Chargeback Representment: A Step-By-Step Guide to Improve Win Rates

Merchants can respond to consumer disputes with a chargeback representment. A representment allows you to defend the validity of the transaction and recover revenue that was lost in the dispute process.

But, you only get one chance to plead your case. You had better make it count!

Here’s how to ensure your chargeback representment has the best possible chance of winning.

Anatomy of a Winning Chargeback Representment

Each cardholder has a unique experience that has led to a unique reason for disputing a transaction. Therefore, each chargeback representment needs to be unique.

However, the actual chargeback representment workflow is not unique. You can formulate a template and then duplicate the process for each subsequent dispute. Customization within a structured workflow is infinitely easier than reinventing the wheel each time.

STEP 1

Receive the Chargeback Notice

Each processor has a different method for communicating chargeback information with merchants.

If your processor sends hard copies of notifications, you’ll need to keep a close eye on the mail. Assign an employee to opening and processing chargeback notifications as soon as they are received.

There is a very short window of time to respond to a dispute, so you’ll need to set your representment workflow into motion as soon as possible.

Helpful Tip

If you use technology to manage chargebacks, this step can be automated. A direct integration with your processor will receive the chargeback notice on your behalf. And, the information will be received much sooner than if it was sent in through the mail.

Case Closed?

If you let a case expire, you cannot win the representment and the process ends here.

As Wayne Gretzky said, “You miss 100% of the shots you don’t take.” Don’t forfeit your right to revenue recovery simply because you were too busy to open the mail.

But, don’t try to salvage a losing battle either. If you fight the chargeback after it has expired, you will waste resources because your case won’t even be considered.

If you work with a third-party vendor for chargeback representments, make sure they are responding promptly and aren’t fighting expired cases.

Helpful Tip

Automation is quicker and more efficient than manual processes. If you use automated technology, your representments will be instantaneous and you’ll never have to worry about a case expiring.

STEP 2:

Check the Reason Code & Find Compelling Evidence

Each chargeback is accompanied by a reason code which attempts to explain why the cardholder or issuer has disputed the transaction.

The reason code also dictates which forms of compelling evidence, or documents that prove the validity of the original transaction, will be accepted.

Compelling evidence must accompany each chargeback representment and includes, but is not limited to:

- Emails exchanged with the cardholder

- Shipping confirmation

- Digital merchandise download and usage information

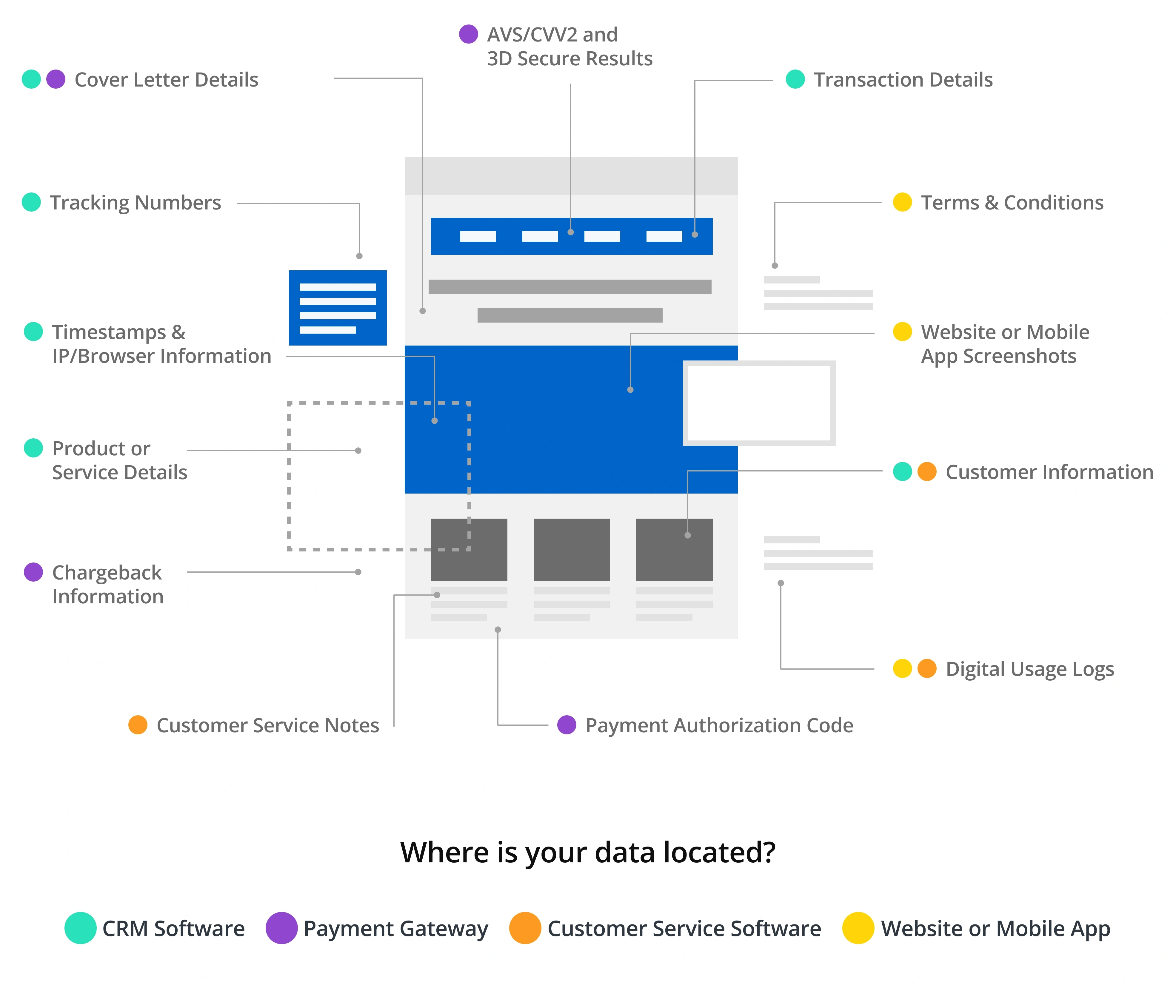

You’ll want to collect as much compelling evidence as possible throughout the customer journey so documents will be available if a chargeback is issued. You also need an efficient way to store this information and an easy way to access it.

Helpful Tip

A technology platform that integrates directly to both your processor and CRM (or order management system) could automate this step for you. The technology can determine what evidence is required for the chargeback representment and locate the items in your CRM.

Case Closed?

The compelling evidence you are required to submit depends on the reason code assigned to the chargeback.

If you don’t have what is required or submit the wrong documents, your chargeback representment won’t be effective.

To maximize ROI, it is best to terminate your representment workflow in this stage if you don’t have sufficient evidence. Up until this point, you’ve invested minimal resources. Stop before you needlessly devote more.

Helpful Tip

You can set customized fight rules within your technology platform to determine if a chargeback should or shouldn’t be fought, saving you from guesswork and unnecessary expenses.

STEP 3:

Create & Submit the Chargeback Representment Package

Chargeback representments are submitted in a package. The package includes:

- A cover letter that states your case

- Your compelling evidence

In your cover letter, include the chargeback identification number so your processor knows which dispute you are responding to. Write a compelling, yet professional, letter that concisely outlines why the chargeback is invalid.

Order your compelling evidence according to your processor’s preferences. Make it as easy as possible for the processor to advocate on your behalf.

Helpful Tip

Working with a professional who can customize your packages by processor preferences increases the odds of winning.

Adhere to your processor’s deadline. Submit the package well within the stated time limit.

STEP 4:

Follow Up

Your responsibilities don’t end once the chargeback representment has been submitted. You still have one last thing to do — you have to check to see if you were successful.

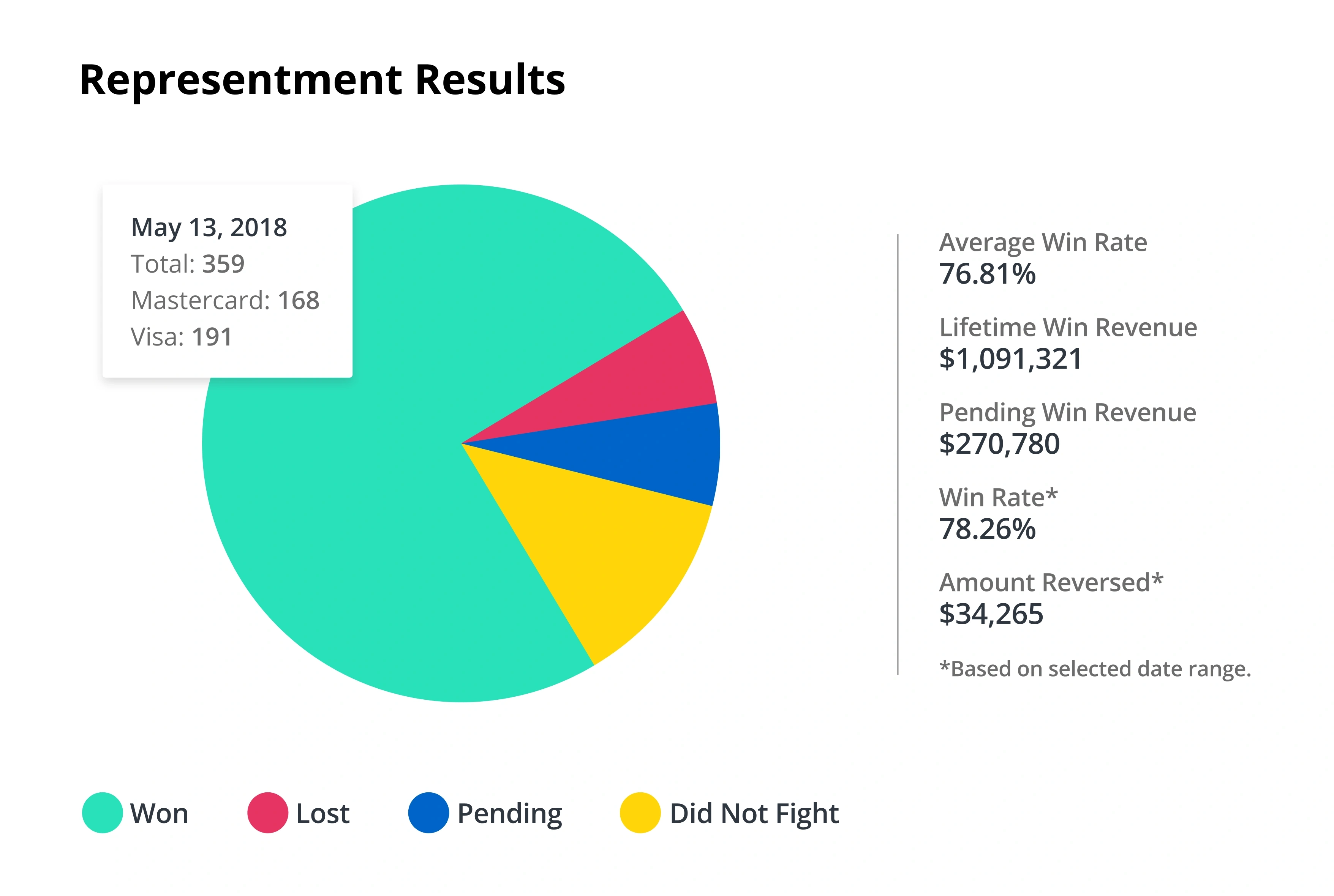

Chargeback representment results are hard to come by. There are no official reporting requirements or standards. Each processor has different policies for sharing outcomes. And, it usually takes several months for outcomes to be determined and recorded.

While it is challenging to obtain this information, it is important to try. Evaluating your efforts will help determine what is and isn’t working. Adjusting your workflow based on what you learn can help achieve better results in the future.

Helpful Tip

If you use a chargeback management platform, your results should automatically be displayed in your dashboard as soon as they become available.

Ready to Win Big?

Representment win rates are a valid KPI (key performance indicator) for chargeback management. However, they are only one of many factors that influence ROI.

It might seem like the goal is to win as many cases as possible because then you will recover as much revenue as possible. But your approach to chargeback management needs to be strategic if you want it to be profitable.

For example, you can fight and win a representment for a $5 chargeback — and you can pat yourself on the back for a job well done. But if $45 worth of labor went into the submission process, you’ll have a negative ROI.

The biggest representment success comes from a balanced approach that recovers revenue with a strategic, efficient, cost-effective strategy.

If that sounds like a chargeback representment strategy you’d like to try, then Kount can help. Sign up for a demo and see the technology in action.