Talk to an Expert

Visa Chargeback Monitoring Program and Dispute Management Tips

If you’ve been in the card-not-present space for long enough, you know it’s crucial to keep your chargeback rate in check. But what happens when you experience an unexpected influx in chargebacks that lands you in the Visa® chargeback monitoring program?

In this guide, we’ll cover everything you need to know about the Visa dispute monitoring program and provide tips for managing chargebacks so you can avoid enrollment in the future.

What is the Visa Dispute Monitoring Program (VDMP)?

The Visa Dispute Monitoring Program (VDMP) is Visa’s global chargeback monitoring program. It’s meant to keep track of merchants’ chargebacks and enforce management techniques if thresholds are breached. It also serves as a penalty when merchants fail to comply with Visa’s standards.

Your acquiring bank monitors activity to ensure that your business doesn’t pose risk to their own organization or card networks. Therefore, if you breach Visa dispute thresholds, you will automatically be enrolled in the VDMP.

Risk thresholds

Visa monitors your dispute count and ratio to determine which program category you fall into. You are issued fines based on that category and the amount of time you spend in the program.

Each month you violate Visa’s thresholds, you could be placed in one of the following categories.

| Classification type | Dispute count | Dispute ratio |

|---|---|---|

| Early warning | 75 | 0.65% |

| Standard | 100 | 0.9% |

| High risk merchant | 100 | 0.9% |

| Excessive | 1,000 | 1.8% |

NOTE: The early warning threshold is not an actual violation, so you will not be issued any fines at that level. It’s an alert that your merchant account is getting close to violating dispute thresholds.

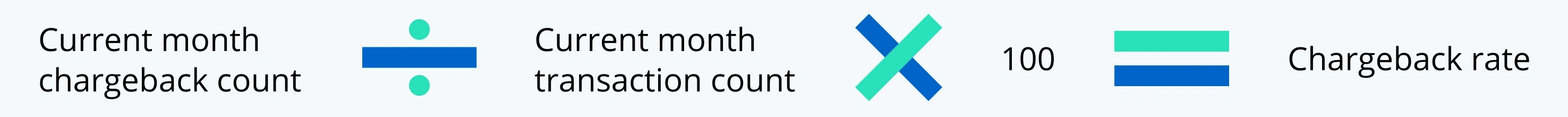

How do I calculate my dispute ratio?

Your dispute ratio — also known as a chargeback ratio or chargeback rate — is a metric that shows the ratio between the total number of transactions you process and the total number of chargebacks you receive.

Here’s how Visa calculator your dispute ratio:

For example:

Violation Statuses

Visa’s violation statuses determine when fines and penalties are issued. Those three statuses are:

- Notification: The first month that your account is in the standard threshold. Visa does not issue any fines during this stage; however, your processor can.

- Workout: In the months following the Notification status, Visa allows time for you to fix your chargeback issues. This is the workout status. Again, Visa won’t issue fines during this stage, but your processor probably will.

- Enforcement: If you do not fix your fraud issues during the months in the workout stage, your account moves to the enforcement stage. During the first month and any following months that your account meets the standard threshold or higher, Visa will issue fines and penalties.

NOTE: The notification and workout statuses only apply to merchants classified in the standard category. If you are classified as high-risk or have a dispute ratio of 1.8 or higher, you’ll immediately be issued fines without a grace period.

Fines

Fines are charged per each dispute. And the fines you owe depend on your classification type — standard, high-risk, or excessive. Fines start as soon as you are enrolled in the Visa chargeback monitoring program if you are classified as high-risk or excessive.

Regardless of the classification, the longer you are in the program, the more you’ll pay in fines. Typically, you are charged $50 per dispute and then a $25,000 review fee during certain months.

If you’re enrolled in the program for 12 months, Visa can close your merchant account, and you will no longer be able to accept Visa payments. However, it’s possible your acquirer will choose to close your merchant account much sooner.

How Chargeback Monitoring Programs Can Affect Your Business

Being enrolled in a chargeback monitoring program can be a huge drain on your revenue. Just the accumulation of chargebacks alone can hurt your profits. But with fines and additional fees, you’re looking at a large expense.

Additionally, fraud and an excessive number of chargebacks can put your merchant account at risk — which means you could potentially lose the ability to accept Visa payments.

Plus the stress of managing chargebacks and working towards exiting the program can be exhausting. You may have to hire more resources to get the problem under control.

The ideal scenario would be to avoid monitoring programs altogether. However, once you are enrolled, there are steps you can take to exit as quickly as possible.

NOTE: Aside from disputes, Visa monitors your fraud count and fraud ratio as well. There are two Visa fraud monitoring programs: the global Visa Fraud Monitoring Program (VFMP) and the Visa Fraud Monitoring Program - 3D Secure for US merchants. You can be enrolled in both the VDMP and VFMP at the same time. And chances are if you have issues with chargebacks, you likely have issues with fraud.

What to Do When You Are Enrolled in the VDMP

So how do you deal with enrollment in the VDMP? Fortunately, there are steps you can take to shorten the amount of time you spend in the program and resources that can help you develop an effective chargeback management strategy.

Develop a remediation plan

Part of a chargeback monitoring program is to encourage merchants to develop an effective chargeback management strategy. Visa may request that you submit a remediation plan that outlines the steps you’re taking to resolve chargeback issues and regain compliance with the card brand standards.

Most remediation plans include the following key elements.

Business description

Describe the type of business you own — including payment and billing methods, marketing strategies, company mission, etc. Provide enough information to give the card brand a good sense of who you are.

Policy outlines

Provide details about your return and refund policies, terms and conditions, and any other internal procedures that could relate to the excessive level of chargebacks.

Chargeback description

Provide details of the events that lead to the increased number of chargebacks and high chargeback rates. That means you may have to investigate beyond the reason codes to figure out what the root cause of the issues are.

Risk management strategy

Your plan for reducing risk is one of the most important parts of this process. Provide a description of all the chargeback management tools you plan to use, when you will implement them, and how those will help prevent chargebacks.

Action plan

Lastly, you’ll want to let the card brand know what steps you will take to reduce chargebacks — what solutions you will use and your expected results. You’ll also need to include a backup plan in case the first plan fails.

Tips for Managing Chargebacks

Getting out of the VDMP really depends on how well you get your chargeback issues under control. There are a variety of tools and resources that can help you resolve disputes and prevent chargebacks from happening in the first place.

Chargeback prevention tools

There are several tools that can help resolve disputes before they become chargebacks.

Order validation helps prevent chargebacks without causing you to issue refunds. When a customer files a dispute with the bank, the bank can look up additional information about the transaction using order validation. With that information, the bank can work with the customer to resolve the issue without a chargeback.

Prevention alerts

Prevention alerts give you an early warning when disputes are issued. With the extra time, you can take steps to resolve the problem — which usually involves issuing a refund — before a chargeback is filed.

Rapid dispute resolution (RDR)

RDR is another chargeback management tool that uses refunds to resolve disputes. The main difference between RDR and prevention alerts is automation.

With RDR, you can set thresholds for what you are willing to accept liability for — such as orders with certain reason codes or maximum dollar amounts. Anything that fits within your criteria is automatically refunded by the bank.

Data analysis

Stopping chargebacks means figuring out what caused the disputes in the first place. And data analysis is usually the best way to do that.

Look for patterns to identify anomalies. For example, maybe chargebacks are more common in one country than another. Or one product is disputed more frequently than others.

Data analysis is easier and more accurate if you use fraud detection software that incorporates chargeback management. Using technology to collect and consolidate the data makes the review process more effective.

Fraud protection software

For most merchants, the vast majority of chargebacks are fraud related. So using fraud technology can be an effective way to reduce chargebacks.

Most solutions use machine learning to automate decisions. What this does is help you minimize the most fraud possible without having to use up all your internal resources.

Additionally, fraud prevention providers can help you create a strategy to reduce chargebacks, lower your chargeback rate, and prevention issues in the future.

Customer service protocols

Sometimes chargebacks happen because customers don’t recognize purchases on their billing statements or they have a difficult time contacting your customer service teams. Other times, it’s because your employees ship items incorrectly — causing goods to arrive damaged or a customer to receive the wrong item.

The best thing to do is reevaluate your customer service protocols — both on and off your website. That includes:

- Making sure your fulfillment team is sending the right merchandise and packaging items correctly.

- Having your customer service teams answer phone calls quickly and accurately.

- Providing clear billing descriptors.

- Writing detailed and accurate product descriptions on your website.

Verification tools

Another way to combat chargebacks is to implement verification protocols during checkout that will check if the cardholder is the one making a purchase. Therefore reducing unauthorized purchases.

One method is to require customers to enter the card verification value (CVV) on the card. Fraudsters who obtain card numbers online will not have this information and will not be able to complete the transaction.

You can also use address verification service (AVS) — which allows you to compare the billing address a customer provides during checkout to the billing address on file with their bank. If the addresses don’t match, the transaction may be declined.

Lastly, you can implement 3D Secure 2.0 — an identity verification tool that authenticates card-not-present transactions. When a customer makes a purchase, you can send information like shipping address and order history to the customer’s issuing bank. The bank then reviews the information to determine the likelihood of fraud and accepts or challenges the transaction.

Web security protocols

One of the easiest ways to mitigate fraud-related chargebacks is by updating your website security. Make sure you have a firewall so that you can monitor incoming and outgoing traffic on your site and block suspicious traffic.

Additionally, you can require CAPTCHAs during checkout to verify that the user interacting with your site is a human. These protocols can help you block bad traffic from bots — software that is programmed to run automated tasks such as card testing fraud and credential stuffing. As a result, you can mitigate chargebacks from unauthorized purchases.

Exiting the program

To leave the VDMP, your merchant account must be below the standard category thresholds for three consecutive months. If either your dispute count or dispute ratio fall below the thresholds, you will be considered compliant for that month.

Want help exiting a Visa chargeback monitoring program?

If you’ve been enrolled in a monitoring program, you need rapid results. And the best way to see quick and accurate improvements to your chargeback situation is to use chargeback management technology.

Kount® can help. Kount has the industry’s leading dispute management software with proven-effective solutions. Sign up for a demo today to learn more.