VISA CE 3.0 WITH KOUNT

How Visa CE 3.0 prevents chargebacks

Visa CE 3.0 transforms the rules for compelling evidence and chargeback management. Via Order Insight, you can reduce fraud and protect chargeback thresholds — all in a matter of seconds!

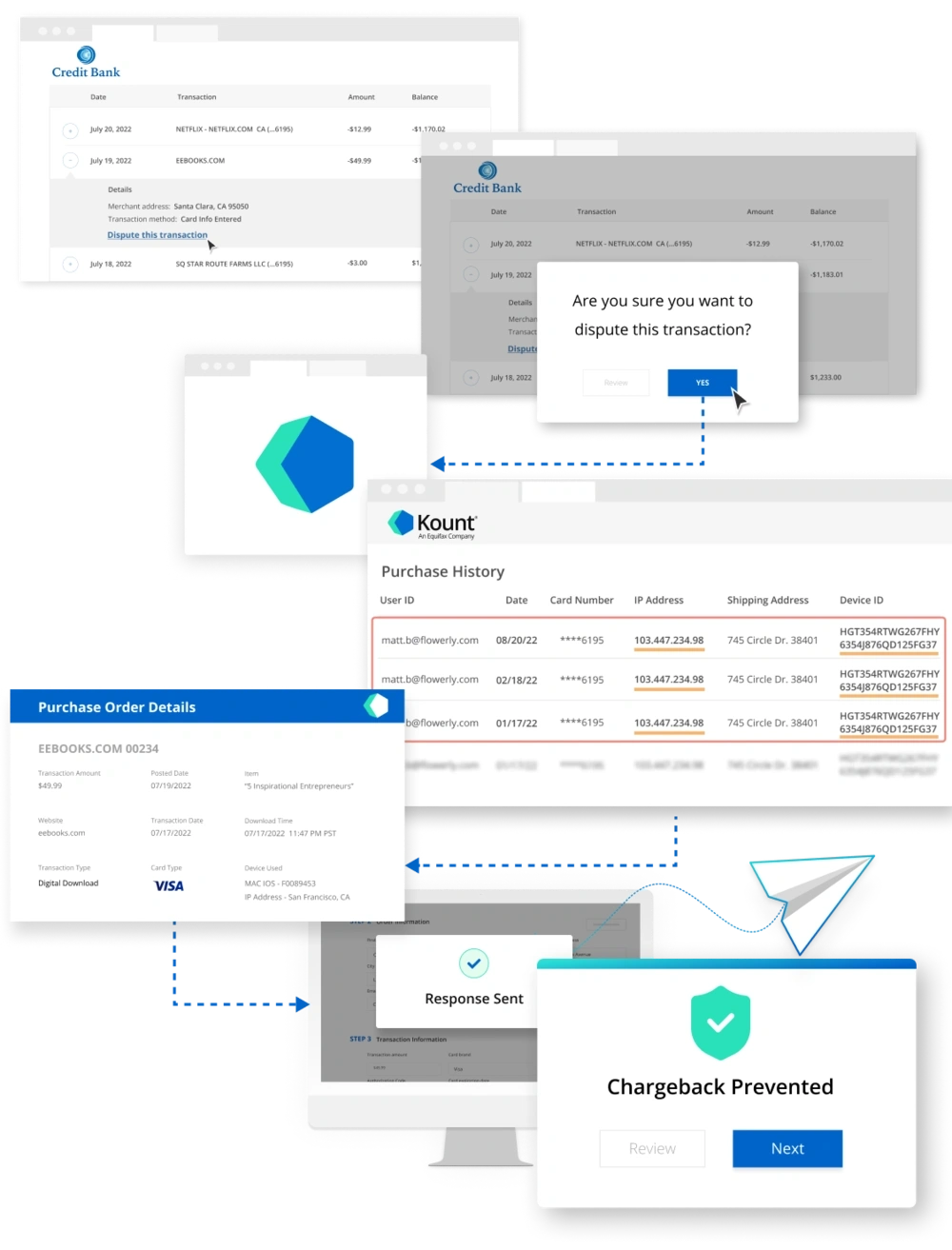

The cardholder attempts to dispute a transaction.

The cardholder contacts the bank to dispute a charge.

The issuing bank files a dispute.

The cardholder’s bank files the dispute under reason code 10.4 (card-not-present fraud).

The dispute is received.

Order Insight intercepts the dispute and sends an inquiry.

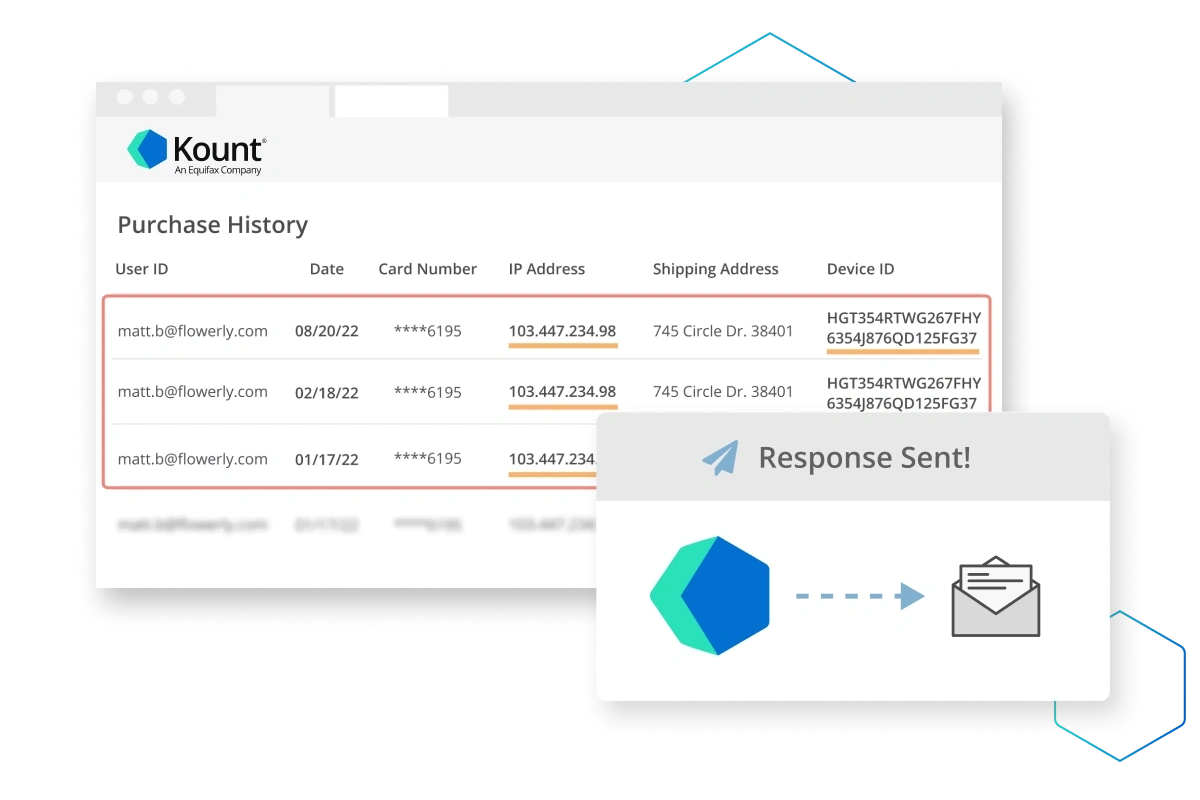

Purchase history is checked.

The technology locates two previously undisputed transactions processed 120 to 365 days prior.

Compelling evidence is gathered.

Data elements — such as IP address, device ID, or device fingerprint — are gathered and matched for each transaction.

The response is submitted to the bank.

The technology returns an Order Insight inquiry response in less than 2 seconds.

The bank overturns the fraud claim.

Visa CE 3.0 protections shift liability from you to the issuing bank. Your fraud ratio, chargeback ratio, and revenue are protected — guaranteed.

BENEFITS

How Visa CE 3.0 helps

Visa CE 3.0 is specifically designed to protect merchants from friendly fraud and the resulting damage caused by invalid disputes.

Lower Your Chargeback Ratio

Visa CE 3.0 can effectively resolve a significant portion of disputes. That means you can lower chargeback ratios, reduce the risk of threshold breaches, and avoid monitoring programs.

Boost Your Bottom Line

Some chargeback prevention techniques involve refunding disputed transactions — meaning you forfeit revenue. But not with Visa CE 3.0. Maximize your return on investment (ROI).

Get Advanced Warning

With Visa CE 3.0, you'll know about issues within seconds of the customer complaint. You don't have to wait weeks for a chargeback to hit your account. Identify and solve issues sooner to stop future disputes.

Stop Fulfillment on Disputed Orders

Quick notification and response times let you stop disputed orders in progress. Reduce or eliminate the loss of shipping and handling costs on disputed orders and retain even more revenue.

Save Time and Labor

As a fully automated solution, Visa CE 3.0 doesn’t require any manual processes or involvement from your team. Plus, the more you prevent, the less you have to manage!

Deliver a Better Customer Experience

Effective support and quick resolution increase perceived value and customer satisfaction. Maintain your business’s credibility and protect the brand’s reputation.

WHAT MAKES KOUNT SPECIAL

Why use Kount for Visa CE 3.0

Kount is a preferred provider for Visa CE 3.0. With a strategy that pays for itself through retained revenue, there’s nothing to lose and everything to gain from fast, accurate protection. And we deliver an experience second to none.

MORE THAN VISA CE 3.0

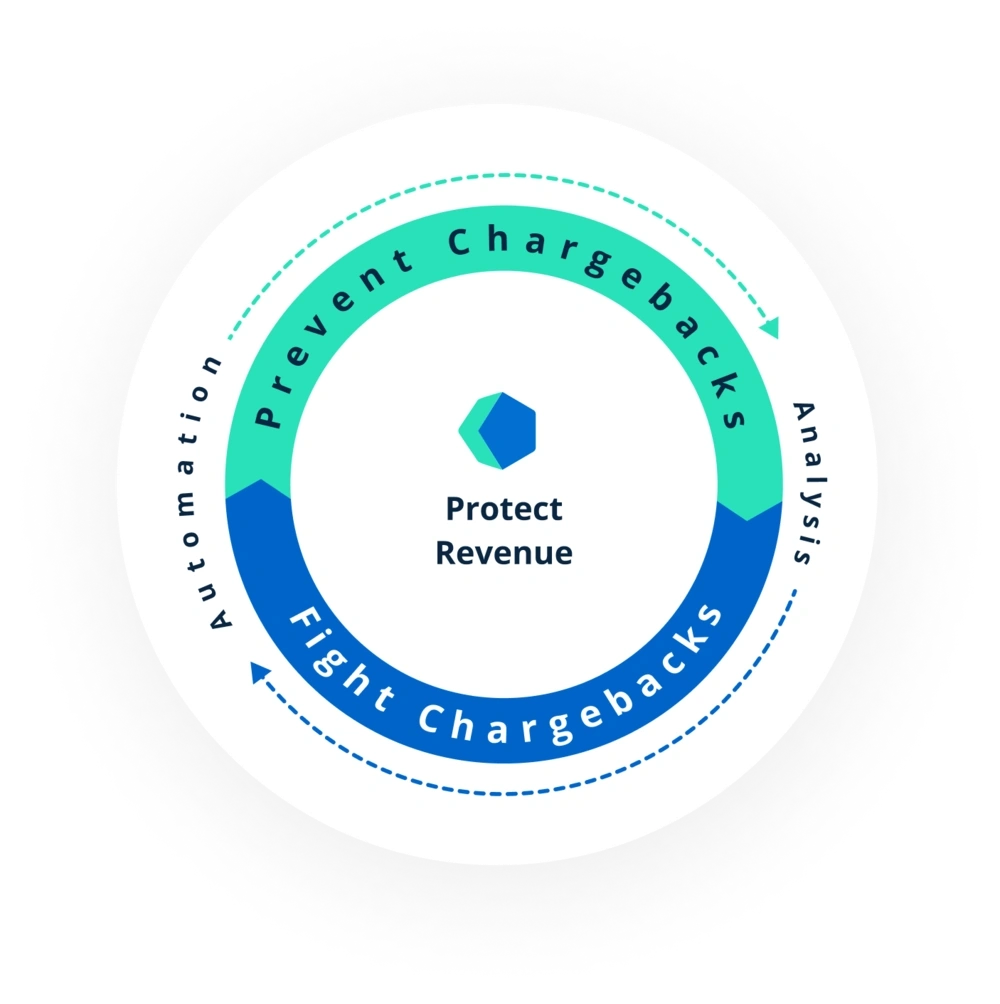

A complete approach to chargeback management

Discover how Kount seamlessly incorporates rule updates, emerging trends, and modern technology into a complete chargeback management strategy.

- Prevent chargebacks

- Fight chargebacks

- Automate tasks

- Analyze data

Talk to an Expert

GET STARTED

The industry leader for Visa CE 3.0

Visa CE 3.0 is revolutionizing fraud and chargeback management. Are you ready to start protecting your business? Sign up for a demo of Kount today. Don’t want to miss this unique opportunity for revenue protection.

Learn more about chargeback management

Related content

WHAT CHANGED AND WHY?

Why Visa CE 3.0 matters for most businesses

Visa continues refining its processes to help balance cardholder and merchant protections while detecting and reducing fraud. The most recent changes are the third major modification to compelling evidence requirements, and they offer a real boon to companies that rely on the latest technology to protect themselves against friendly fraud.

Fewer successful invalid chargebacks

Chargebacks result in lost revenue. Fighting them costs time, and losing a chargeback dispute results in additional expenses and potential arbitration fees. Since 3 out of 4 Visa chargeback disputes involve reason code 10.4, costing millions if not billions in invalid chargebacks, updates to compelling evidence requirements have a direct impact on chargeback-related costs.

Enhanced objectivity for disputes

Card networks rely on “compelling evidence” to disprove the claim of unauthorized transactions. Visa CE 3.0 helps solidify what counts as compelling evidence to make it easier for companies to prove legitimate transactions.

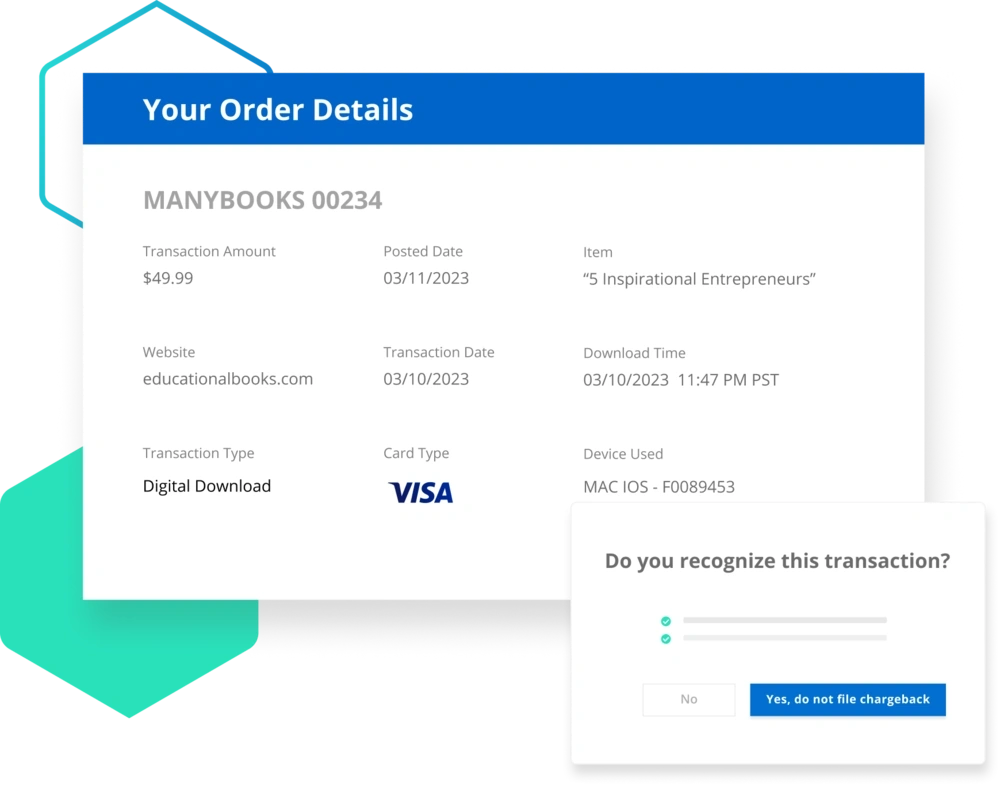

More specific transaction requirements

Customers attempting friendly fraud often got around the previous requirement, which only required merchants to show one instance of a previous transaction, by claiming previous transactions were also fraud. The new rules lean toward legitimacy whenever the customer has previous purchases inside a 120- to 365-day window.

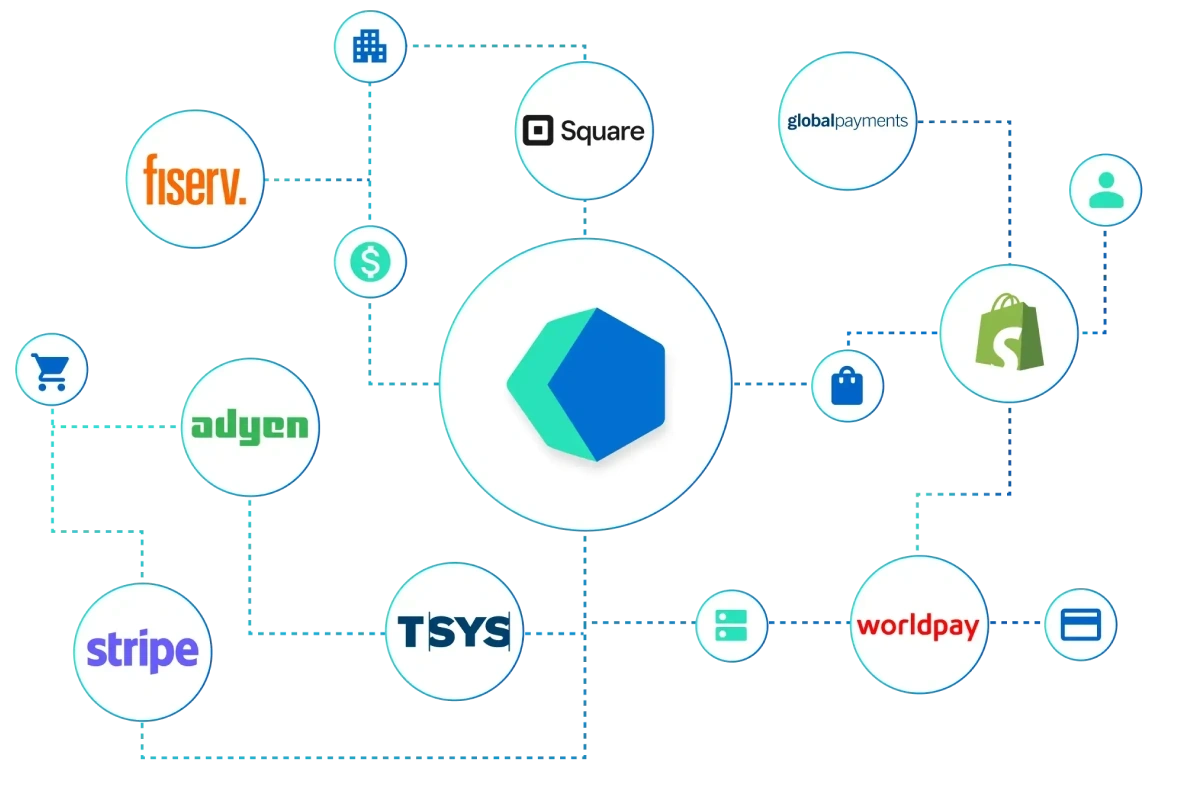

Integration with Order Insight

Now, thanks to Order Insight integration through Kount, your company can deliver compelling evidence during the inquiry process. This eliminates the need for a chargeback as the case can be dismissed with a quick response that includes the required Visa CE 3.0 data elements.

HOW DOES AUTOMATION WORK

The many benefits of automation with Kount

Disputes cost time and money that are usually better spent elsewhere. Your solutions provider should simplify the process as much as possible, delivering results without sacrificing service.

- Saves time - Integrated solutions with Order Insight take milliseconds for responses and practically eliminate much of the “busy work” involved tracking down transactions, order histories, device information, and other data elements required for a successful inquiry or chargeback dispute.

- Enhances accuracy - Accuracy is paramount when dealing with disputes from cardholders. Chargeback disputes are often lost due to simple human error when compiling important information.

- Truly compelling evidence - Visa CE 3.0 is only the first line of defense when it comes to dispute resolution. Kount chargeback management efficiently and accurately handles disputes that go beyond basic data elements.

- Puts you in control of your protection - Automation doesn’t mean abdication. You remain in control of management strategies, risk thresholds, and all of the industry- and company-specific elements that only you know best.

WHY USE KOUNT FOR CHARGEBACK MANAGEMENT?

Integration delivers industry-leading results

Ready to put Visa CE 3.0 to work for you and boost your bottom line? Kount can help.

Visa CE 3.0 saves companies millions of dollars

Since the launch of the Visa CE 3.0 rule update, Order Insight has deflected more than $30 million dollars, according to Visa / Verifi. That’s money that your competitors without this protection are leaving on the table.

- Order Insight also enhances customer service, giving customers on-demand access to the details they need to self-resolve purchase inquiries

Kount is a preferred provider for Visa CE 3.0 and Order Insight integration

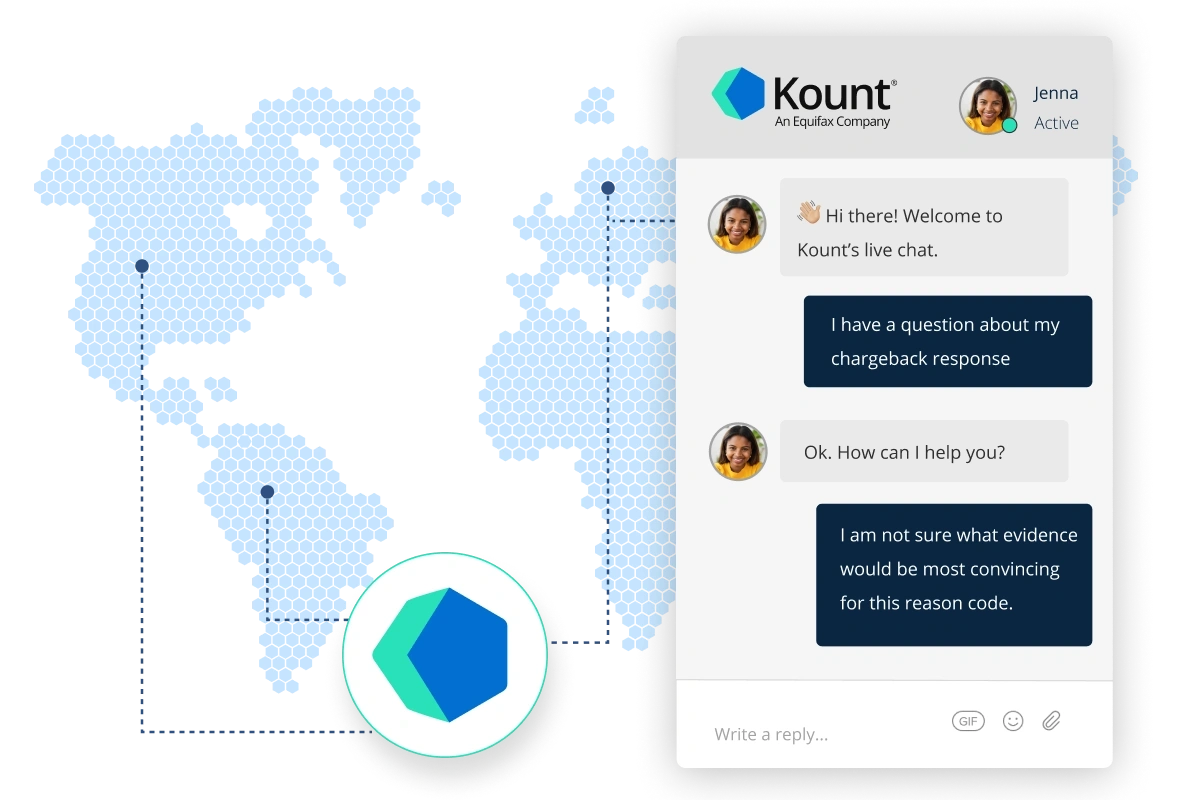

With years of experience, we know what it takes to win. Whether it’s building our expertise into the technology or being available when you have questions, we make sure you always have what you need to succeed.

- Kount combines required data compilation with Order Insight speed and efficiency to deliver industry-leading chargeback management.

- Official partnerships with Visa and Verifi deliver the communication and insight to win.

- On-demand support keeps your team informed at all times.

Pricing is based on positive outcomes

Kount customers don’t pay based on the number of disputes we handle, you only get charged when we deliver positive outcomes. There’s nothing to lose and everything to gain from bringing the latest technology and customized solutions to bear against fraud.

SIGN UP NOW

Ready to get started?

Want to see if Visa CE 3.0 is a good fit for your business? Sign up for a demo today. We'll show you how Visa CE 3.0 fits into a complete fraud and chargeback management strategy.