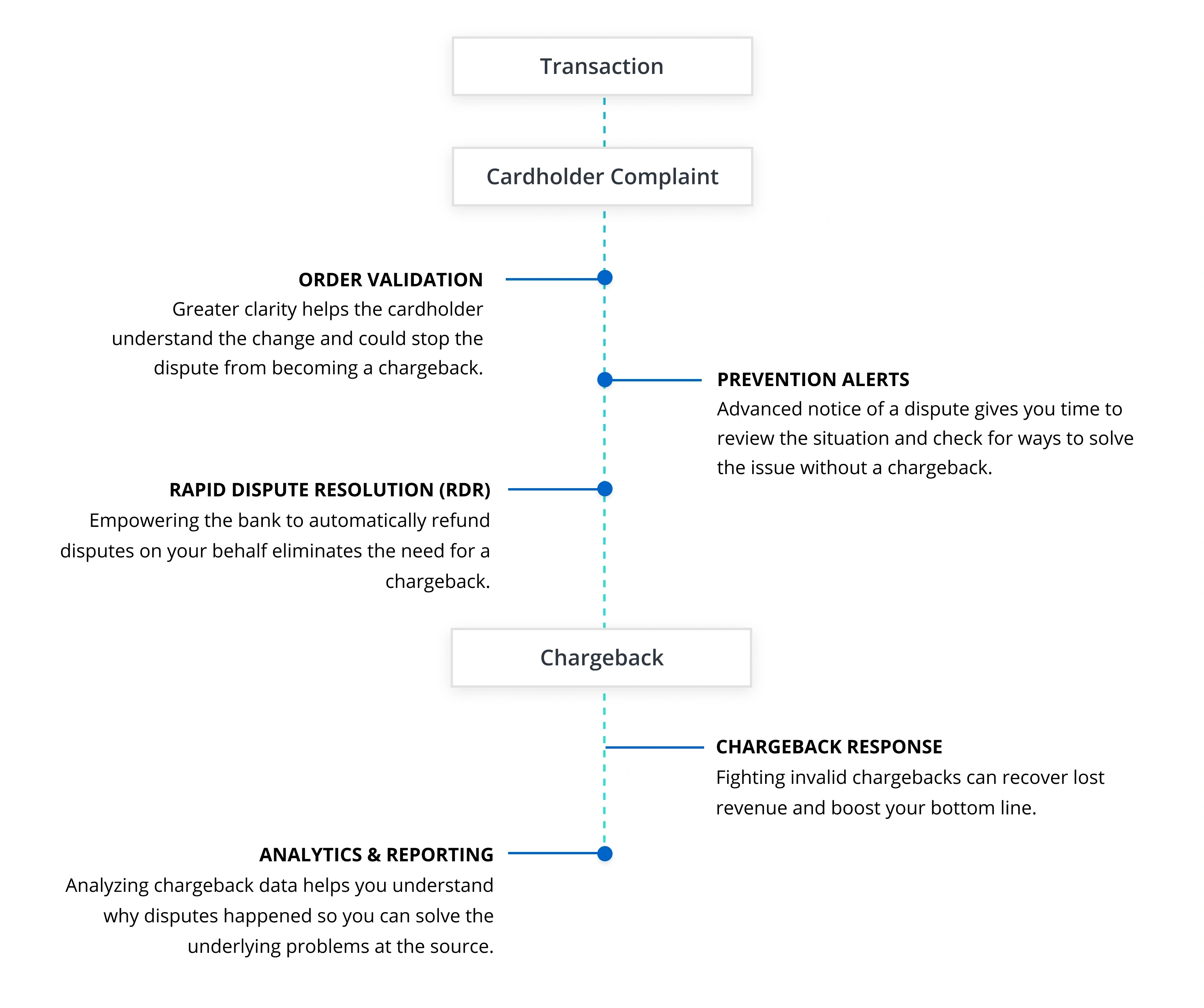

Where do the different prevention solutions fit into the dispute lifecycle?

We offer multiple solutions for chargeback management so that you get complete protection. Those solutions include order validation, prevention alerts, rapid dispute resolution (RDR), and chargeback responses.

Using multiple solutions ensures you have protection at every stage of the transaction lifecycle. And when it comes to the dispute process, here’s where those solutions fit in.

How the solutions contribute to the dispute lifecycle

Keep in mind that these solutions aren’t competing with each other — they complement one another. And the more solutions you use, the better protected you will be for anything that comes your way.

Order validation

When a cardholder files a dispute, banks often side with the cardholder because they don’t have enough information about the transaction to counter the dispute. Order validation addresses this gap by providing banks with details about transactions so they can resolve disputes on your behalf.

Examples of information that can be shared via order validation include:

- Merchant information like the business name and website.

- Customer information like the corresponding email and phone number.

- Product details like the name and description of the item purchased.

- Order details like the device name and payment type.

- Delivery details like signature confirmation or usage details like frequency.

- Customer service notes like date and type of communication.

- Recent purchase details like purchase date and item purchased.

With additional insights, banks can “talk off” a dispute and eliminate the need for a chargeback.

For example, Mary sees a charge on her billing statement that she doesn’t recognize. She calls her bank and claims the charge is fraudulent. Because her bank is enrolled in an order validation platform, they tell her the charge is from a gym membership that Mary signed up for last weekend. Mary remembers the purchase and does not continue with a chargeback.

Order validation is a great prevention tool, but it isn’t effective in all situations. For example, order validation might not resolve the dispute if:

- You aren’t enrolled in order validation.

- The cardholder’s bank isn’t enrolled in order validation.

- The cardholder’s bank doesn’t have the training or abilities needed to use the platform to its full potential.

- The cardholder continues to dispute the transaction.

If order validation doesn’t successfully resolve the issue, the dispute may advance to a prevention alert.

Prevention alerts

The cardholder’s bank can initiate an alert to notify you of a dispute.

With the advanced warning of an impending chargeback, you can decide how to act. Usually, you’d pick one of two options:

- Issue a refund in an attempt to stop the chargeback

- Deny the request and risk a chargeback.

Typically you have about 24 hours to review the alert, decide on an action, and respond to the bank.

If you decide to refund the disputed transaction and notify the bank within the given time limit, you should be able to avoid a chargeback.

Like order validation, the prevention alert process has its limitations. There are a couple scenarios where a prevention alert won’t be able to stop the chargeback.

- You aren’t enrolled in prevention alerts.

- The cardholder’s bank isn’t enrolled in prevention alerts.

- A response wasn’t sent to the bank (or wasn’t sent by the deadline).

- The cardholder’s account wasn’t credited by the deadline.

- The bank employee doesn’t wait for the alert process to expire before advancing the case.

If a prevention alert doesn’t successfully resolve the issue or you aren’t enrolled, the dispute may advance to RDR.

Rapid dispute resolution (RDR)

RDR gives your acquiring bank the authority to refund disputes on your behalf.

You set up parameters with the bank — such as cases with certain reason codes or transactions under a given dollar amount — to let them know what disputes you will accept liability for.

For any dispute that falls within your parameters, the bank will automatically issue a refund so that a chargeback doesn’t happen. If filters don’t apply, the case will advance to a chargeback because RDR is the last prevention initiative.

Data Analysis

Data analysis is the key to discovering the root cause of chargeback issues. It’s great having tools that resolve customer complaints, but a complete strategy involves preventing disputes from happening in the first place.

Reviewing your chargeback data can help you detect patterns and underlying causes for problems — which allows you to solve issues at the source. This can prevent future disputes from happening.

For example, you review your data and find out the majority of chargebacks are tied to a specific product. If you remove that product from inventory, your chargeback activity would decrease.

As you can see, each tool and technique has its place in the transaction lifecycle. Using a combination of these tools is the best way to get the most protection from chargebacks and revenue loss.

Learn more about preventing and fighting disputes on our chargeback management page.