Discover Chargeback & Dispute Guide for Merchants

The process that Discover® uses to manage chargebacks is unique and sometimes difficult to understand.

The following guide provides an easy-to-understand overview of the card brand’s policies with tips to effectively manage Discover card chargebacks and disputes.

- Differences Between Discover & Other Card Brands

- The Discover Chargeback Process

- Discover Retrieval Request Reason Codes

- Discover Chargeback Reason Codes

- Discover Chargeback Tools & Resources

Differences Between Discover & Other Card Brands

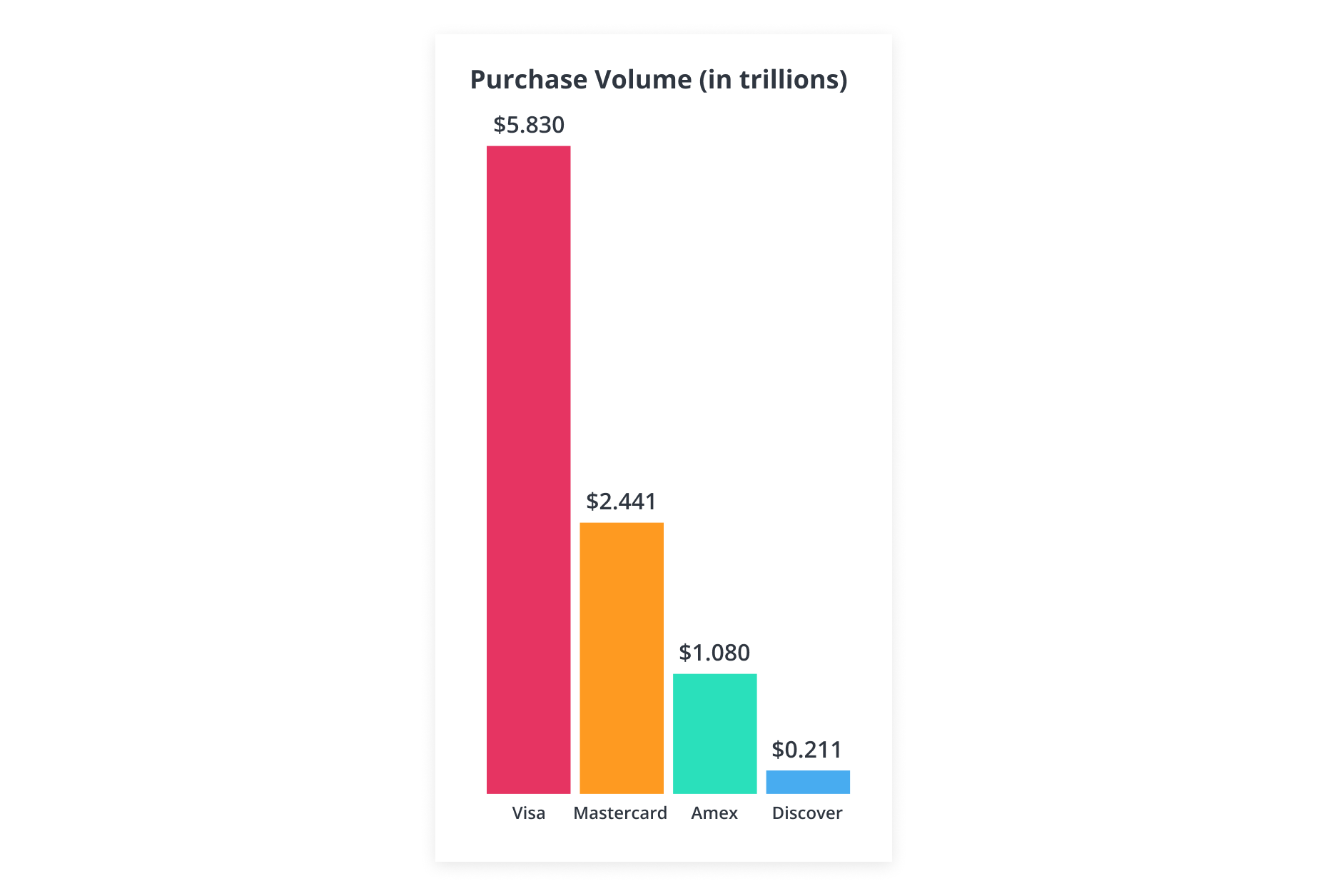

There are four US-based card brands that facilitate general payment card transactions: Visa®, Mastercard®, American Express®, and Discover.

According to Nilson Report, Discover had the lowest transaction volume of all four in 2022.

Discover’s processing volume relates to a few characteristics that make the brand uniquely different from Visa, Matercard, and American Express.

1. Discover issues primarily to U.S. cardholders.

One of the reasons that Discover has a significantly smaller portion of market share is because cards are issued almost exclusively within the U.S. Discover is accepted by merchants in certain international markets, but cardholders don’t have the same global diversity as Visa and Mastercard.

2. Discover usually acts independently.

There is another reason for Discover’s limited reach: the brand has a very different networking philosophy than Visa and Mastercard.

Visa and Mastercard connect with cardholders and merchants through card networks of partners that act on the brands’ behalf. Issuing banks issue the brands’ cards to cardholders, and acquiring banks process transactions for merchants.

Discover — and American Express — do things differently. Originally, Discover acted independently. The brand issued its own cards directly to cardholders without the help of issuing banks. And Discover processed payments for merchants too.

Recently, the company made some changes. Discover still acts as the credit card issuer, but it has expanded to allow certain banks to issue cards on Discover’s behalf. And while the brand continues to process payments, there are some merchants that have the option to run Discover transactions through the same processors that handle their Visa and Mastercard sales.

3. Discover requires retrieval requests.

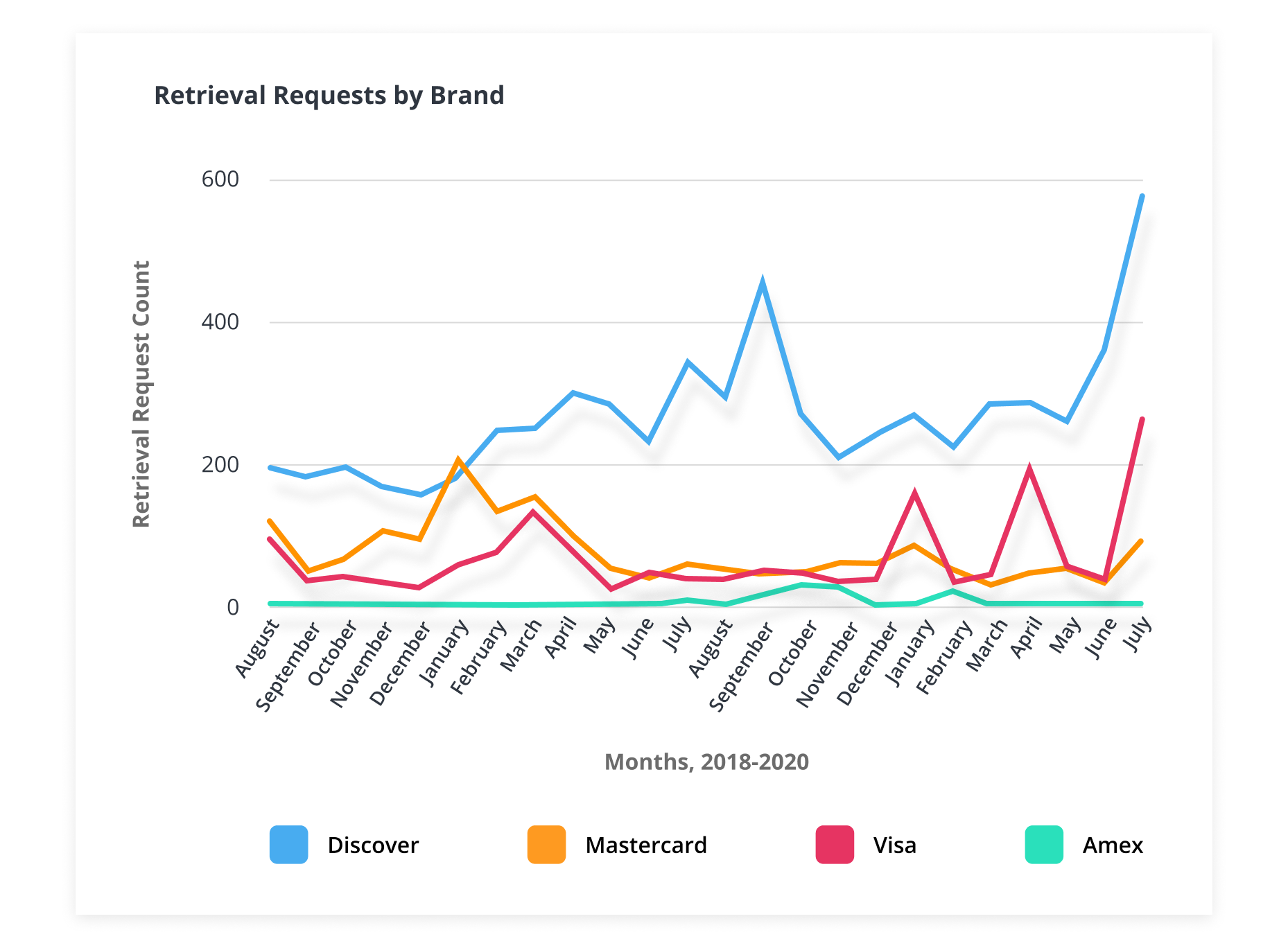

Historically, all four card brands required issuers to submit a retrieval request before advancing a cardholder dispute to a chargeback. In recent years, Visa and Mastercard have discontinued this practice.

Discover, however, continues to use the retrieval request process. If neither the cardholder nor bank has supporting documentation to accompany a chargeback, the issuer is required to first submit a retrieval request.

As a result, Discover issues retrieval requests with greater frequency than the other card brands.

The Discover Chargeback Process

The chargeback process for Discover transactions differs slightly from Mastercard and Visa’s processes. The most notable difference is the use of retrieval requests (see the next section).

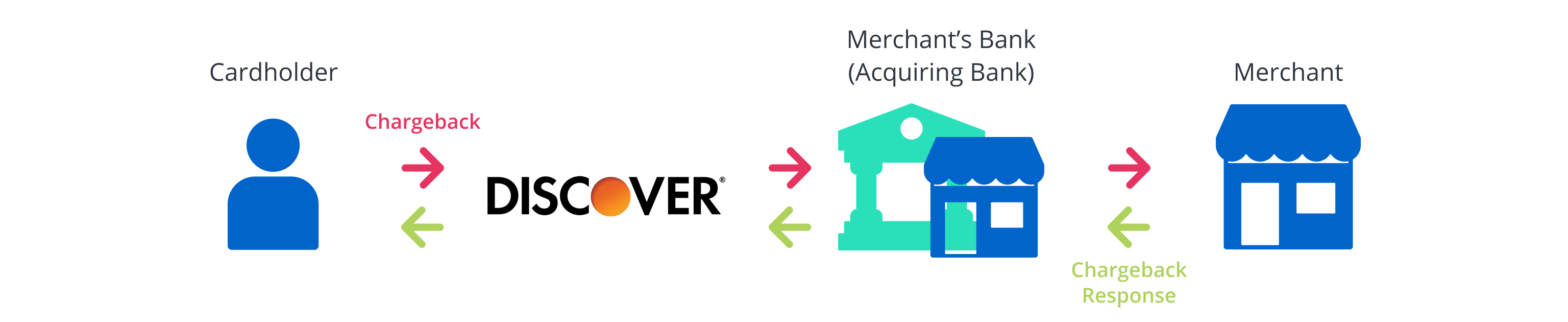

Another variable that influences the Discover dispute process is whether the cardholder obtained the card from the brand directly or via an issuing bank.

If the cardholder obtained a card through a bank, Discover will simply act as a go-between for the issuer and acquirer.

If the card was issued by Discover, then the brand — not a bank — is responsible for initiating the chargeback, reviewing the chargeback response, and assigning liability.

Regardless of who issued the card, timelines for most Discover disputes are the same. Nearly all Discover chargebacks have a 120 day time limit. That means a cardholder contacts their issuing bank to dispute the transaction within 120 days of the purchase.

Discover doesn’t share timelines for merchants; there is no published number of days to respond to a chargeback.

Discover Retrieval Request Reason Codes

If an issuer needs additional information to make a qualified decision about whether or not a chargeback is warranted, the issuer will send you a retrieval request.

The following are Discover’s retrieval request reason codes and examples of evidence that you can send in response.

Reason code

01

Dispute Reason

Transaction Documentation Request

Dispute Explanation

The cardholder or issuer is requesting information for general purposes.

Examples of evidence for merchant response

- Proof that the cardholder agreed to the transaction (for example, a signed transaction document)

- Proof the cardholder received the goods or services

- Proof the transaction complied with Discover’s operating regulations

Reason code

03

Dispute Reason

Transaction Documentation Request Due to Cardholder Dispute

Dispute Explanation

The cardholder or issuer is requesting information because the cardholder claims one of the following:

- The transaction was a duplicate

- The cardholder doesn’t recognize the transaction

- The cardholder was billed after a recurring payment plan expired or was canceled

- The transaction amount was incorrect

- The cardholder never received the goods, services, or cash

- The cardholder disputes the quality of the goods or services

- Credit was due but never issued

Examples of evidence for merchant response

- Proof that the cardholder agreed to the transaction (for example, a signed transaction document)

- Proof the cardholder received the cash, services, or goods (for example, proof of delivery)

- Proof the transaction complied with the merchant’s terms and conditions, including a recurring payment plan if applicable

- Proof the transaction complied with Discover’s operating regulations

- Proof the merchant has already refunded the cardholder’s account

Reason code

04

Dispute Reason

Transaction Documentation Request for Fraud Analysis

Dispute Explanation

The issuer is requesting information as part of a fraud investigation.

Examples of evidence for merchant response

- Proof that the cardholder agreed to the transaction (for example, a signed transaction document)

- Proof the cardholder received the goods or services

- Proof the transaction complied with Discover’s operating regulations

- Proof the merchant has already refunded the cardholder’s account

Reason code

05

Dispute Reason

Good Faith Investigation

Dispute Explanation

The issuer or cardholder is requesting information but the deadline to file a chargeback has passed.

Examples of evidence for merchant response

- Documents submitted are completely at the merchant’s discretion and are offered on a good faith basis

It is very important that you respond to every Discover retrieval request that you receive. If you don’t, Discover will likely assess a fee.

Even worse, if you don’t acknowledge a retrieval request, the dispute will automatically advance to a chargeback.

Certain retrieval requests will turn into “non-appealable chargebacks” if you don’t respond. This means you won’t be able to fight the chargeback nor recover lost revenue.

Chargebacks with the following reason codes cannot be fought if you didn’t acknowledge the preceding retrieval request.

- AA - Does Not Recognize

- UA01 - Fraud: Card Present Transaction

- UA02 - Fraud: Card Not Present Transaction

- UA05 - Fraud: Chip Card Counterfeit Transaction

- UA06 - Fraud: Chip and PIN Transaction

Discover Chargeback Reason Codes

There are dozens of reasons why a cardholder or issuer might dispute a transaction. When a dispute comes in, Discover assigns a reason code to communicate those motives to you.

Discover chargeback reason codes are divided into three categories: service disputes, processing errors, and fraudulent transactions. Certain reason codes are also broken down by card-present and card-not-present transactions.

Chargeback prevention strategies vary based on the reason for the dispute. And each reason code has unique compelling evidence requirements if you choose to fight.

Expand the categories below to view the full list of Discover chargeback reason codes.

05 - Good Faith Investigation Chargeback

AA - Does Not Recognize

AP - Recurring Payments

DP - Duplicate Processing

AW - Altered Amount

CD - Credit/Debit Posted Incorrectly

NF - Non-Receipt of Cash from an ATM

PM - Paid by Other Means

RG - Non-Receipt of Goods, Services, or Cash

RM - Cardholder Disputes the Quality of Goods or Services

RN2 - Credit Not Processed

AT - Authorization Noncompliance

IN - Invalid Card Number

LP - Late Presentation

UA01 - Fraud: Card Present Transaction

UA02 - Fraud: Card Not Present Transaction

UA05 - Fraud: Chip Card Counterfeit Transaction

UA06 - Fraud: Chip and PIN Transaction

Discover Chargeback Tools & Resources

Discover offers three brand-specific chargeback prevention tools. Discover’s tools are intended to provide layered protection and be used in conjunction with common chargeback management tools.

Before the Transaction

ProtectBuy

ProtectBuy is Discover’s 3D Secure tool. It can help you verify the shopper’s identity and detect fraud before the transaction is authorized.

ProtectBuy compares information provided during checkout with information that Discover has on file for the cardholder (billing address, phone number, email address, etc.). If there is a mismatch or ProtectBuy senses questionable activity, the technology will send a one-time password via text or email for an additional layer of validation.

If the shopper is able to access the password and authenticate the information provided, you can approve the transaction with confidence. If ProtectBuy is unable to verify the shopper’s identity, you will be notified. Then you have the option to approve or decline the transaction.

All cardholders are automatically enrolled in ProtectBuy. If you choose to use this tool, you’ll be able to monitor potential fraud for all Discover transactions.

After the Transaction

Verify+

Like ProtectBuy, Verify+ compares information provided during checkout with information that Discover has on file. However, this fraud detection tool works after the transaction has been completed.

If Verify+ detects a mismatch or other questionable activity, the technology will notify you. You then have the option to proceed with the order or cancel it and stop fulfillment.

There are two ways you can receive notifications.

- The standard version is a web based interface.

- The premium version is accessed through an API.

After the Dispute

Fraud Alerts

If a cardholder disputes a purchase because of fraud, Discover will notify you immediately via its Fraud Alerts tool. With this information, you can:

- Cancel shipment or call the shipment back if it’s already gone out

- Cancel future charges if the transaction was part of a subscription

- Create a negative list to block any other transactions that may be attempted

There are two ways you can receive these notifications.

- The standard version is a web based interface.

- The premium version is accessed through an API.

NOTE: Discover’s chargeback prevention tools should be used as part of a comprehensive dispute management strategy. The more tools and techniques you use, the better your protection will be. Check out Kount’s full suite of chargeback prevention solutions.

Need Help Managing Discover Chargebacks as a Merchant?

Discover chargebacks are unique — which makes them challenging to understand and manage. However, mastering complicated processes isn't something you should have to worry about.

At Kount, we aim to remove the complexity of payment disputes. Let us manage your chargebacks so you can focus on growing your business.

Sign up for a demo today and find out how Kount can help you streamline chargeback management responsibilities for any card brand.