Going Beyond Chargeback Win Rates: How to REALLY Measure Success

How do you measure chargeback management success? Do you rely solely on chargeback win rates? If so, you are only looking at one small piece of the chargeback puzzle. There is so much more to consider with your chargeback management strategy.

Chargeback Win Rates Explained

Your chargeback win rate is a calculation that compares the number of successful chargeback responses to the number of chargebacks fought.

Number of Wins ÷ Number of Chargebacks Fought x 100 = Win Rate as a Percentage

WARNING: High win rates don’t necessarily mean a better strategy

Win rates have become one of the most popular KPIs, or key performance indicators, for chargeback response management. Success is often defined by win rates — the higher the win rates, the better the strategy.

Win rates are important — but focusing on them exclusively is dangerous. There are two other KPIs that must be considered too: fight rates and ROI.

Take a look at two hypothetical examples. Both situations produce high win rates, but the overall impact on the business is negative.

EXAMPLE #1:

High Win Rate, Low Fight Rate

A fictitious chargeback management company, Faux Chargeback Pros, says their average win rate is 70%. That sounds pretty impressive!

But when you ask a few questions, you discover Faux Chargeback Pros has a whole long list of reason codes they won’t fight. It turns out they would only respond to about 40% of your chargebacks. So, if your company receives 100 chargebacks in a month, you’d only win 28!

Since it is difficult and time consuming to figure out what evidence is needed to create a compelling case and fight chargebacks, the Faux Chargeback Pros philosophy is to only fight the easy and obvious cases. Since the win rate is the ratio of chargebacks successfully fought to those challenged, challenging fewer makes them look better — but the strategy doesn’t help you.

It means a lot of your revenue will be sacrificed to maintain their attention-grabbing promises, leaving a lot of money on the table.

EXAMPLE #2:

High Win Rate, Negative ROI

Another fictional chargeback service provider, Acme Chargeback Company, has a pretty impressive win rate too — about 20% more than what you are able to accomplish with your in-house team. But their strategy is to respond to everything. Their fight rate is 100%.

That means Acme Chargeback Company is fighting expired cases, cases that don’t have compelling evidence, and legitimate cases of fraud. You would invest resources into cases that are impossible to win! That’s negative ROI — and a lot of it.

The Perfect Situation: High Fight Rate + High Win Rate + High ROI

In a perfect world, you would have all three KPIs — high fight rate, high win rate, and high ROI. Add to that a low chargeback ratio, and it’s a real winning solution.

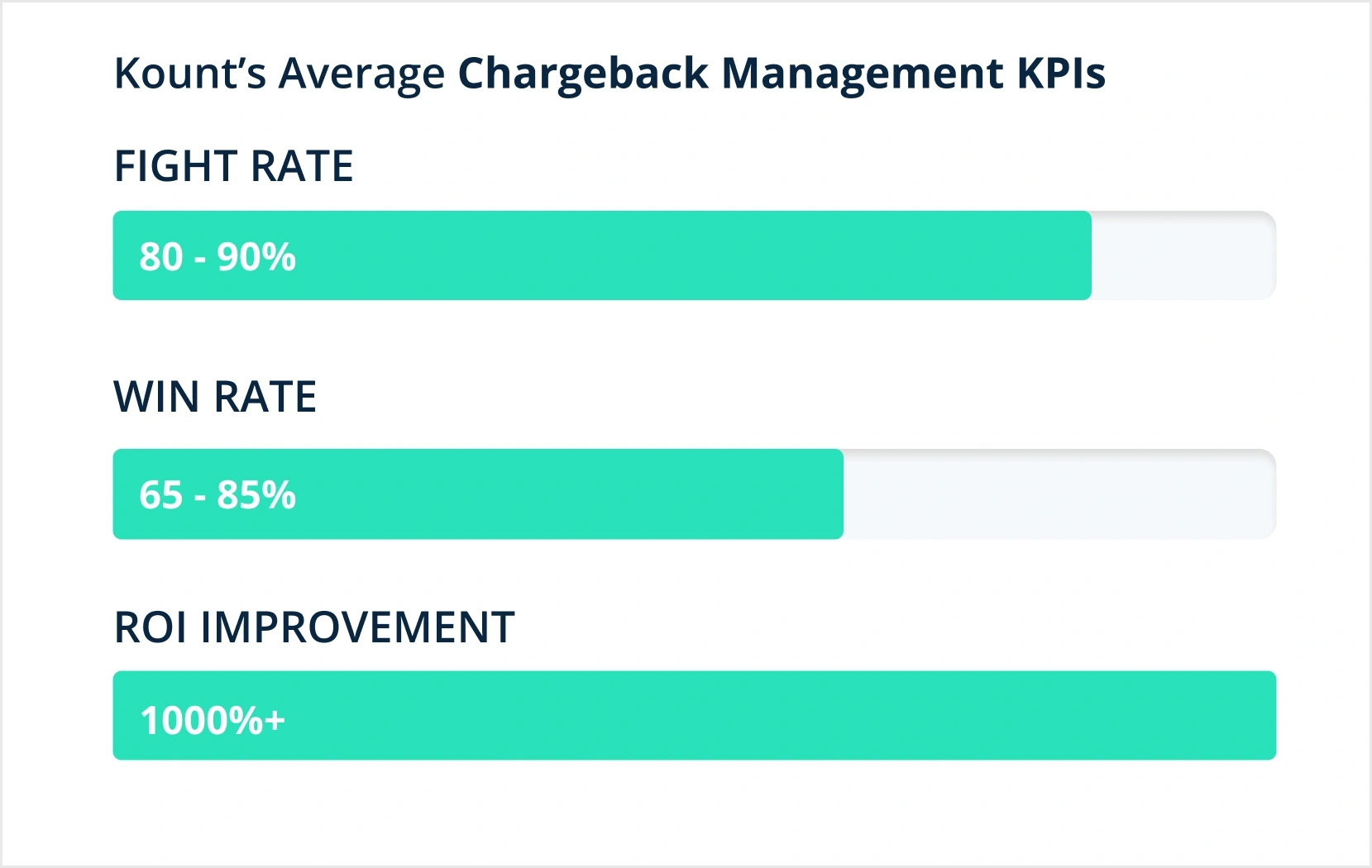

It might seem too good to be true, but it isn’t. Those KPIs are exactly what Kount’s chargeback management technology provides.

How are results like that possible? If other strategies are only capable of two of the three necessary KPIs, how can Kount achieve all three?

The difference is technology. Kount has automated technology that manual processes lack.

MANUAL PROCESSES

- A complicated hunting and matching game that may or may not produce the evidence needed to win

- A time-consuming process, difficult to complete within the given time limits

- An error-prone process dependent on human expertise

- Subjective fight rules applied on a case by case basis

AUTOMATED TECHNOLOGY

- A decisive case containing all necessary documents, customized by dozens of characteristics

- A real-time response that eliminates the risk of an expired case

- An efficient, accurate process not prone to human error

- ROI-optimized fight rules that know what should and shouldn’t be fought

See it for yourself!

Do you want to put this theory to the test? Go right ahead!

Sign up for a demo of Kount, and we’ll create a custom ROI analysis. Compare your current strategy to Kount's capabilities and see for yourself what is possible.