close

Talk to an Expert

Schedule a call with an expert to talk about your unique business needs.

Educational resources

Videos, Reports, Guides, and News

Want to learn more about trust and safety topics? Check out our webinars, educational videos, and industry reports. Take a deep dive into the subject of your choice.

Educational videos

See more Educational videos

Ebooks and guides

See more Ebooks and guides

Podcasts

See more podcast resources

Payment processing

Emerging Trends Shaping The Future of Online Payments

In this Podcast, experts discuss the rapidly changing online payments landscape and how retailers can navigate through it while mitigating risk.

Fraud detection and prevention

Optimize Security to Prevent Fraud and Protect Revenue

In this Podcast, experts discuss proven strategies for retaining revenue and thwarting fraud before it hits the bottom line. Learn how machine learning can boost results.

Data reports

See more Data reports

Webinars

See more webinar resources

Disputes and chargebacks

Disputes and Chargebacks: Overcoming the Challenges of 2024

Want to learn how to overcome today's dispute and chargeback challenges? Check out this webinar where we talk about how to reduce these risks and maximize ROI.

Fraud detection and prevention, Payment processing

Emerging Fraud Inside and Outside of Payments

This session focuses on emerging fraud trends and Kount’s approach to staying one step ahead.

Payment processing

Explaining Visa CE3.0 - A fireside chat with Kount, Midigator, and Verifi

Visa CE 3.0 is poised to bridge pre- and post-authorization processes. Join Kount, Midigator, and Verifi in a live discussion to learn the true potential of Visa CE 3.0.

Fraud detection and prevention

How to get the most out of Omniscore

Watch now to learn how Kount’s Omniscore helps you better understand consumers and maximize your bottom line.

Fraud detection and prevention

Friendly Fraud Solutions: The CE 3.0 Update

Join industry expert, Mark Standfield, for this timely educational event as he guides you through the ins and outs of CE 3.0.

Kount + Midigator

Kount + Midigator: Why this new partnership matters

Discover why Equifax’s acquisition of both Kount and Midigator will have a major impact on the payments industry.

Consumer insights, Payment processing

The top consumer payment trends to watch for this holiday season

Explore the latest holiday spending trends and get expert advice on mitigating fraud, protecting the customer journey, and saving revenue this season.

Disputes and chargebacks

How eharmony optimizes revenue by resolving disputes pre-chargeback

Over the past two years, eharmony has fine-tuned its fraud strategy to optimize subscription-based revenue by slashing chargebacks nearly 50% and driving operational efficiencies.

Disputes and chargebacks

How to Mitigate Chargebacks

Chargebacks are a top concern for businesses that are expanding their offerings to fulfill customer demand for digital purchasing options.

Fraud detection and prevention

Webinar Recording: Critical analysis you can do today that will save you time tomorrow

Tune in for essential tips and tricks for increasing return with Kount Command.

Disputes and chargebacks

How to Refuse Refunds Without Ruining Customer Experiences

Watch now for expert, insider knowledge on saving sales and stopping refund abuse.

Identity

Kount and Equifax : The future of digital enablement capabilities and consumer insights

Learn more about how Kount, an Equifax Company, is transforming the future of identity verification a year after joining Equifax, how this will reshape the customer experience, and the opportunities this presents that were once thought impossible.

Fraud detection and prevention

Top fraud trends and predictions in 2022

Watch now for expert, insider knowledge on digital fraud trends and predictions in 2022.

Fraud detection and prevention

Live Training: How to Optimize After the Holidays

Learn how optimize your policies after the holidays during Kount’s Live Holiday Webinar.

Disputes and chargebacks

How to stop customer disputes and holiday chargebacks

Kount and Verifi, a Visa Solution, show you how to stop chargebacks, protect revenue, and speed up dispute time frames from a single platform.

Fraud detection and prevention

Webinar | The Right Solution at the Right Time: How to Build a Modern Fraud Strategy

Join experts from 451 Research, JP Morgan Payments, Cinch Home Services, and Kount for an in-depth look at modern fraud management strategies.

Fraud detection and prevention

Recorded Training: How to Optimize Your Rules for the Holiday Season

Learn how to optimize your rules and policies during Kount’s Live Holiday Webinar

Fraud detection and prevention

The 5 Ways to Block Fraudsters Without Blocking Revenue

Our panelists from Jagex, Kount, and Ekata share their advice for addressing evolving fraud schemes and industry regulations.

Disputes and chargebacks

How to Protect and Grow Sales Like JOANN and Conair

Learn how to adapt quickly and easily to e-commerce changes using Kount and Salesforce Commerce Cloud

Disputes and chargebacks

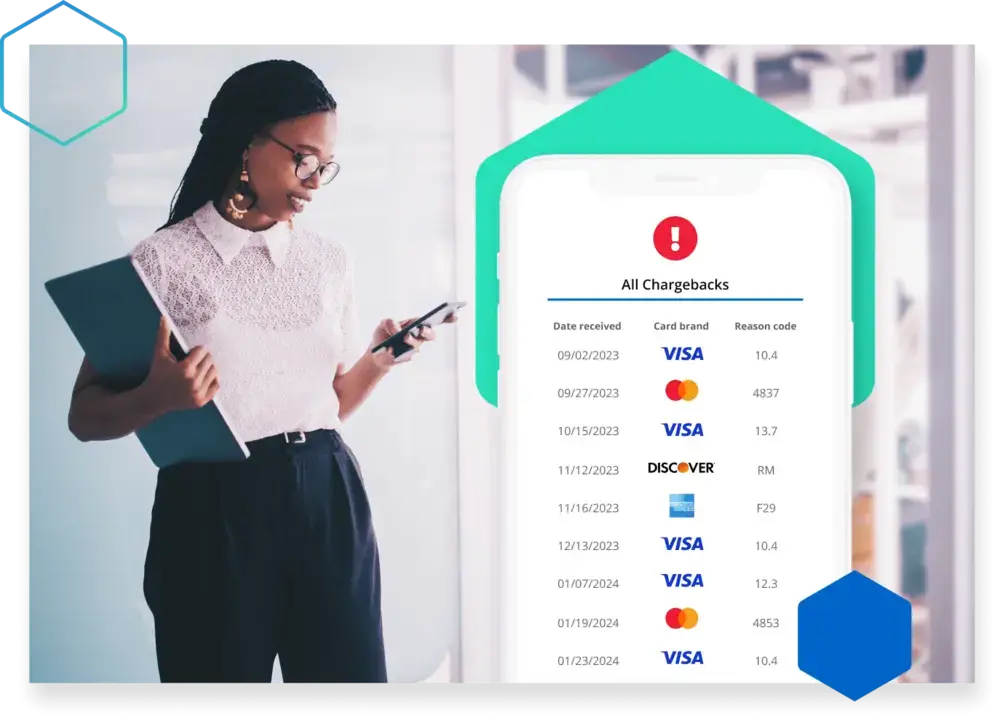

Customer Live Demo: Dispute and Chargeback Management

How Kount’s latest solution makes it easy to resolve disputes and increase revenue

Fraud detection and prevention

4 Types of Fraud You Might Be Missing and What to Do

Learn how to respond to today’s top fraud threats while saving time and protecting revenue

Fraud detection and prevention

How a Multi-Million Dollar Company Manages International Payments and Fraud

Featuring BlueSnap, the All-in-One Payment Platform for Global Business

Fraud detection and prevention

Frictionless Fraud Prevention in FinTech

How it works and why identity trust is key.

Disputes and chargebacks

How to Quickly Resolve Disputes Before They Become Chargebacks

Learn how to intercept and deflect disputes from criminal and friendly fraud, post-authorization and pre-chargeback

Fraud detection and prevention

Strategies to Scale Order Approvals & Stop Chargebacks

Learn quick strategies to stop fraud, increase orders, and grow revenue on your Magento store

Fraud detection and prevention

Securing Growth: Scaling Your Payment and Fraud Strategy

Accept more payments online, in-store, and on the go. Learn how industry-leading payment solutions can help your business grow

Identity

5 Ways to Protect Customer Accounts and Unlock Growth

Learn how to secure your customer journey with five essential elements

Disputes and chargebacks

How to Stop Chargebacks in Time to Recover Revenue

Learn the necessary steps to stop chargebacks and recover lost revenue

Payment processing

New Strategies to Turn Customer Data Into Revenue Growth

Learn how to gain deep customer insights that drive new sales opportunities, minimize friction, and increase approvals

Disputes and chargebacks

How to Prevent Chargebacks & Resolve Disputes Immediately

Learn how to stop chargebacks, recover revenue, and speed up dispute timeframes with a single platform

Fraud detection and prevention

Strategies to Assess Current eCommerce Fraud Prevention Technologies

Learn how to evaluate and pick an eCommerce fraud prevention solution best suited to your unique business goals and customer...

Identity

3 Key Elements Needed For Successful Bot Detection

Learn the 3 key elements to prevent sophisticated bot attacks while delivering a frictionless customer experience

Fraud detection and prevention

How to Protect the Complete Customer Journey From Fraud

Learn best practices to navigate new fraud trends and maintain business growth while enhancing the customer journey

Fraud detection and prevention

7 Essential Elements to Remove Friction From Your Fraud Prevention Strategy

Learn the 7 essential elements required to effectively prevent existing and emerging fraud attacks

Disputes and chargebacks

Capitalizing on 3-D Secure 2.0: Reduce Customer Friction, Chargebacks, and False Positives

Learn how to capitalize on 3-D Secure 2.0 by reducing customer friction, chargebacks, and false positives

Disputes and chargebacks

3 Steps to Stop Chargebacks and Recover Lost Revenue

Learn the necessary steps to stop chargebacks and recover lost revenue

Identity

How to Stop the Fast-Moving Target of Account Takeover with Adaptive Protection

Find out how to identify and protect against account takeover fraud with expert strategies

Chargeback reason code database

Wondering what a particular chargeback reason code means? Want advice on how to better prevent and fight specific chargebacks? Check our complete database of chargeback reason codes.

Testimonial videos

See more Testimonial videos

Analyst reports

See more Analyst reports

Frequently asked questions

See more frequently asked questions

News

See more News