Talk to an Expert

CASE STUDY

Brooks Uses Kount to Cut Chargebacks and Improve Customer Experiences

Chargebacks

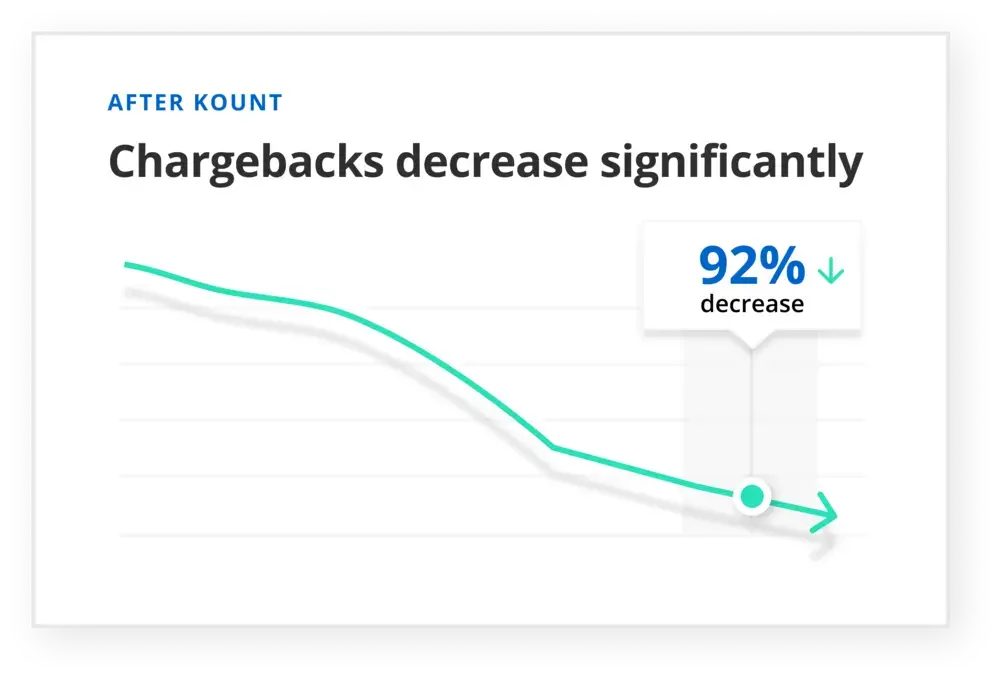

Reduced chargeback rates by 92%

Revenue

Boosted revenue with international orders

Automation

Automated protection against fraudulent orders

Brooks is a popular retailer of running shoes known for its environmental sustainability programs and technical innovation. For over 100 years, the brand has brought high quality, reliable shoes to runners all over the world.

THE PROBLEM

Fraud schemes bring in chargebacks.

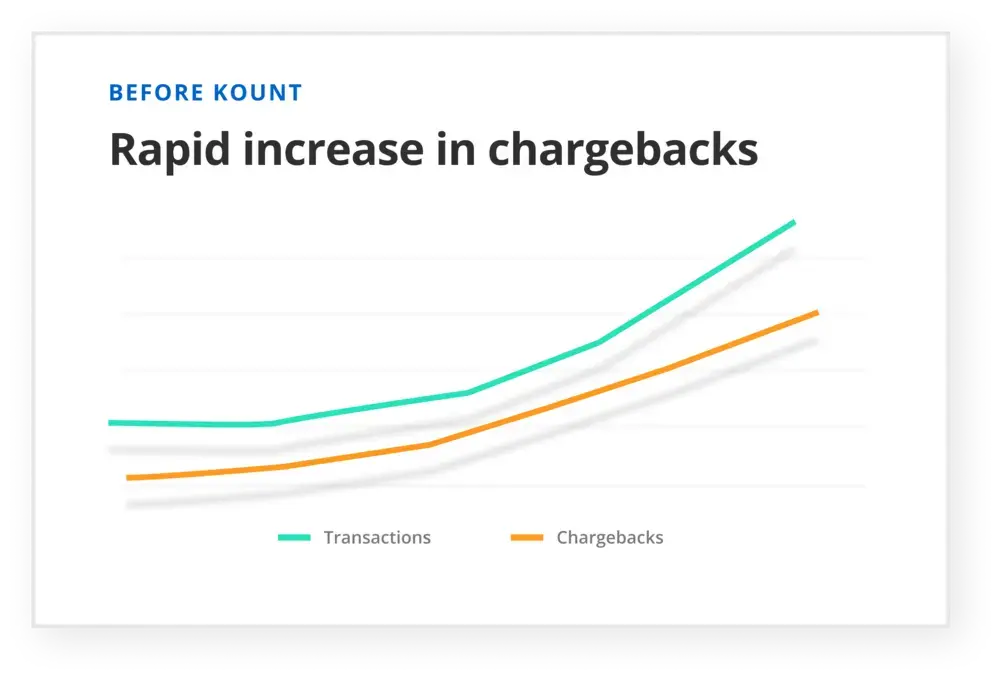

As Brooks’ ecommerce platform grew, so did fraudulent activity. Fraudulent websites were stealing payment card information from unsuspecting customers and using the Brooks website as part of a drop-shipping scheme.

And as fraud increased, so did the amount of chargebacks Brooks received — eventually threatening the company’s ability to process cards from key issuers. That’s when Brooks decided to find a solution to stop fraud, reign in chargebacks, improve customer experiences, and open revenue channels into international markets.

THE SOLUTION

A safer, more confident way to grow.

After a careful search, Brooks selected Kount for its all-in-one fraud protection platform and customizable business policies — providing the flexibility to fine-tune customer experiences while minimizing risk.

And once fraud protection was in place, Brooks used Kount’s robust network of data to expand into new international markets. Before Kount, Brooks flat-out declined international payment cards — a common practice among businesses to decrease fraud risk. Now the company can safely and confidently accept orders from all over the world.

Kount gives me everything I need in order to fulfill my job to a high standard.

— Chad Funk, Fraud Specialist, Brooks

THE RESULTS

Less chargebacks. Better customer experiences.

The most notable accomplishment Brooks experienced shortly after implementing Kount was slashing its chargeback rate by 92% — eliminating the threat of monitoring programs. Plus, thanks to Kount’s automation capabilities, Brooks drastically reduced the amount of hours spent manually reviewing orders.

But for Brooks, one of the greatest benefits of Kount is how it enables best-in-class customer experiences. The company can now easily balance automation and customization — efficiently stopping fraud without creating friction for good customers.

Kount is really good at giving you a lot of information at a glance. You don't have to really dig into a lot of different things. It's just right there at your fingertips.

— Chad Funk, Fraud Specialist, Brooks

GET STARTED TODAY

Create better customer experiences

Want to improve your relationships with customers? And reduce fraud losses? Get in touch with us. We'd love to help you take your business to the next level.