue loss, reputational damage, and sometimes even business closure.

It is essential to learn about chargebacks before they become an unmanageable liability for your business. Use this detailed guide from Kount to minimize their impact and prevent future risk.

- The Purpose of Chargebacks

- Chargebacks vs. Refunds

- Chargebacks vs. Transaction Disputes

- Important Chargeback Terms

- The Chargeback Process

- Valid vs. Invalid Chargebacks

- The Impact of Chargebacks

- Managing Chargebacks

- Chargeback Fact vs. Fiction

- Your Rights as a Merchant

- Reasons for Chargebacks

- Chargeback Time Limits

- Chargeback Fees

- Credit Card vs. Debit Card Chargebacks

The Purpose of Chargebacks

When general purpose credit cards were introduced several decades ago, the new payment method offered several benefits — but it also brought unprecedented challenges. For example, what would happen if someone stole a credit card and used it without permission? Would the cardholder have to pay for the unauthorized purchases?

To address this and other concerns, lawmakers took steps to provide needed protections for consumers. Those protections came in the form of transaction disputes which ensure cardholders aren’t liable for fraud and other issues.

However, transaction disputes shift financial responsibility from the cardholder to the bank — and banks weren’t too excited about the additional liability. This was a problem, because the card brands (Mastercard®, Visa®, etc.) needed the banks to be advocates for the new payment method. Without bank support, it would be difficult for the brands to get their cards into the hands of consumers.

To overcome this challenge, the card brands created their own safeguards — the chargeback process. With chargeback regulations in place, financial liability is distributed more evenly and accurately between cardholders, banks, and merchants.

Merchant Expectations

Designed for consumer protection, chargebacks ultimately hold you, the merchant, accountable for your actions and encourage you to do things like:

- Sell high-quality goods or services

- Follow through on promises (deliver merchandise, issue refunds, etc.)

- Do your best to stop fraudsters from making unauthorized transactions

Chargebacks vs. Refunds

It may seem like ‘chargeback’ is just another name for ‘refund’ because there aren’t many obvious differences between the two. After all, both chargebacks and refunds cause you to lose money.

But despite their similarities, there are a few important differences that you need to be aware of.

| REFUND | CHARGEBACK | |

| COMMUNICATION | You and your customer work together to identify a solution that benefits you both. | Your customer bypasses you and discusses the problem with the bank instead. |

| CLARITY | Your customer tells you exactly what’s wrong so you can solve the underlying issue. | You have to make adjustments based on assumptions that may or may not be accurate. |

| REVENUE LOSS | You are aware of the upcoming revenue loss and can plan for it. | Funds are forcibly removed from your account without any warning. |

| MERCHANDISE | The customer may be willing to return the merchandise so you can try to sell it again. | You can’t ask the customer to return the merchandise since you’ve been omitted from the conversation. |

| IMPACT | Refund counts are monitored but they are a relatively low indicator of risk. | Chargebacks are meticulously scrutinized and penalties are quickly issued if activity increases. |

Refunds aren’t great, but they are usually much better than chargebacks. Ideally, you’ll be able to create a great customer experience that reduces the need for both refunds and chargebacks.

Chargebacks vs. Transaction Disputes

If there is a significant difference between ‘refunds’ and ‘chargebacks’, is there also a notable difference between ‘chargebacks’ and ‘transaction disputes’?

Kind of.

The simplest, most accurate way to think of the two is like this:

All chargebacks are transaction disputes, but not all transaction disputes are chargebacks.

The payments industry is full of complicated processes and terms. The difference between chargebacks and transaction disputes is a perfect example.

Visit this detailed guide on transaction disputes for a complete, yet easy-to-understand, overview.

Important Chargeback Terms

The chargeback process and its regulations can be difficult to understand. One common reason for confusion is the unique terms and phrases that are used. Here is a brief introduction to chargeback terminology.

| TERM | DEFINITION |

| Cardholder | A cardholder is a consumer who has been approved to use a credit or debit card to make purchases. |

| Merchant | A merchant is you — a business that has been approved to process credit and debit card purchases. |

| Card brand | Through partnerships with participating banks, card brands enable cardholders to make purchases at authorized businesses. Some examples of card brands include Visa, Mastercard, American Express®, and Discover®. |

| Issuer | An issuer, or issuing bank, is the cardholder’s bank. These financial institutions are authorized by the brands to issue payment cards to cardholders. |

| Merchant account | A merchant account is the bank account where your funds are deposited after credit and debit card transactions are processed. |

| Acquirer | An acquirer, or acquiring bank, is the merchant’s bank. These financial institutions are authorized to provide merchant accounts to merchants and accept deposits on their behalf. |

| Processor | An acquirer partners with a processor to facilitate transactions. The processor’s technology platform shares and receives necessary payment data between merchants and issuers. |

| Dispute | A chargeback is sometimes called a dispute because the legitimacy of the transaction is disputed. |

| Chargeback response or representment | A chargeback response is a merchant’s reply to an invalid chargeback. The goal is to prove the original transaction was legitimate, reverse the chargeback, and recover the funds that were withdrawn. This is sometimes called representment because the merchant is re-presenting the transaction to the issuer for consideration. |

| Supporting documentation | Supporting documentation is included in a chargeback response and helps prove the merchant’s argument. |

| Pre-arbitration | Pre-arbitration is the final stage of the chargeback process. It is the last chance for an issuer and merchant to resolve a dispute before it escalates to arbitration with the card brand. |

To learn about other common industry terms, visit our glossary.

The Chargeback Process

The chargeback process involves several tasks that are completed at different stages of the chargeback lifecycle. Sometimes the process is long, and the chargeback advances through multiple stages. Other times, the dispute is resolved quickly with limited effort.

The following is a simplified explanation of the full chargeback process.

How the Chargeback Process is Impacted by Your Payment Processing Platform

The card brands — Mastercard, Visa, etc. — regulate the chargeback process. So in order to create an effective chargeback management strategy, you’ll want to have a detailed understanding of those official rules.

However, the platform that you use to process payments might put its own unique spin on the process. So you also need to be familiar with your platform’s rules, expectations, and processes.

We have detailed guides for many of the most popular payment platforms. If yours isn’t listed here, let us know!

Valid vs. Invalid Chargebacks

Chargebacks are an important and much-needed form of consumer protection. But over time, cardholders gradually started to use the chargeback process in ways it wasn’t originally intended to be used.

Now, merchants receive a mix of both valid and invalid chargebacks.

Valid Chargebacks

The dictionary defines VALID as “legally binding,” “compliant,” and “officially acceptable.”

So a valid chargeback would be defined in the following way:

A valid chargeback is a legitimate payment dispute. The reason for the dispute is credible, and the dispute adheres to card brand rules.

There are really only two reasons why a chargeback should be initiated:

- Criminal activity resulted in an unauthorized transaction.

- You made a mistake but aren’t willing to accept responsibility.

The following are some examples of valid chargebacks.

Rebecca was supposed to cancel a customer’s gym membership but she forgot.

Jake processed an unauthorized transaction because he didn’t want to pay for a fraud detection tool.

Kate accidentally shipped a pair of size 6 shoes instead of the size 9 that the customer ordered.

Invalid Chargebacks

INVALID is defined as “without foundation,” “deficient in substance,” and “without legal force.”

Therefore, an invalid chargeback would have the following definition:

An invalid chargeback is an unnecessary or non-compliant payment dispute — a chargeback that shouldn’t have happened. The reason for the dispute is false or inaccurate, or the dispute doesn’t follow card brand rules.

Invalid disputes can happen when the issuer overlooks or misunderstands one or more of the card brand’s regulations.

Some examples of actions that may make a dispute invalid include:

- Filing a chargeback after the time limit

- Initiating a dispute for an amount that is greater than the original transaction amount

- Not contacting the merchant prior to disputing the transaction

- Initiating a chargeback without attempting to return the merchandise

But the most common reason for invalid disputes is ‘friendly’ fraud. Similar to the military concept of friendly fire, friendly fraud is an attack that comes from someone you would normally trust — your customers.

Friendly fraud happens when a cardholder uses the chargeback process incorrectly, either as an intentional attempt to get something for free or an innocent misunderstanding. There are several reasons why a cardholder might seek an invalid chargeback:

- The cardholder experienced buyer’s remorse and regretted the purchase.

- The cardholder didn’t act quick enough and the refund time limit has passed.

- The cardholder wanted something for free so made the purchase with the intention of later disputing it.

- The cardholder didn’t cancel a subscription before the next billing cycle.

- The cardholder didn’t remember the purchase and incorrectly assumed it was fraud.

The following are some examples of invalid chargebacks.

Kevin contacted the bank and asked to dispute a transaction. The bank quickly obliged — without noticing the chargeback time limit had already passed.

After buying a new tablet, Kate suffered from buyer’s remorse. Rather than return the tablet for a refund, Kate opted for a chargeback because it was more convenient.

Randall forgot to cancel his hotel reservation. When his account was charged, he was irritated by the unplanned expense. So Randall called the bank to complain.

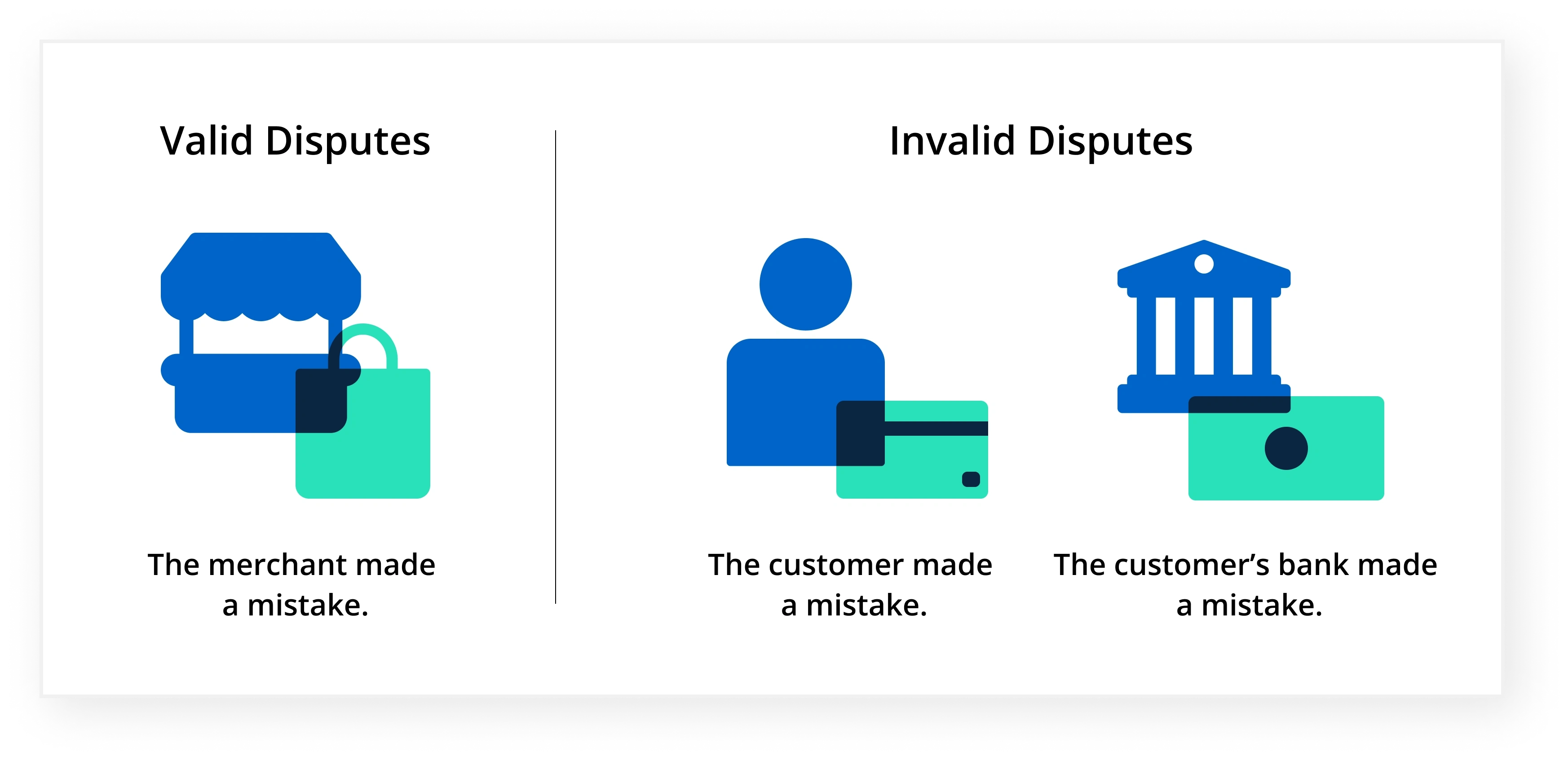

Another way to think about chargeback validity is this: who made a mistake?

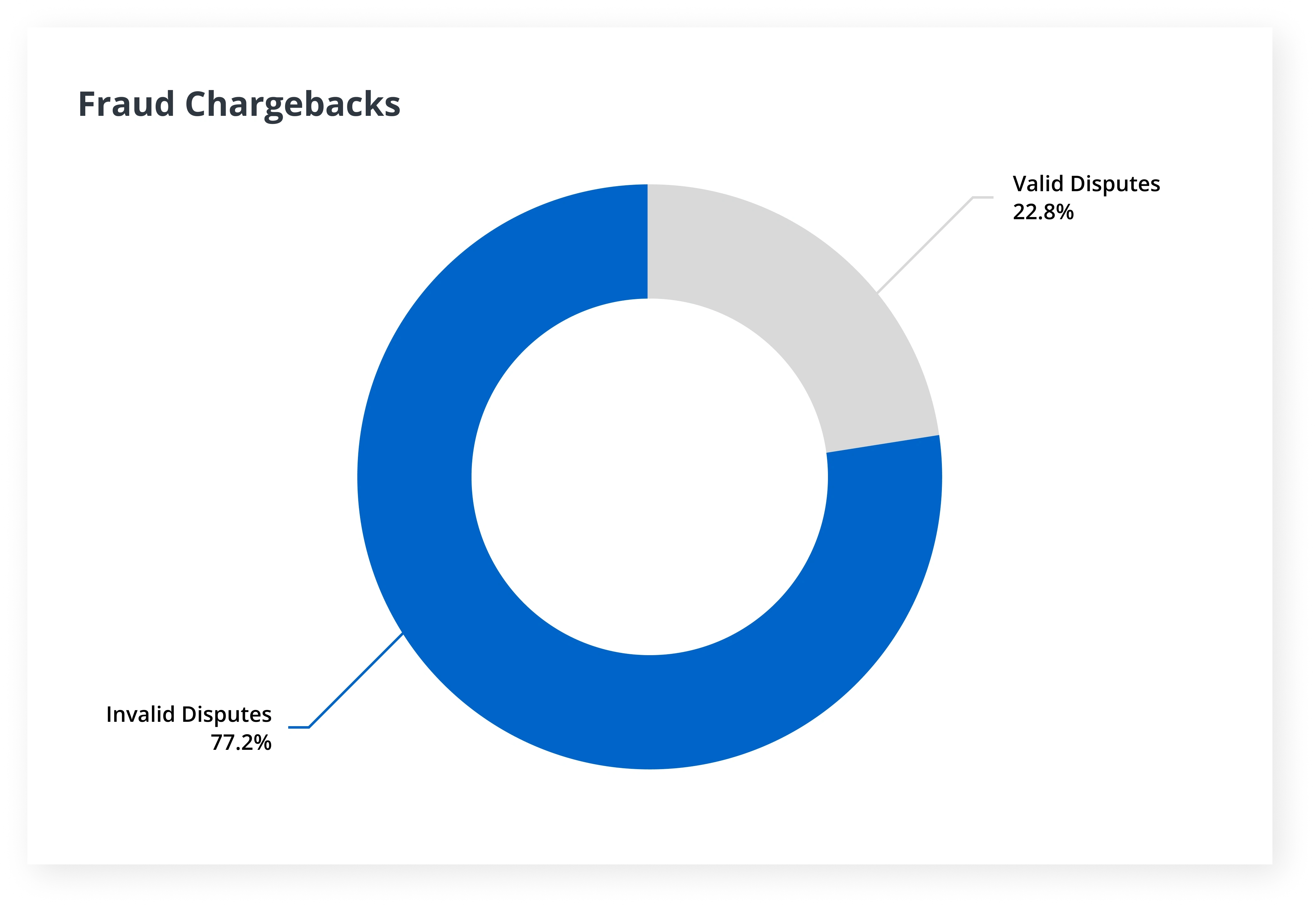

Which Dispute Type is Most Common — Valid or Invalid?

It’s logical to assume the majority of chargebacks are valid. But ironically, valid chargebacks make up a very small percent of overall chargeback activity.

And technically, that’s a good thing.

Because valid chargebacks essentially mean you’ve made a mistake. And repeatedly making mistakes means your business has some pretty big issues to deal with.

But if you are doing all you can to minimize errors and solve problems at their source, the majority of your disputes will be invalid.

According to Kount's The Year in Chargebacks report, 77.2% of disputes classified as fraud were actually cases of friendly fraud (customer or bank mistakes).

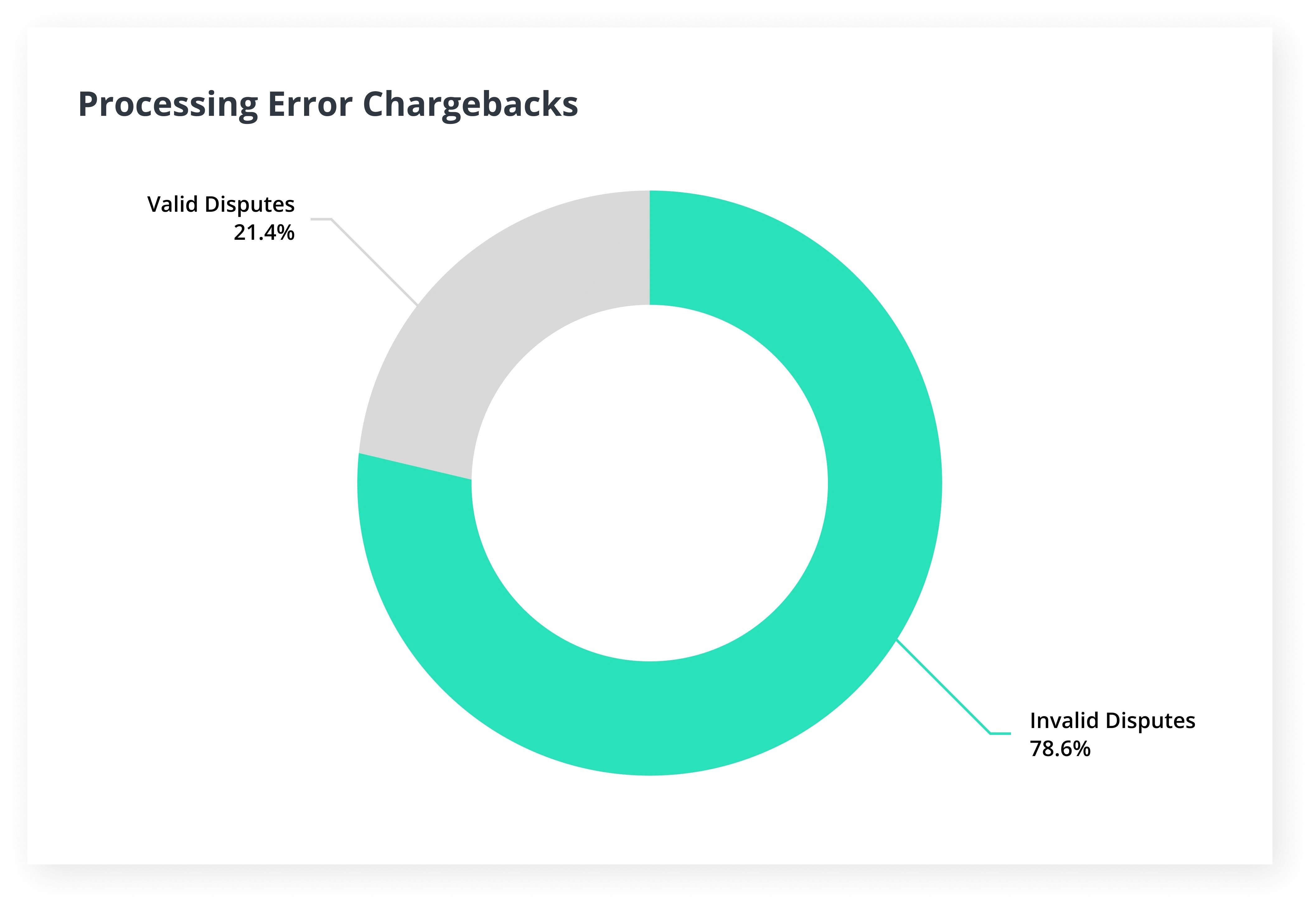

Other data found that merchants were only at fault for 21.4% of processing error disputes. The majority were either customer or bank errors.

Why Does it Matter if a Chargeback is Valid or Invalid?

Who cares if a dispute is valid or invalid? You should!

There are two reasons why it is important to monitor your chargeback types:

- Valid chargebacks can be prevented.

- Invalid chargebacks can be fought.

It is essential to understand these two realities. They should be the foundation of your chargeback management strategy: provide the very best customer experience — and then challenge anyone who falsely claims you’ve done something wrong.

Because every chargeback you receive — both the valid and invalid — has a negative impact on your business.

A Word of Warning

Remember when we said determining validity is kind of like deciding who made a mistake? Invalid disputes are mistakes made by either the customer or the customer’s bank.

A lot of times, merchants will only respond to bank mistakes (disputes filed after the deadline, disputes that have already been refunded, etc.) because they are easy to fight and win.

If that is your philosophy — or your chargeback service provider’s — you are jeopardizing both your bottom line and the future of your business.

Bank mistakes make up a very small portion of invalid disputes. The vast majority are caused by customer mistakes or friendly fraud.

You should fight all invalid chargebacks, not just the easy-to-win cases.

There are several very valuable benefits of fighting invalid chargebacks. If you aren’t sure how to challenge a customer’s false claim, Kount can help.

The Impact of Chargebacks

Chargebacks are a costly, time-consuming, frustrating process for everyone involved. But usually, merchants are affected the most.

There are several ways that chargebacks can negatively impact your business. Here are just a few:

- Dissatisfied customers stop doing business with you.

- Bad reviews damage your reputation.

- Revenue is lost when transactions are disputed.

- Fees are added for every chargeback you receive.

- Even more revenue could be withheld in a reserve account.

- Enrollment in one or more chargeback monitoring programs could add more fines.

- You might lose the ability to process payments.

- You could go out of business.

The impact that chargebacks have on your business can intensify over time. The longer you have a chargeback problem, the worse it will be.

That’s why you shouldn’t ignore chargebacks or just accept them as a cost of doing business. There are steps you can take to prevent disputes and recover lost revenue to improve your bottom line.

Managing Chargebacks

How do you deal with chargebacks?

You create a strategy to minimize revenue loss. The more comprehensive your strategy, the greater your protection will be.

A complete approach to chargeback management involves three components.

Preventing Chargebacks

Chargeback prevention is the process of reducing the likelihood of chargebacks and minimizing the impact they have on your bottom line.

The process is usually driven by two key components:

- Using the right solutions: There are dozens of solutions you can use to prevent chargebacks — fraud detection technologies, 3D Secure, address verification service, prevention alerts, order validation, and RDR are just a few. These tools are used at different stages of the transaction lifecycle to create multiple layers of protection.

- Creating an ideal customer experience: There is low probability of a chargeback from a satisfied, fully-informed, well-served customer. Focusing on perfecting every touchpoint along the customer journey will reduce the risk of chargebacks.

It might seem like chargeback prevention is a difficult task. It certainly is a detailed process, but it doesn’t have to be challenging.

We have easy-to-understand resources that can guide you through the entire process. Start with our introductory article on preventing chargebacks, and then branch off into the different topics that are most relevant to your business.

Fighting Chargebacks

Fighting chargebacks is the process of recovering revenue revoked by illegitimate disputes.

If a chargeback is invalid — it shouldn’t have happened — you have the right to respond and challenge the claims that were made. With a convincing argument and documents that support your case, you can overturn a chargeback and recover lost revenue.

The process includes several important steps:

- Knowing what you should and shouldn’t fight: Not all chargebacks should be challenged. Sometimes, it’s best to just accept responsibility. For example, you shouldn’t fight legitimate cases of criminal fraud. Nor should you respond if you made a mistake. And sometimes, the effort that goes into fighting would cost more than you could recover. You need to pick your battles carefully.

- Creating a convincing argument: When you fight a chargeback, you are requesting that the bank take money from the cardholder and give it to you — and that’s a pretty big ask! In order to be successful, you have to have a very convincing argument. Be prepared to collect various forms of evidence throughout the customer journey so it’s available when you need to create a chargeback response.

- Submitting a fully-compliant case: Even the most persuasive case will be rejected if it doesn’t abide by the rules. You have to know which documents to include, how those documents need to be formatted, and when they need to be submitted.

The idea of fighting chargebacks might be intimidating, but it is an important process. You have the chance to add a significant amount of revenue to your bottom line — don’t walk away from that opportunity!

Check out the resources we’ve created on fighting chargebacks. We outline the most efficient, effective, and accurate ways to challenge chargebacks. You’ll be able to recover the most revenue with the least effort and fewest costs.

Analyzing Chargebacks

Analyzing chargebacks is the process of collecting and reviewing the data associated with chargebacks.

The ultimate goal of data analysis is to identify and correct weaknesses in your processes so you can improve your results.

There are dozens of different chargeback metrics you’ll want to monitor. Some examples include:

- Chargeback variables: If you break down your chargeback data by different variables, you can identify the underlying problems that caused them. For example, which price point has the highest chargeback rate? Which country? Which marketing source?

- Prevention rate: Using multiple solutions to prevent chargebacks gives you the best protection. But you have to monitor the effectiveness of each technique. How many chargebacks are prevented with alerts? Order validation?

- Win rates: In some regards, fighting chargebacks is more of an art than a science. You can always test different techniques to see which has the best success. For example, which supporting documentation has the highest win rate? Which reason code? Which employee?

- Return on investment: You want to make sure you are helping, not harming, your bottom line. Are there ways to recover more revenue? Reduce costs?

Visit our detailed guide to analyzing chargeback data. It outlines other important KPIs and offers tips on how to improve the efficiency of your analysis.

As your business grows, so will your need to minimize the financial impact of chargebacks. The more proactive you are, the more manageable the situation will be.

When your chargeback situation becomes something you can no longer manage on your own, Kount can help. Sign up for a demo. We’ll show you what your business’s strategy could look like and the outcomes you can expect.

Chargebacks by Product Type

Chargebacks have a lot of things in common. For example, they all cause you to lose money and jeopardize your business’s reputation.

But despite their similarities, each chargeback you receive has unique qualities — such as the associated card brand and the assigned reason code. Another important variable is the type of item that was purchased: physical merchandise, digital merchandise, or a service.

Product type can have a significant influence on your chargeback management strategy.

Physical Merchandise

Physical merchandise is tangible goods — items that can be felt, touched, handled. These products can be bought at a brick-and-mortar store, online, over the phone, or through the mail.

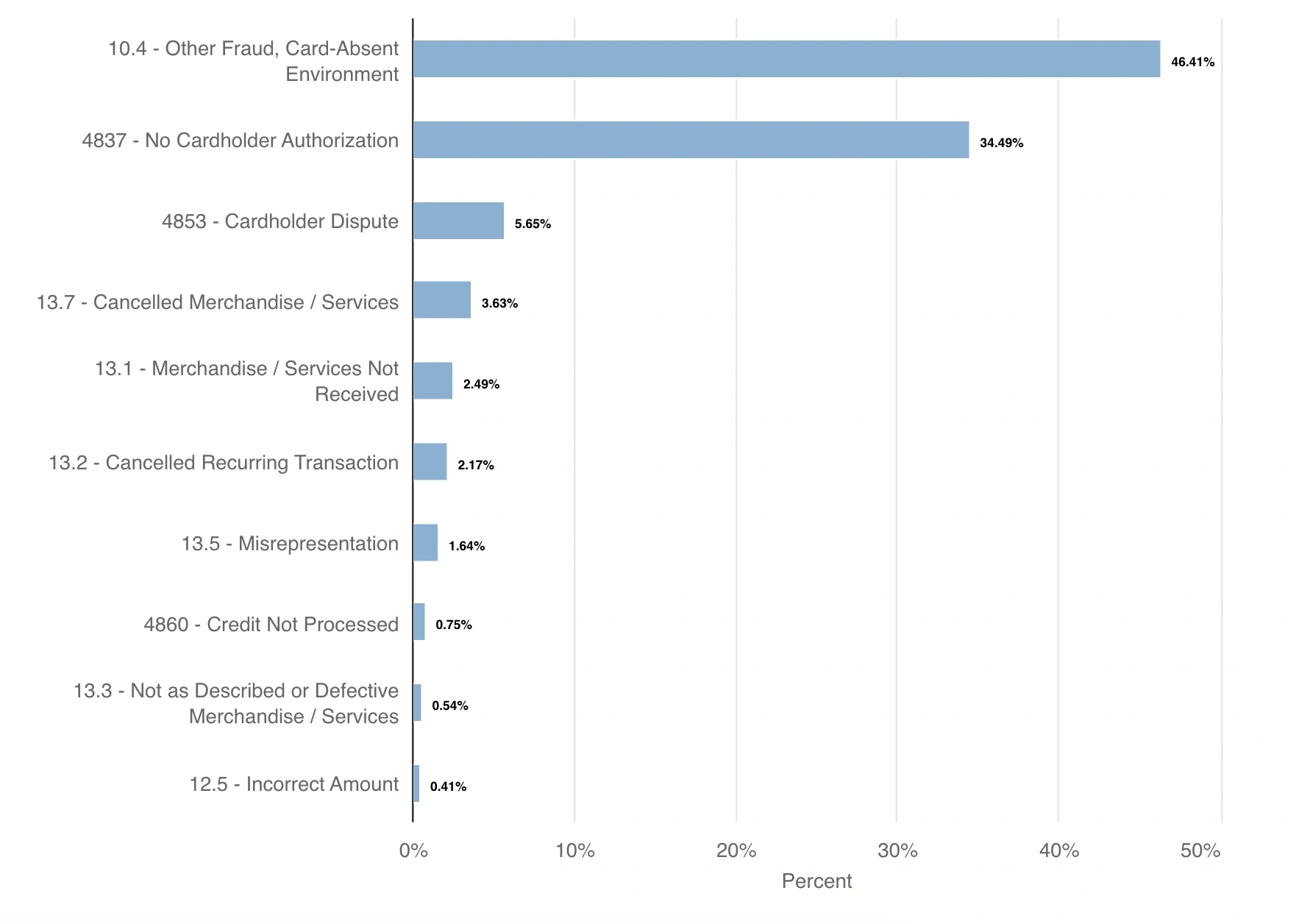

The following are the most commonly used reason codes for merchandise chargebacks.

When fighting chargebacks associated with physical goods, you’ll want to include the following supporting documents. This evidence can help increase the odds of winning.

- A screenshot of the product description on your website

- A copy of your return or refund policy

- Delivery confirmation and/or shipment tracking information

- An in-store pickup form with the cardholder’s signature

- Photographs or emails that prove the cardholder is in possession of the merchandise

Merchants who do fight these types of chargebacks have an average win rate of 53.42% and an average ROI of 568%.

Digital Merchandise

Digital merchandise is intangible goods that only exist in digital form. Some examples include ebooks, music downloads, and movie streaming.

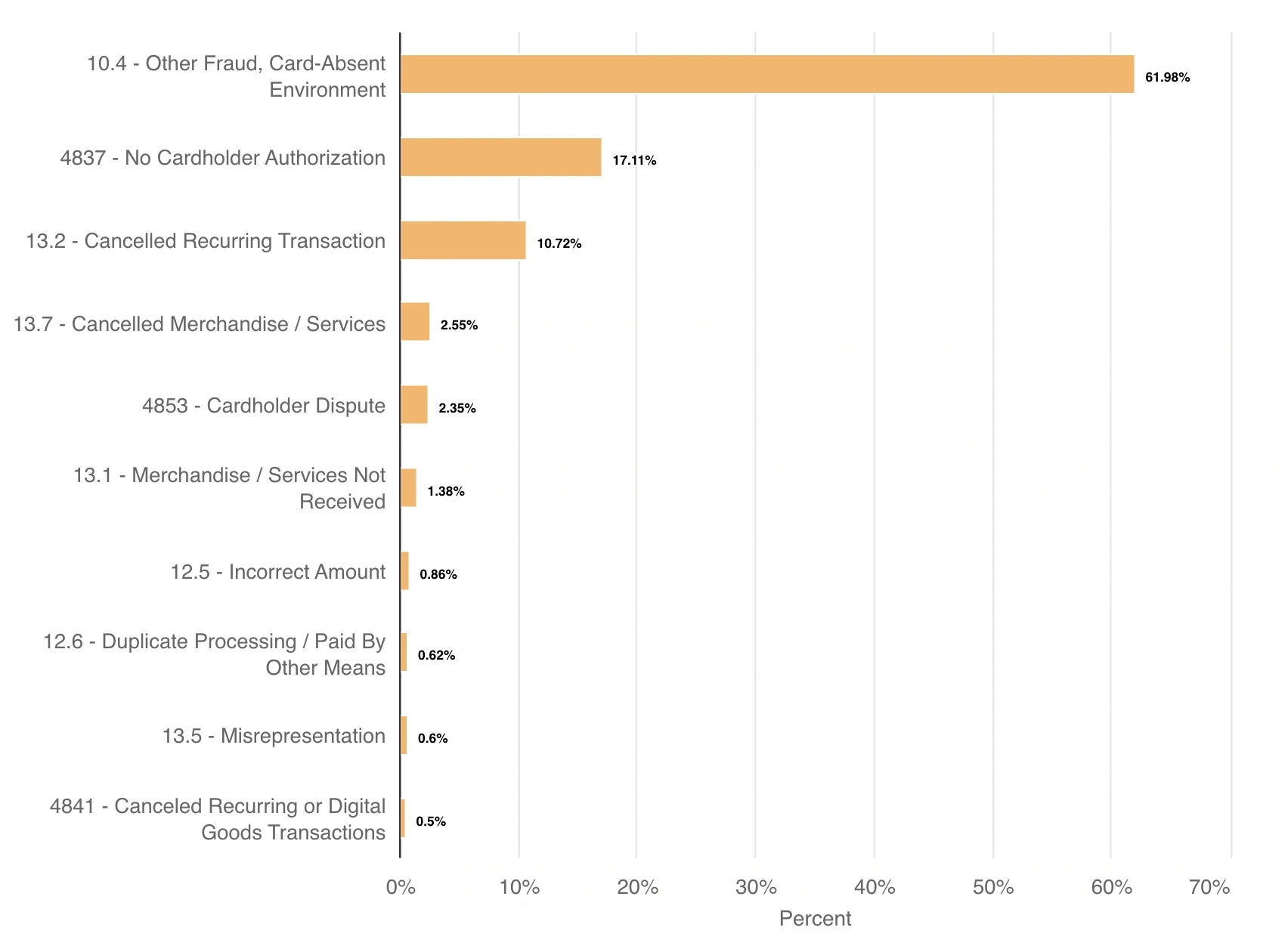

The following reason codes are most commonly associated with chargebacks for digital goods.

Card brands recommend the following types of supporting documents when fighting chargebacks for digital goods.

- A written description of the digital goods that were purchased

- Usage logs such as login dates and download activity

- The shopper’s IP address

- The device’s geographical location at the date and time of purchase

- Proof your digital platform asks for login credentials after a set period of inactivity

Many merchants think physical merchandise chargebacks are the easiest to fight since there is a tangible item in question. However, the success of a chargeback response depends entirely on the quality of the argument and supporting evidence.

Because it’s commonly believed that digital goods chargebacks are difficult to win, merchants tend to put more effort into the fight. As a result, digital goods have the highest average win rate of any product type: 72.56%. And, on average, the ROI is 777%.

Services

A service is a helpful act, for example mowing someone’s lawn or fixing a broken cell phone.

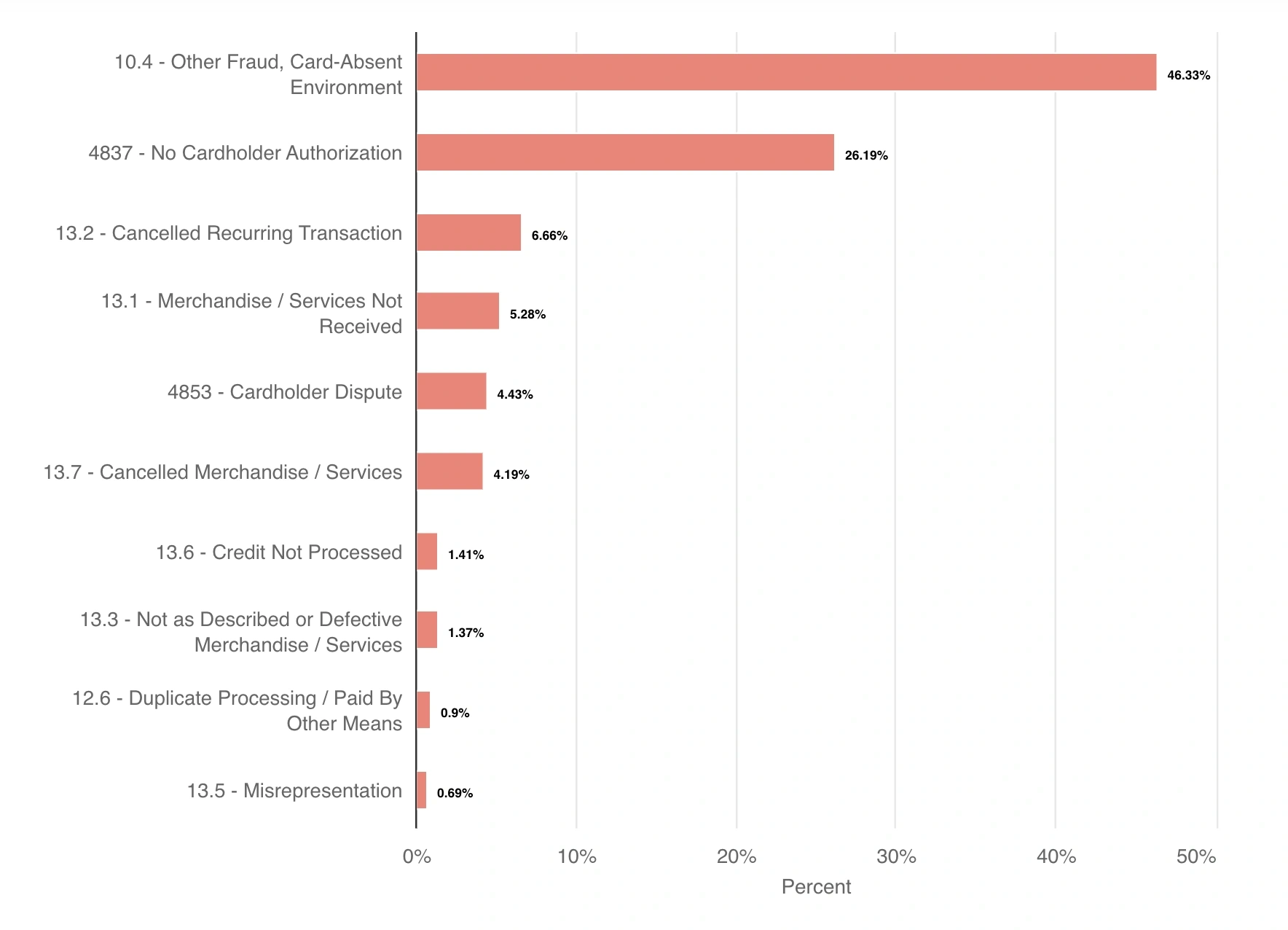

The following reason codes are most commonly associated with chargebacks for services.

When fighting chargebacks for services, you’ll want to include the following supporting documents. This evidence can help increase the odds of winning.

- A written description of the services provided

- A contract or work order signed by the cardholder

- Proof a ticket or boarding pass was scanned at the gate

- Proof the cardholder made additional purchases tied to the original transaction (seat upgrade, extra baggage, on-board purchases, room service, etc.)

Merchants who fight chargebacks for services have an average win rate of 46.78% and an average ROI of 2,285%.

Chargeback Fact vs. Fiction

As you build a chargeback management strategy, you’ll receive lots of advice.

Unfortunately, that advice won’t always be good.

There are lots of myths, legends, and assumptions floating around. And if you believe those falsehoods, your business will suffer.

It can be challenging, though, to distinguish between fact and fiction. So we’d like to help.

We created two valuable resources to help guide you — and alert you to potential pitfalls — as you build a chargeback management strategy.

The first resource outlines the 15 most common payment industry myths and the chargeback facts you should believe instead. The second guide shares insider tips, preferences, and little-known facts that payment processors want merchants to know about chargebacks.

If you ever have any question about building a chargeback management strategy or you’d like help along the way, reach out to Kount. Our team of experts is always willing and able to help in any way we can.

Your Rights as a Merchant

Because of the original purpose and goals of the dispute process, chargeback rights are often more oriented towards protecting cardholders than merchants.

However, you do have rights. And it’s important to understand and defend those rights because they impact your business in significant ways.

Let’s take a look at what you can and can’t do when it comes to chargeback management.

You have the right to…

- Be educated on card brand rules - The entire chargeback process is governed by card brand regulations. You have the right to know which rules you have to follow. And, you have the right to be informed of how the other people involved in the process (cardholders, banks, etc.) are expected to act.

- Know why a transaction was disputed - You have the right to know why a chargeback is revoking your hard-earned revenue. The cardholder (or bank) should have a valid reason for disputing a transaction and that reason has to be shared with you.

- Blacklist high-risk customers and banks - If a customer is causing you to lose money, you have the right to stop doing business with that person. Similarly, if a bank’s cardholders are a threat to your bottom line, you have the right to block purchases from that particular financial institution.

- Fight invalid chargebacks - Not all chargebacks are valid. And if you’ve unfairly sacrificed revenue, you have the right to defend your innocence and try to get the money back.

- Escalate a case to arbitration - Sometimes, two people aren’t able to come to an agreement and an objective third party is needed to make a fair decision. So when necessary, you can ask the card brand to step in and arbitrate your case.

- Get help - No one expects you to navigate the complex, costly, time-consuming chargeback process on your own. You always have the option to get professional help. If you’d like to execute this right, Kount can help. Sign up for a demo to learn more.

It’s important to understand and uphold your chargeback rights. Check our related blog article for more details.

Reasons for Chargebacks

Why would a customer dispute a purchase? What is a valid reason for requesting a chargeback?

Should the customer’s claims impact whether or not you respond? And if you understand the reason behind the chargeback, can you prevent similar disputes in the future?

To address these questions and more, the card brands created chargeback reason codes. Reason codes are a classification system used to explain why transactions are disputed.

Chargeback reason codes are usually expressed as letters, numbers, or a combination of both letters and numbers. Codes are often followed by a short description. The following are some examples:

- 4837 - No Cardholder Authorization

- 13.4 – Counterfeit Merchandise

- RM – Cardholder Disputes the Quality of Goods or Services

- C32 – Merchandise Was Damaged Or Defective

Every chargeback is assigned a reason code. In addition to helping you understand why the transaction was disputed, reason codes also regulate things like time limits, which supporting documents are needed to fight the chargeback, and what can be done to prevent future disputes.

Each card brand has their own unique list of reason codes. Click the links below to learn more about brand-specific codes and rules.

You can also visit our complete chargeback reason code database. It takes a deep dive into each reason code, giving you tips on how to manage each one. You can also learn about the top five ways reason codes impact your business.

Despite the card brands’ best intentions to clarify the reason for a dispute, you might still be confused about why you received a particular chargeback.

In an effort to provide even more insights, we’ve come up with a simplified way to explain why chargebacks happen. Our goal is to help you better understand the rationale and motives behind disputes.

There are three main reasons for chargebacks.

- Merchant Error - Merchant error happens when you make a mistake while processing a transaction, fulfilling an order, or navigating the customer experience. If you don’t make an effort to fix your mistakes, a customer could request a chargeback.

- Criminal Fraud - Criminal fraud happens when someone uses a cardholder’s payment card or account information to initiate an unauthorized transaction. Because the shopper didn’t have permission to make the purchase, a chargeback is the typical outcome.

- Friendly Fraud - Friendly fraud happens when a cardholder uses the chargeback process incorrectly, either as an intentional attempt to get something for free or an innocent misunderstanding.

Be sure to visit our detailed guide to learn more about these three chargeback reasons, including how to effectively manage each one.

Chargeback Time Limits

The chargeback process is heavily regulated. Rules outline the actions that should be taken — and how quickly those actions need to be executed.

In particular, there are two deadlines that you should be aware of. These two timelines have a direct impact on your bottom line.

How Long a Cardholder Can Wait to Dispute a Transaction

How much time can pass between the transaction processing date and the chargeback?

The reason code assigned to the chargeback will determine the time limit. Each code has a different timeline. Most chargebacks have to be filed within 75, 90, or 120 days of the initial purchase.

Why This Chargeback Time Limit Matters

If you can anticipate your chargeback trends and predict when risk will escalate, you can act preemptive.

For example, more sales during the holiday season could mean more chargebacks in the first few months of the year. If you can predict when chargeback will happen, you can have extra employees on hand to manage them.

How Long You Can Wait to Respond

How long do you have to fight a chargeback? What is the deadline to respond?

Submission deadlines vary by processor — we’ve seen a range of 2 to 20 days from the date the chargeback is issued. Usually, the exact due date is listed on the chargeback notice.

Why This Chargeback Time Limit Matters

Response timelines are tight. And there is a lot to do in a very short amount of time. You need to be aware of your deadlines so you don’t miss them.

Because if you do — if a case expires — your revenue is lost forever. Submissions made after the deadline won’t be considered.

Be sure you understand both types of deadlines so you can limit the impact that chargebacks have on your bottom line. Visit this guide on time limits to learn more.

Chargeback Fees

Each chargeback you receive causes a lot of financial loss.

Because every time a transaction is disputed, you lose the time, effort, and expenses that went into making the sale happen. Think of all the costs that can go into a single transaction:

- Marketing and acquisition

- Fraud detection

- Transaction processing

- Product or service

- Warehouse and inventory

- Order fulfillment

- Shipping

- Customer service

But that’s not all.

Most chargebacks also come with a fee — which just adds insult to injury.

These fees are charged by your acquiring bank and help cover the costs associated with processing a chargeback. They are usually between $10 and $50 per chargeback.

Fees and policies vary by acquirer. However, there are a few characteristics that are fairly common for most banks.

- The chargeback fee, along with the chargeback amount, is usually automatically withdrawn from your merchant account.

- If your business has been classified as “high-risk”, you’ll probably have a higher-than-normal chargeback fee.

- Enrollment in a chargeback monitoring program will cause your chargeback fee to increase.

- Chargeback fees aren’t usually refundable. If you fight a chargeback and win, you’ll recover the transaction amount — but not the fees that were charged to you.

Want to learn more about chargeback fees and how to avoid them? Check our detailed guides.

Credit Card vs. Debit Card Chargebacks

Payment cards are a cash alternative. The two most popular types of payment cards are debit cards and credit cards.

Both cards serve the same purpose — to facilitate a purchase. But the way each card goes about enabling a transaction is slightly different. The primary difference is where the funds come from.

A credit card provides a line of credit to the cardholder. The issuer essentially loans money to the cardholder for every purchase that is made, and the cardholder is expected to repay the issuer at the end of each billing cycle.

When a purchase is made with a debit card, funds are immediately withdrawn from the associated checking or savings account.

Credit card purchases are charged against a line of credit.

Debit card purchases withdraw money directly from a bank account.

It’s important to understand these differences because the source of the funds may determine which law governs the transaction.

Credit and Debit Dispute Rules

Before we outline the different dispute rules, let’s first review where the rules come from.

There are three different sets of regulations that govern transaction disputes.

The Electronic Fund Transfer Act (Regulation E) establishes the rules associated with debiting a bank account.

The Consumer Credit Protection Act (Regulation Z) establishes the rules associated with managing consumer credit.

The card brand regulations establish rules for using brand-endorsed payment cards (Visa, Mastercard, etc.).

Issuing banks must abide by federal laws, so all Regulation E and Regulation Z requirements should be upheld when transactions are disputed. However, extending additional card brand chargeback rights is optional.

Card brand rules typically offer even greater consumer protections than the legal regulations. Issuers may choose to extend this coverage to their cardholders, but they technically don’t have to.

WHAT THIS MEANS FOR MERCHANTS

The term ‘chargeback’ is often thought to be synonymous with ‘transaction dispute’. Technically, the two aren’t interchangeable.

All chargebacks are transaction disputes, but not all transaction disputes are chargebacks.

Regulations E and Z give cardholders the right to dispute transactions, but only the card brands offer a chargeback process.

Why does that matter?

Think about your dispute management strategy. What does it entail? Are you focused solely on activity facilitated by the card brands — alerts, order validation, and chargebacks? If so, you might not have a complete understanding of the customer experience.

Chargeback data is incredibly valuable. It can help you identify hidden issues and resolve problems at their source. However, there are several reasons why a consumer complaint might not ever make it to a chargeback — an issuer’s choice to limit protections is just one of the reasons. Therefore, chargebacks shouldn’t be the only metric you use to gauge customer satisfaction, the effectiveness of your processes, and the risk of potential revenue loss.

Focus on creating an exemplary customer experience — one that ensures satisfaction and resolves issues without the need of a chargeback.

The following is a high level overview of the dispute rules associated with the three different sets of regulations.

Regulation E (Debit Cards) | Regulation Z (Credit Cards) | Card Brand Regulations (Debit and Credit Cards) | |

| Type of Issues Regulated |

|

| All potential disputes, including:

|

| Maximum Amount of Cardholder Lability & Time Limits | The cardholder may be liable for:

| The cardholder may be entitled to a full credit if billing errors (goods or services not provided, credit not issued, and accounting errors) are reported within 60 days of the statement being issued. The cardholder may be responsible for paying up to $50 for unauthorized transactions if the fraud is reported within 60 days of the statement being issued. | If the merchant accepts the chargeback, the cardholder won’t have any financial liability. But if the merchant responds, the cardholder or issuer could be liable for the full transaction amount. Time limits vary based on the chargeback reason code, but most disputes must be filed within 75-120 days of the purchase. |

The nuances of these rules mostly impact cardholders. However a cardholder’s actions could, in a roundabout way, potentially impact your business.

WHAT THIS MEANS FOR MERCHANTS

Again, an issuer doesn’t have to offer the extended protections provided by the card brands to the cardholder when disputes arise. If the Regulation E or Z stipulations don’t apply, the issuer may choose to simply close the case.

If that happens, the cardholder may try other methods to recover the money — like reaching out to you, the merchant, directly.

The following is a hypothetical example.

When Carter — Carli’s son — turned 18, she called her issuing bank and gave permission for Carter to use one of her credit cards. But she didn’t do a good job of monitoring the account. Months later, Carli discovered that Carter had made dozens of purchases that she hadn’t anticipated.

Frustrated and reluctant to pay the credit card bill, Carli contacted her issuing bank and tried to claim the transactions were unauthorized. But Carli’s case didn’t fit within the Regulation Z rules for two reasons. First, she attempted to dispute the transactions after the 60 day deadline. Second, her son was technically authorized to use the card.

Since it costs the bank about $30 to process each chargeback and Carli was attempting to dispute nearly a dozen transactions, the bank decided not to advance her case.

Since the bank wouldn’t initiate chargebacks, the only way Carli could get her money back would be to call each individual merchant and request a refund.

This may not be an extremely common situation, but it is possible. Therefore, you’ll want to balance an exceptional customer experience that proactively prevents chargebacks with a revenue-retention strategy that thoughtfully considers all potential outcomes.

Credit and Debit FAQs

Managing chargebacks, whether they are for debit or credit cards, is an important task. These are some of the most common questions we’ve encountered from merchants trying to manage the different threats.

Don’t see your question listed here? Contact Kount. We’ll help you any way we can!

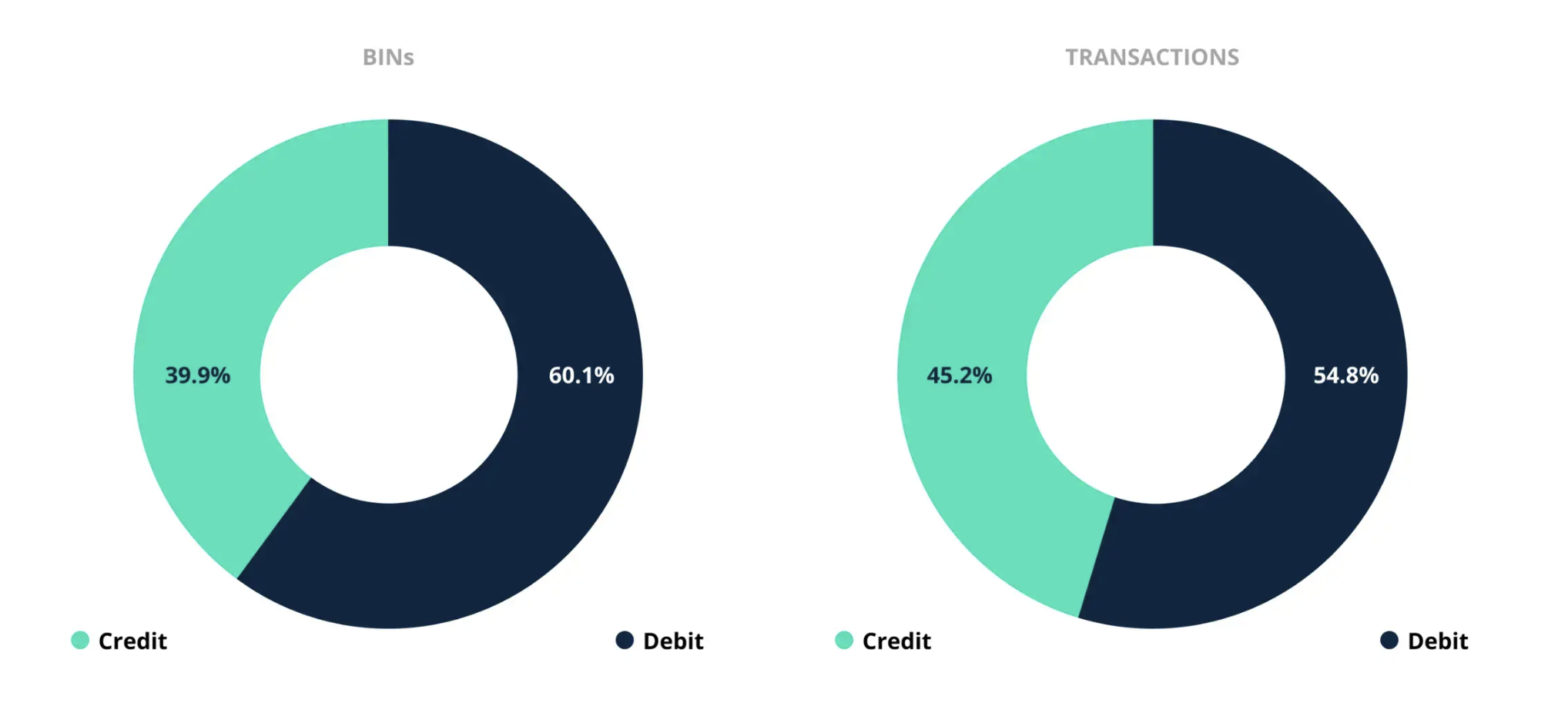

Each year, we analyze merchant data to create our annual Year in Chargebacks report. As part of the 2021 report, we included an analysis of bank identification numbers (BINs).

Analyzing data from BINs that processed 20,000 or more transactions revealed that 60.12% of BINs were associated with debit cards. However, only 54.79% of transactions were processed on debit cards.

The slight discrepancy between debit card usage and transactions processed provides interesting insights.

Debit cards are a popular payment method, but they aren’t the preference in all situations. Debit cards have less protections and more liability than credit cards. Therefore, cardholders tend to be more cautious with their use.

As a result, credit cards — the safer option with less liability — are used more frequently for subscriptions where there is a greater risk for potential fraud. Thus, merchants that sell goods or services through a recurring billing model tend to process more credit card transactions than debit.

It’s important to note the frequency of use for each card type because the risk of chargebacks varies slightly between debit and credit.

Analyzing BIN data revealed some interesting insights about the average chargeback-to-transaction ratio (or the percent of transactions that become chargebacks).

Despite the fact that the majority of transactions were processed on debit cards, credit cards actually posed a greater risk for chargebacks.

The primary reason for the difference is because consumers tend to be more aware of the protections available for credit cards than debit. So credit cardholders exercise their chargeback rights with greater frequency.

This means you’ll want to keep an eye out for credit card transactions — those processed by the card brands as opposed to the electronic fund transfer (EFT) network. For credit card purchases, you may want to take a more proactive approach to chargeback prevention. That might involve strategies such as tightening your fraud detection rules for credit card transactions or reaching out to customers to gauge satisfaction.

Unfortunately, most issuers tend to use the chargeback process quite frequently — even if the cardholder doesn’t have a case based on Regulation E or Z rules.

One reason is because chargebacks tend to require less effort and invoke limited liability if handled incorrectly.

Regulation Z, for example, requires that issuers conduct a thorough investigation if the cardholder is held liable for any amount of the unauthorized transactions.

"If a card issuer seeks to impose liablity when a claim of unauthorized use is made by the cardholder, the card issuer must conduct a reasonable investigation of the claim."

This extra effort may seem overwhelming or even impossible for many issuers — especially small financial institutions.

Card brand regulations have similar requirements. However, the liability for potential non-compliance is significantly less. Failing to abide by Regulation E or Z requirements mean the issuer is breaking a federal law, whereas overlooking or falling short of card brand expectations may merely invoke a fine.

Another reason why issuers may tend to favor chargebacks — even in cases of potential friendly fraud — is because banks need to provide great customer service too. Banks are as interested in customer retention as you are!

In Conclusion

Thank you for letting Kount be a part of your chargeback learning experience. It’s an honor to be trusted with the job of educating on this important topic.

Hopefully this detailed guide answered your most pressing questions. If you’d like to learn more about managing chargebacks, we recommend you check out these resources.