A Chargeback Win Rate Guarantee Isn’t as Great as You Think: Here’s Why

As you shop for a chargeback management service provider, you’ll find each prospect has different selling points. A popular marketing ploy these days is to offer a chargeback win rate guarantee.

There are lots of performance metrics that you should base your decision on, but whether or not the company offers a chargeback guarantee probably isn’t one of of them.

Here’s why.

How to Read Between the Lines of a Chargeback Guarantee

There are several different types of guarantees out there these days. We aren’t saying each and every one is bad. What we are saying is…these guarantees probably aren’t as great as you’ve been led to believe.

If you want to know the truth about what you’ll receive, you have to be able to read between the lines.

Let’s break down a popular promise.

EXAMPLE

Win Rate Guarantee

A chargeback management service provider offers a win rate guarantee. The sales rep might say something like:

We are the only company in the industry that offers a win rate guarantee.

– Sales Rep, Acme Chargeback Company

What does that mean?

It’s completely logical to hear that and think: “This company must have better win rates than anyone else. And since they have a guarantee, I’ll get my money back if things don’t work out like they promise. I have nothing to lose!”

Unfortunately, even though that’s a very legitimate thought process, those aren’t safe assumptions to make. The reality can be quite different.

Here’s an example of a win rate guarantee:

Let’s take a closer look at what this actually means:

...drops below 40%...

A 40% win rate is really low. The Merchant Risk Council reports that most merchants are able to achieve a win rate of about 38%. That means you are bound by contract to pay a company to do what you could do yourself.

And, remember what you were led to believe with their initial promise? They supposedly offer a guarantee because their win rate is better than everyone else in the industry. In reality, the very best this service provider can promise is half of what is possible elsewhere.

...for a continuous 90 days…

This is a double whammy.

First, you’ll have to suffer through really bad results for at least three months before you can even voice your concerns.

Second, if your win rate rises above 40% just once — like on day 89, for example — the clock starts back at zero.

...for reasons other than those caused by Merchant and/or its merchant processor(s)...

Couldn’t the service provider blame just about all chargeback management issues on merchant mistakes or unreasonable processors?

For example, “You didn’t give us enough compelling evidence!” Or, “Your processor won’t accept chargeback responses for those reason codes.”

If there are genuine issues that need to be resolved, the service provider should be expert enough to proactively detect those issues. They shouldn’t wait until your win rate drops and you reach out for help.

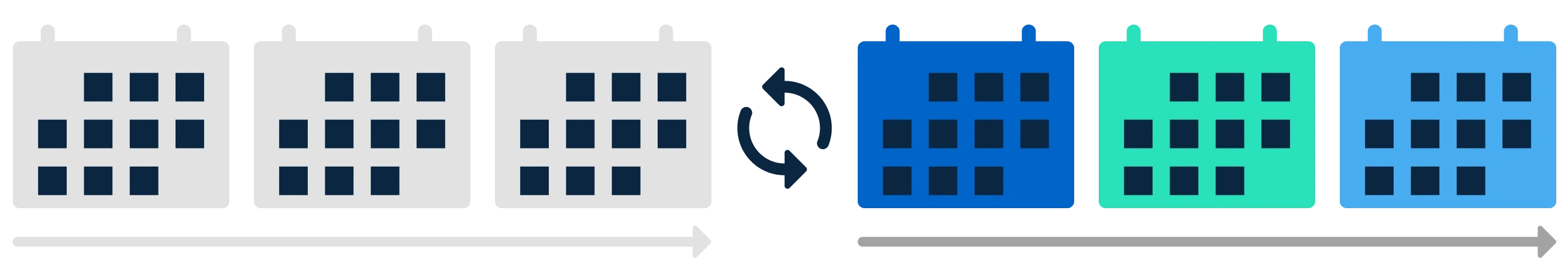

...request that Acme Chargeback Company cure its win rate within 90 days...

Think about this sentence in context. The service provider hasn’t been able to get your win rate up in the last 90 days, why would they be able to during the next 90 days?

Because this is probably what will happen.

The service provider will stop fighting all the difficult-to-win cases and only fight the chargebacks that have a high probability of winning — like those that have already been refunded.

All of a sudden, your win rate will go from less than 40% to nearly 100%. And then, once they’ve cleared the 40% requirement, the service provider will go back to fighting everything. And your win rate will tank — again — for another three months.

...Merchant may then exercise its right to terminate this Agreement…

After at least six months of terrible win rates, you get…to cancel your services. You don’t get a credit. You don’t get your money back.

That means the service provider doesn’t have a whole lot to lose. There is no incentive to improve your win rates. You could continue in this 180-day cycle of awful performance and quick fixes for the duration of your contract.

...providing 15 days written notice...

If you tell a service provider you want to terminate services, what would be the sales team’s most natural reaction? They’re going to try to get you to stay! They’ll probably offer a ton of other “deals” that will be equality tempting, yet just as misleading.

The Bottom Line

Put all that insight together and do the math. What does this win rate guarantee really mean?

If you have a three-year contract, the service provider guarantees you’ll have a win rate over 40% for 6 days out of 1,095!

What do you think? After breaking down all the legal jargon, is the guarantee as valuable as you originally thought? Unfortunately, probably not.

So, what does matter? Which sales propositions have merit?

A Better Alternative: No Guarantee Required

What makes one chargeback management strategy better than another? Here’s what a high-quality service provider can offer — without needing to hide behind a chargeback win rate guarantee.

No Long-Term Commitment

In the example above, the guarantee merely served as an escape clause: if you don’t receive the results you’ve been promised, you can cancel your contract. But you shouldn’t need an escape clause! The best service provider would be able to help you without any type of long-term commitment. You should be able to pay month-to-month and cancel any time.

High Fight Rate + High Win Rate + High ROI

A win rate guarantee is very one dimensional. As shown above, it isn’t hard to manipulate win rates and imply outcomes are better than they actually are. What really matters is getting the very most net dollars back in your pocket. To do that, you’ll need multiple metrics to be high achieving, not just one.

Customized Dispute Responses

Rather than promising to meet the bare minimum, your service provider should constantly be trying to improve. To win, you need to know what is required for a successful dispute response and the flexibility to adjust when expectations change. Find a service provider that is willing and able to customize your dispute responses so you have the best chance of winning.

Transparent Reporting

If you are enticed by a performance guarantee, outcomes are probably pretty important to you. And if outcomes are important, you’ll need an easy and accurate way to monitor them. Look for a service provider that offers transparent reporting — not just on what the outcomes are, but also how those outcomes were achieved.

Want something better?

If you’ve been misled by a chargeback win rate guarantee, don’t worry — you certainly aren’t the only one! In fact, Kount® leaders likewise fell for a win rate guarantee when they were merchants. It’s one of the reasons they developed chargeback management solutions; they felt merchants deserved transparency and strategies that focused on more than the bare minimum.

If your chargeback guarantee is starting to show it’s true colors and you’d like to learn about genuine results, Kount can help. Schedule a demo to learn more.