The Visa Acquirer Monitoring Program (VAMP): Key Insights and Upcoming Changes

The primary goal of the Visa Acquirer Monitoring Program (VAMP) is to ensure the integrity of the Visa payment system. This program continuously monitors transaction activities to detect and prevent fraudulent behavior, ensuring that both merchants and consumers can trust the system. For acquirers and merchants, this means adhering to a set of stringent standards to maintain a high level of transaction security.

Acquirers are responsible for ensuring that their merchants comply with VAMP standards and remain below specific thresholds. This compliance includes implementing robust monitoring systems, conducting regular reviews of transaction data, and taking corrective actions when potential actions are identified. Failure to meet these standards can result in penalties, increased scrutiny, and potential loss of the ability to process Visa transactions.

Visa plans to deploy new changes to VAMP globally beginning April 2025. However, at this time the compliance will not be enforced until October 2025 for merchants and Acquirers.

How VAMP currently works

VAMP last underwent major changes in October of 2019, with the creation of a set of critical components. These include:

- Monitoring metrics and criteria:

VAMP uses various metrics to monitor the performance of acquirers, including transaction volumes, fraud rates, and dispute occurrences. These metrics help Visa evaluate how well acquirers maintain transaction safety and security. Acquirers must have robust systems in place to track these metrics accurately, ensuring they stay within acceptable limits to avoid penalties. - Reporting and compliance requirements:

Visa evaluates transaction data monthly for compliance with VAMP expectations. This reporting helps detect and rectify potential issues. Non-compliance with reporting requirements can lead to penalties. Acquirers invest heavily in advanced data management and reporting systems to ensure accurate analysis and use of reported information. Merchants must ensure their data is accurately captured as reported by acquirers, requiring clear communication and cooperation. - Penalties for noncompliance:

If an acquirer fails to meet VAMP standards, they face penalties such as fines. These penalties help maintain the integrity of the payment system. The threat of penalties motivates both acquirers and merchants to prioritize compliance and maintain high standards when dealing with chargebacks and related fraud.

RELATED READING

What you need to know about upcoming VAMP compliance

Starting in April of 2025 will begin to see the elimination of the separate VDMP and VFMP programs for merchants. A combined VAMP system with integrated and simplified metrics will replace these programs.

The new changes include stricter thresholds for acquirers.

- The new “Above Standard” threshold will be set to 0.3% for Acquirers dispute ratios. This significant reduction means acquirers must be more vigilant in monitoring and managing their transaction processes to stay compliant, and Visa will expect proof of enhanced dispute management. Merchants will also need to ensure their operations are efficient and transparent to avoid contributing to their acquirer’s risk of exceeding these thresholds.

- “Excessive” categorization thresholds, those above 0.5%, will place acquirers at risk of severe penalties. At this level, Visa may begin to look into specific merchants or payment providers to help the acquirer bring down their thresholds. Acquirers may need to take drastic actions against merchants violating these standards.

- Merchants will also have new standards, the “Above Standard” threshold will remain at 0.9%. However, the “Excessive” threshold for merchants will be reduced to 1.5%. Merchants who reach this threshold will be subject independently of their Acquirer to severe penalties.

- If acquirer portfolio performance is above the Excessive threshold, enforcement fees will apply to each dispute for all merchants with a VAMP ratio of >=30 bps, regardless of dispute count.

- The minimum requirements for all programs will kick in at 1,000 disputes. But these dispute totals will also include non-fraud related reason codes 11,12, and 13 as well as TC40 fraud transactions. It remains to be seen if disputes resolved using Rapid Dispute Resolution (RDR) will count against these requirements.

These updates will be phased in over six months following April of 2025. Visa plans to provide clear guidelines to help acquirers transition smoothly to the new standards. Acquirers and merchants should plan for these changes by reviewing current practices and identifying areas that need improvement to meet the new requirements.

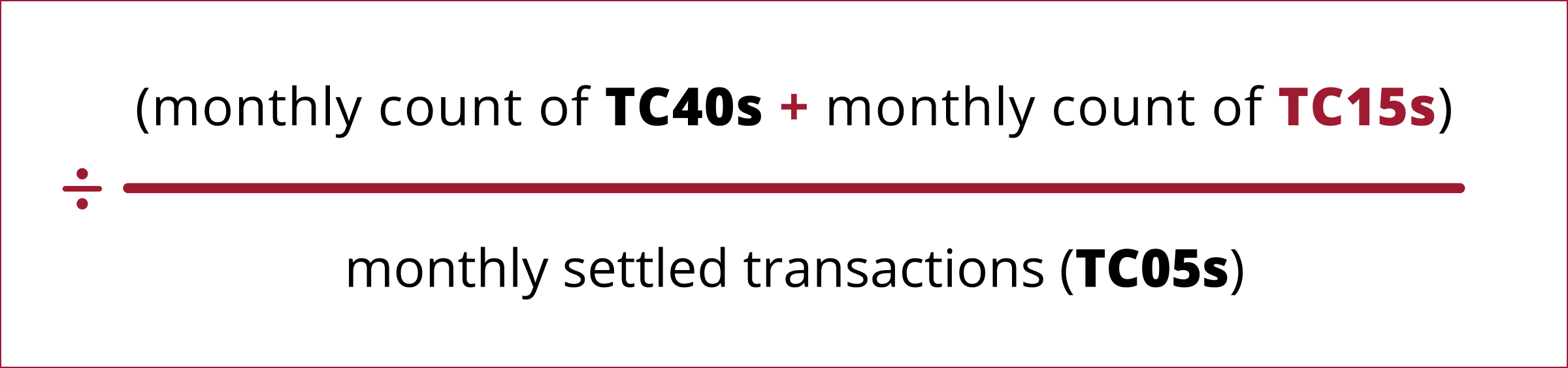

How to calculate your VAMP Ratio

The VAMP ratio is a single, count-based metric used by Visa to monitor fraud and disputes on card-not-present (CNP) transactions. It is calculated by adding the total monthly count of TC40 fraud transactions and TC15 non-fraud disputes, then dividing that by the total monthly transaction volume. The resulting percentage is the VAMP ratio.

What to know:

- TC40s are reported fraudulent transactions identified by Visa.

- TC15 are non-fraud disputes that stem from customer dissatisfaction or processing errors.

- Your total transaction volume refers to the total number of settled Visa transactions for the acquirer's merchant portfolio during the month.

Note: A single transaction may be counted in both TC40s and TC15s if it's initially flagged as fraud and then results in a chargeback.

Implications for acquirers and merchants

Acquirers will need to adjust their operations to meet the new standards. This might involve investing in better fraud detection tools or updating reporting and analysis systems to comply with the enhanced requirements. Merchants must ensure their business practices are transparent and efficient to avoid contributing to their acquirer’s risk of non-compliance.

To stay compliant, acquirers and merchants should adopt best practices that include regular training for staff, investing in robust fraud prevention technology, and maintaining clear communication with customers or clients. These strategies help ensure compliance with VAMP requirements to reduce the risk of penalties. Continuous monitoring and proactive management of all transactions are essential to meet the stricter thresholds and reporting standards.

How the VAMP updates impact Visa services worldwide

The integration of VDMP and VFMP into the overall VAMP program delivers a comprehensive approach to monitoring both disputes and fraud losses, providing a robust security framework for Visa transactions.

- Enhanced fraud detection

The new VAMP rollout includes additional measures intended to drive safer transactions globally. These changes — including anticipated updates to the new Visa Account Attack Intelligence (VAAI) Score — will enhance Visa’s ability to detect and prevent fraud, protecting all parties involved. Acquirers and merchants need to stay informed about best practices and technological advancements in fraud detection to remain effective and compliant. - Consistency in standards

By aligning regional standards, Visa ensures a consistent approach to transaction monitoring. This consistency helps maintain a uniform level of security and reliability. Acquirers and merchants globally will benefit from clear, standardized expectations, making it easier to comply with Visa’s requirements following the initial adoption period. - Regulatory alignment

The changes also help align Visa’s practices with regional regulations, providing a smoother, more unified approach to compliance. This alignment will likely reduce the complexity of managing compliance across different regions, simplifying integration between these different markets. This benefits acquirers and merchants who operate in multiple regions.

The new, stricter requirements and removal of early warning thresholds may also provide Visa providers worldwide with insight into future rollouts. By aiming to ensure they remain below the strictest requirements Visa offers, acquirers can stay ahead of the curve and align their practices with emerging global standards.

Best practices and tools for managing VAMP requirements

Managing VAMP requirements effectively requires the right tools and practices. Look for a solutions provider that can help grow your protection as your business scales. Quick and simple onboarding combined with around-the-clock protection is essential. Handling chargebacks and similar disputes in real-time gives you an edge that can help keep your company far from VAMP thresholds.

Fraud detection and prevention tools

Multiple fraud solutions exist, and the right option is often a mix of critical components.

Security code validation

Your processor or gateway can provide verification through CVV2, CVC2, CID and similar services that help validate card-not-present transactions.

Address verification

Cut down on fraud and get information critical for Visa CE 3.0 disputes using the Address Verification Service (AVS). Check with your payment processor or gateway for AVS access.

Order validation

Certified solutions providers can set up Visa Order Insight for another level of transaction validation. Order Insight simplifies the process of preventing disputes before they become official chargebacks.

Prevention alerts

Your solution provider can also set up prevention alerts, such as those offered by Verifi, that notify you of chargebacks immediately. This gives you time to respond and potentially stave off additional fraud and disputes before they hit your ratios.

Rapid Dispute Resolution (RDR)

RDR offers a final chance at avoiding chargebacks by having acquirers automatically handle transaction refunds using specific guidelines. Solutions providers should offer this along with additional tools to help keep chargeback ratios where they belong.

Real-time fraud detection

A detection and prevention tool helps you stop transactions that are likely to result in chargebacks. These work by identifying suspicious transactions, vetting purchasers, or a combination of these operations. Many have advanced features that can help prevent unauthorized account access and otherwise safeguard against fraud.

Check out our video series for more insights into managing VAMP.

Best practices for maintaining compliance

Regularly review and update your compliance strategies, stay informed about regulatory changes, and ensure clear and transparent communication with customers. This helps maintain compliance and ensure smooth, secure transactions. Acquirers and merchants should engage in continuous learning and improvement to stay ahead of regulatory changes and technical advancements. Fraud solutions providers should also help educate their clients about emerging threats and trends that threaten their revenues.

An end-to-end strategy for handling chargeback-related fraud

We have years of experience thwarting fraudsters while helping merchants and acquirers avoid monitoring programs like VAMP. Streamlining protection with integrated solutions means less time spent trying to stave off fraudsters and more time focused on the core of your business. Our teams and partners combine the latest technology and tools to deliver unparalleled protection for acquirers, merchants, and companies of all sizes.

Reach out to us for assistance crafting an end-to-end strategy that addresses the specific needs of your business. We’ve got the tools, know-how, and experience needed to help you work with merchants to reduce chargeback-related ratios and protect transactions from fraud in real time.