CASE STUDY

Lease Now Reduces Chargebacks and Customer Friction with Kount

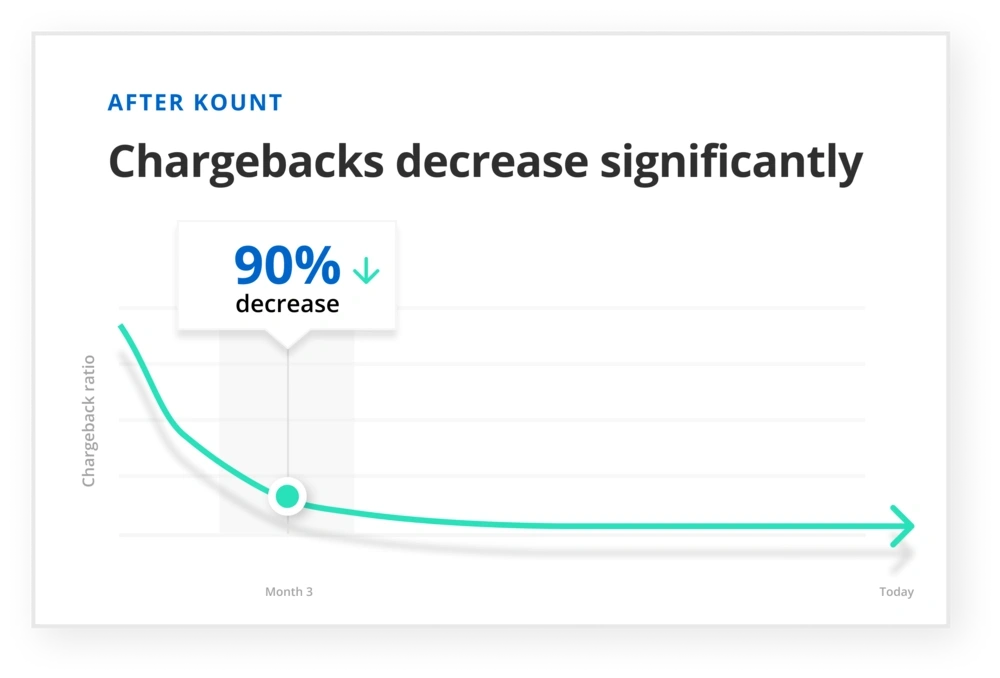

90%

decrease in chargeback rate

18,000+

chargebacks stopped post-authorization

Lease Now*, a lease-to-own service, helps people get easier access to the things they need and want without using credit. The company enables customers to shop through a mobile app, online, or in stores and provides flexible purchase options.

THE PROBLEM

Too much customer friction. High chargeback rates.

As a company that deals with high-value transactions, it’s important for Lease Now to screen their customers diligently for risks. However, their strategy was actually doing more harm than good.

The first challenge was determining who they should and shouldn't do business with. Part of the company’s fraud detection process involved identity verification. But the technique they used created too much friction for legitimate customers.

Additionally, fraud management was tasked to multiple teams — which made it difficult to see the bigger picture. Because there wasn't enough consistency and transparency across departments, Lease Now struggled with high chargeback rates — caused by both friendly fraud and criminal fraud — and high delinquency rates on leases.

When chargebacks reached an all-time high, Lease Now decided to reconsider their fraud strategy.

THE SOLUTION

Better verification protocols. Better customer experiences.

Lease Now brought in a fraud expert to evaluate needs and goals. The team member recognized the company needed fraud detection technology. So Kount — which offered the multi-layer, data-driven solution they were looking for — was implemented straightaway.

The technology solves two of the company's biggest challenges: customer friction and chargebacks.

First, Lease Now uses Kount to simplify the identity verification process. After completing an application, the customer makes an initial payment on a lease. And Kount’s technology verifies that payment and the customer with minimal friction. Customers no longer have to answer lengthy, difficult questionnaires.

Second, Lease Now leverages Kount’s complete chargeback management platform to keep their chargeback rate low and to recover revenue from false fraud claims.

THE RESULTS

Significant decline in chargebacks. New opportunities for growth.

Within the first month of using Kount, Lease Now saw a 45% decrease in chargebacks. By three months, they saw a 90% decrease. And since then, they have kept the chargeback rate consistently low, despite a huge increase in transactions.

What’s more, because of Kount’s technology, the company has been able to automate their chargeback management process, saving time on manual labor and improving consistent response times.

With more time to focus on the growth, the company is now able to expand into new international markets.

Everybody I've worked with at Kount has been fabulous. I've worked with other solution providers in the past and there's a noticeable difference with Kount. There’s a shared interest and purpose — our success is your success and vice versa. What's most important is that Kount gives us the support we need to be successful.

— Fraud Prevention Manager, Lease Now

Ready to cut down chargebacks and see results like Lease Now?

Talk to us about your goals, and we’ll help you get there.

Related case studies

* Not Company's real name. Our Customer has asked that their name be anonymous.